Answered step by step

Verified Expert Solution

Question

1 Approved Answer

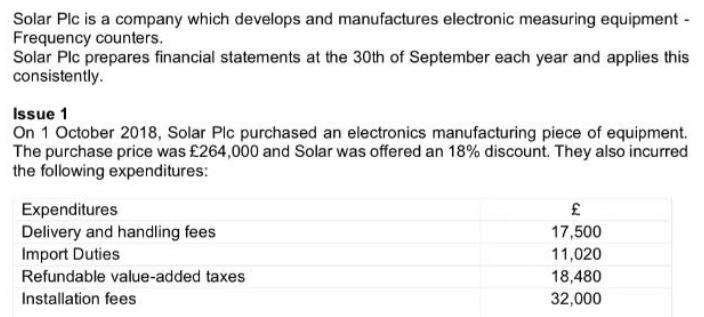

Solar Plc is a company which develops and manufactures electronic measuring equipment - Frequency counters. Solar Plc prepares financial statements at the 30th of

Solar Plc is a company which develops and manufactures electronic measuring equipment - Frequency counters. Solar Plc prepares financial statements at the 30th of September each year and applies this consistently. Issue 1 On 1 October 2018, Solar Plc purchased an electronics manufacturing piece of equipment. The purchase price was 264,000 and Solar was offered an 18% discount. They also incurred the following expenditures: Expenditures Delivery and handling fees Import Duties 17,500 11,020 Refundable value-added taxes 18,480 Installation fees 32,000 Salary of officer who calculates wages of all employees 15,000 Legal fees for building permits Invoice for training of 4 mechanics to use this equipment 23,000 32,000 The present value of the estimated dismantling and site restoration fees 47,000 The estimated residual value of this equipment is 24,000 and the estimated useful life is 10 years. The straight-line method is adopted to calculate depreciation. On 30 September 2020, Solar Plc hired valuers to assess the fair value of the equipment and the valuation price was 290,000; the residual value remained the same but the remaining number of years of useful life was extended to 10 years. On 30 September 2021, another valuation took place and the valuation for this equipment was 254,000. The residual value and the useful life were not adjusted. Required: For the equipment, calculate how much needs to be recognised in the initial recognition of the cost, fully explaining your reasons for your workings; your explanation should reference and relate to the relevant international accounting standard. For the equipment, calculate and explain how the above changes of value should be reflected in the financial statements of 2020 and 2021 under the revaluation model; again, your explanation should refer to relevant accounting standards.

Step by Step Solution

★★★★★

3.53 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Stepbystep explanation Requirement 1 Initial Recognition Sno Description Amount Calculation Explanation 1 Purchase Price 216480 26400026400018 IAS 16 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started