Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sol Company is issuing the bond on Jan 1, 2020 as follows: Face Value: $10000 Contractual Interest Rate: 3%, payable annually Due in 5 years

Sol Company is issuing the bond on Jan 1, 2020 as follows: Face Value: $10000 Contractual Interest Rate: 3%, payable annually Due in 5 years on Jan 1, 2025

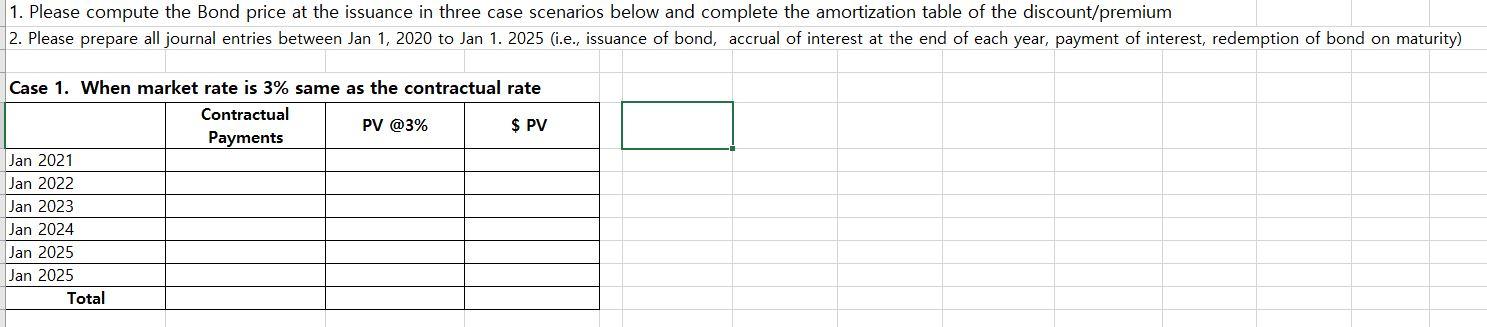

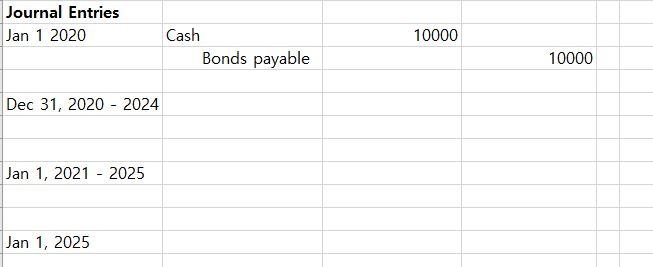

1. Please compute the Bond price at the issuance in three case scenarios below and complete the amortization table of the discount/premium 2. Please prepare all journal entries between Jan 1, 2020 to Jan 1. 2025 (i.e., issuance of bond, accrual of interest at the end of each year, payment of interest, redemption of bond on maturity)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started