Solar Energy NPV Question

Calculate the NPVs for 30 years and 12 years, (Cells B56 and B57, respectively) using the Modified Accelerated Cost Recovery System (MACRS)

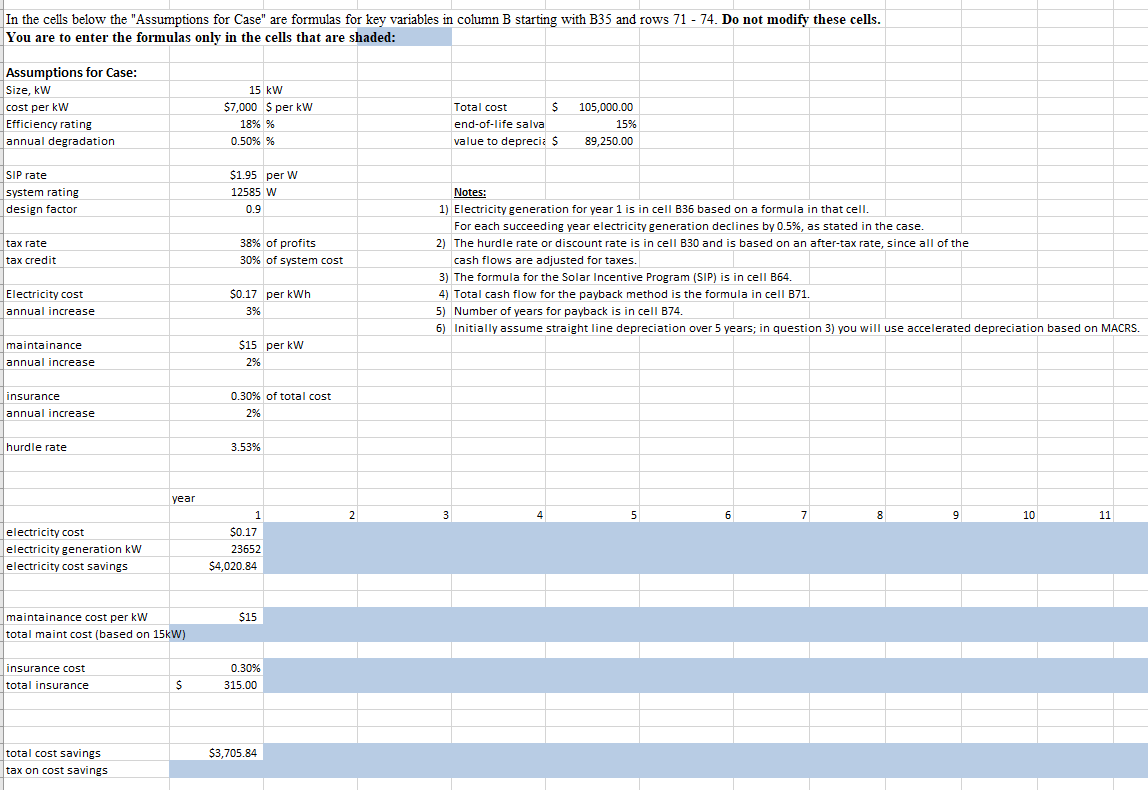

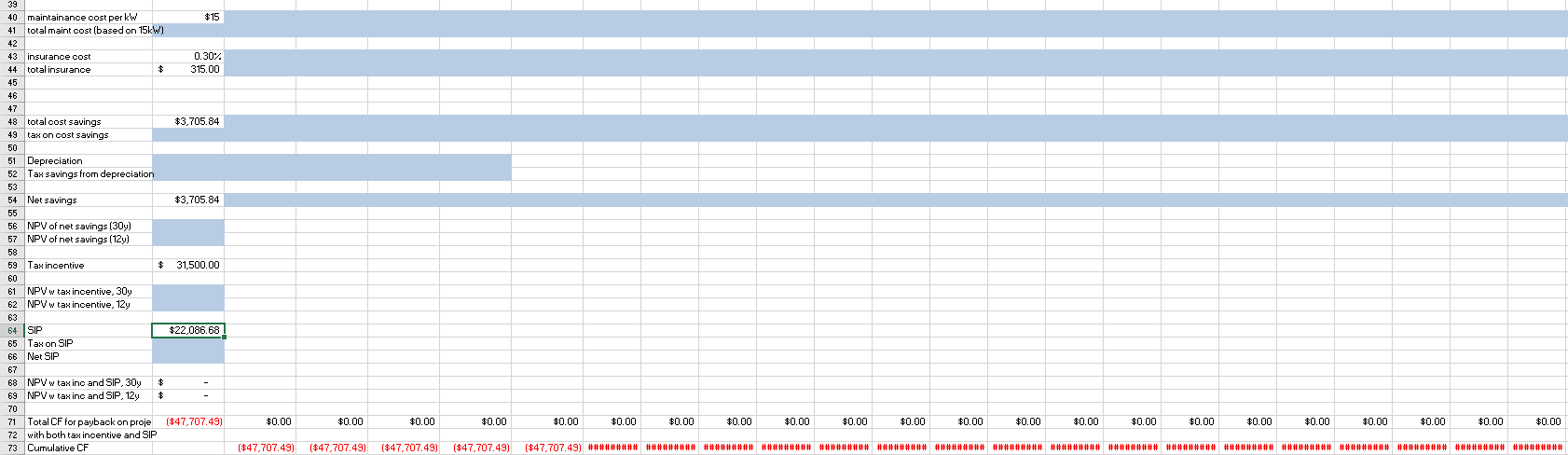

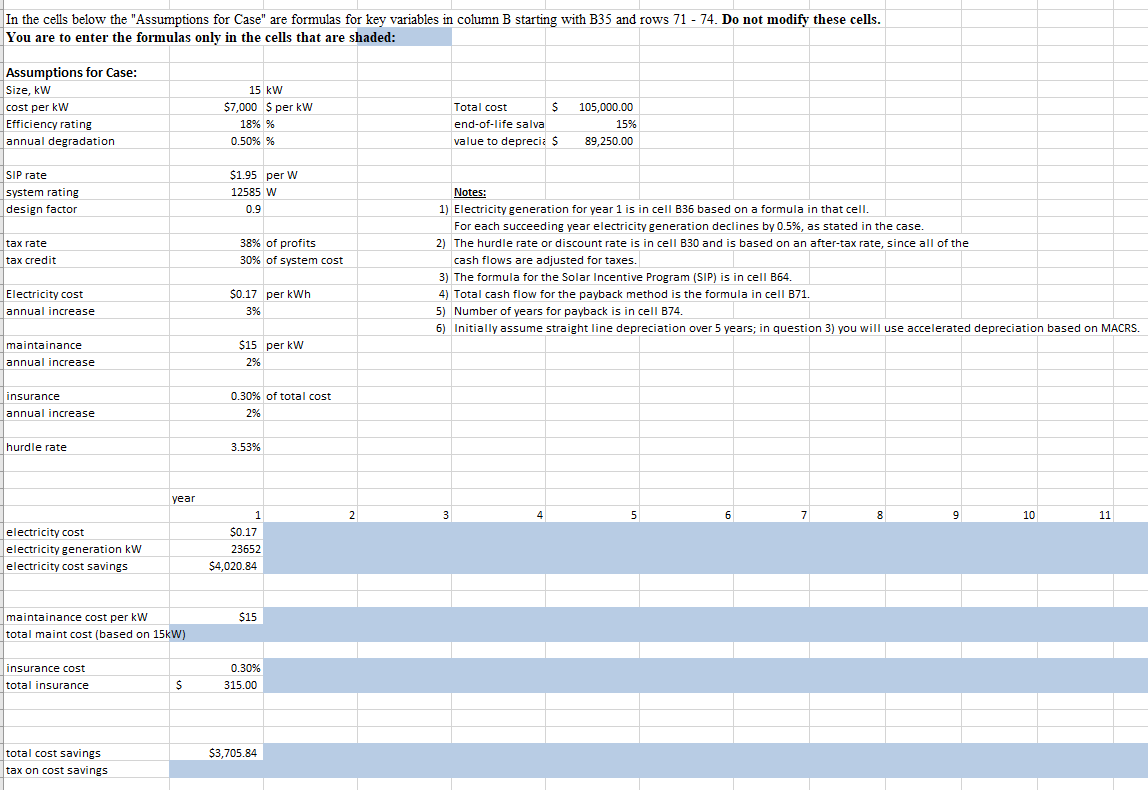

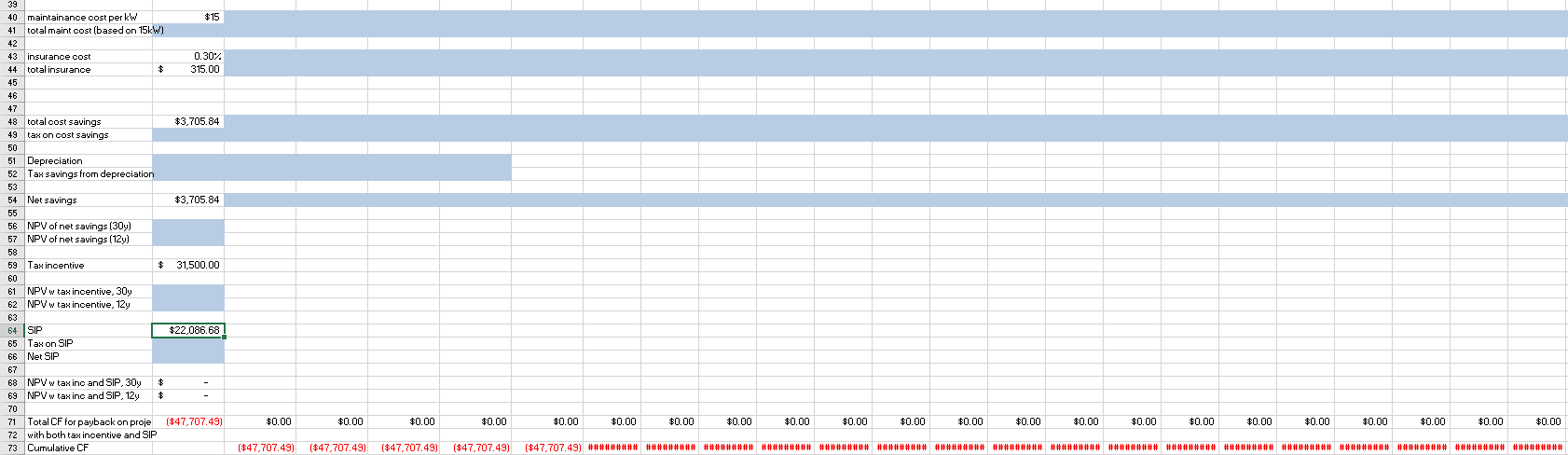

In the cells below the "Assumptions for Case" are formulas for key variables in column B starting with B35 and rows 71 - 74. Do not modify these cells. You are to enter the formulas only in the cells that are shaded: Assumptions for Case: Size, kW cost per kW Efficiency rating annual degradation 15 kW $7,000 $ per kW 18% % Total cost $ end-of-life salva value to deprecia $ 105,000.00 15% 89,250.00 0.50% % SIP rate system rating design factor $1.95 per W 12585 W 0.9 tax rate tax credit 38% of profits 30% of system cost Notes: 1) Electricity generation for year 1 is in cell B36 based on a formula in that cell. For each succeeding year electricity generation declines by 0.5%, as stated in the case. 2) The hurdle rate or discount rate is in cell B30 and is based on an after-tax rate, since all of the -, cash flows are adjusted for taxes. 3) The formula for the Solar Incentive Program (SIP) is in cell B64. 4) Total cash flow for the payback method is the formula in cell B71. 5) Number of years for payback is in cell B74. 6) Initially assume straight line depreciation over 5 years; in question 3) you will use accelerated depreciation based on MACRS. Electricity cost annual increase $0.17 per kWh 3% maintainance annual increase $15 per kW 2% insurance annual increase 0.30% of total cost 2% hurdle rate 3.53% year 2 3 4 5 6 7 8 9 10 11 1 $0.17 electricity cost electricity generation kW electricity cost savings 23652 $4,020.84 $15 maintainance cost per kW total maint cost (based on 15kW) insurance cost total insurance 0.30% 315.00 $ $3,705.84 total cost savings tax on cost savings 39 40 maintainance cost per kW $15 41 total maint cost (based on 15kW) 42 43 insurance cost 0.30% 44 total insurance $ 315.00 45 46 47 48 total cost savings $3,705.84 49 tax on cost savings 50 51 Depreciation 52 Tax savings from depreciation 53 54 Net savings $3,705.84 55 56 NPV of net savings (304) 57 NPV of net savings (127) 58 59 Tax incentive $ 31,500.00 60 61 NPVw tax incentive, 30y 62 NPV w tax incentive, 12y 63 64 SIP $22,086.68 65 Tax on SIP 66 Net SIP 67 68 NPVw tax inc and SIP, 30y $ 69 NPV w tax ino and SIP, 12y $ 70 71 Total CF for payback on proje ($47,707.49) 72 with both tax incentive and SIP 73 Cumulative CF $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 1547 ($47,707.49) ($47,707.49) ($47,707.49) ($47,707.49) ($47,707.49) ######### ######### ######### ################## ######### ######### ######### ######### ######### ######### ######### ######### ######### ######### ######### ######### In the cells below the "Assumptions for Case" are formulas for key variables in column B starting with B35 and rows 71 - 74. Do not modify these cells. You are to enter the formulas only in the cells that are shaded: Assumptions for Case: Size, kW cost per kW Efficiency rating annual degradation 15 kW $7,000 $ per kW 18% % Total cost $ end-of-life salva value to deprecia $ 105,000.00 15% 89,250.00 0.50% % SIP rate system rating design factor $1.95 per W 12585 W 0.9 tax rate tax credit 38% of profits 30% of system cost Notes: 1) Electricity generation for year 1 is in cell B36 based on a formula in that cell. For each succeeding year electricity generation declines by 0.5%, as stated in the case. 2) The hurdle rate or discount rate is in cell B30 and is based on an after-tax rate, since all of the -, cash flows are adjusted for taxes. 3) The formula for the Solar Incentive Program (SIP) is in cell B64. 4) Total cash flow for the payback method is the formula in cell B71. 5) Number of years for payback is in cell B74. 6) Initially assume straight line depreciation over 5 years; in question 3) you will use accelerated depreciation based on MACRS. Electricity cost annual increase $0.17 per kWh 3% maintainance annual increase $15 per kW 2% insurance annual increase 0.30% of total cost 2% hurdle rate 3.53% year 2 3 4 5 6 7 8 9 10 11 1 $0.17 electricity cost electricity generation kW electricity cost savings 23652 $4,020.84 $15 maintainance cost per kW total maint cost (based on 15kW) insurance cost total insurance 0.30% 315.00 $ $3,705.84 total cost savings tax on cost savings 39 40 maintainance cost per kW $15 41 total maint cost (based on 15kW) 42 43 insurance cost 0.30% 44 total insurance $ 315.00 45 46 47 48 total cost savings $3,705.84 49 tax on cost savings 50 51 Depreciation 52 Tax savings from depreciation 53 54 Net savings $3,705.84 55 56 NPV of net savings (304) 57 NPV of net savings (127) 58 59 Tax incentive $ 31,500.00 60 61 NPVw tax incentive, 30y 62 NPV w tax incentive, 12y 63 64 SIP $22,086.68 65 Tax on SIP 66 Net SIP 67 68 NPVw tax inc and SIP, 30y $ 69 NPV w tax ino and SIP, 12y $ 70 71 Total CF for payback on proje ($47,707.49) 72 with both tax incentive and SIP 73 Cumulative CF $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 1547 ($47,707.49) ($47,707.49) ($47,707.49) ($47,707.49) ($47,707.49) ######### ######### ######### ################## ######### ######### ######### ######### ######### ######### ######### ######### ######### ######### ######### #########