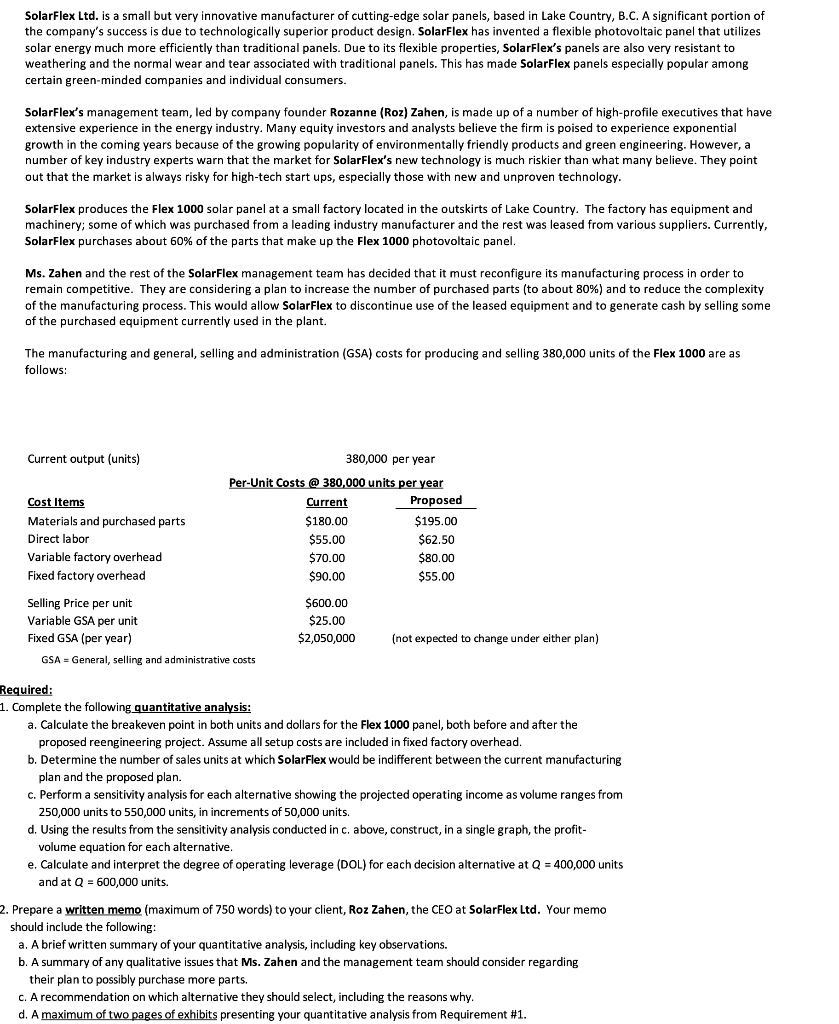

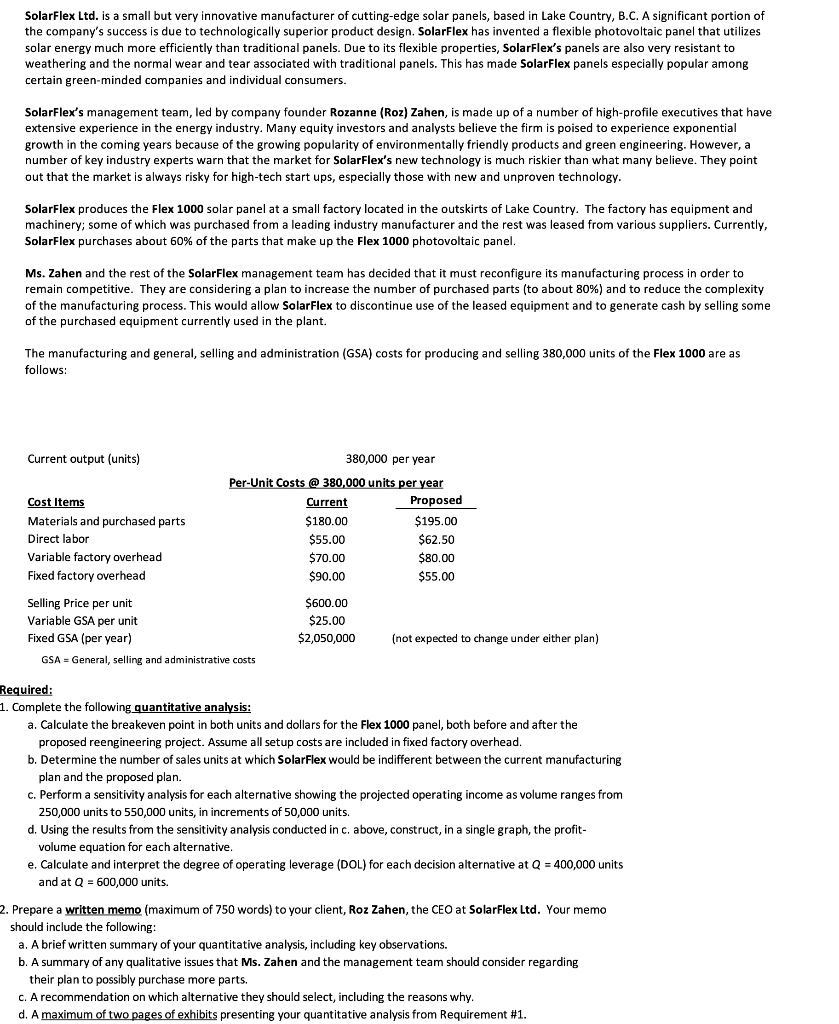

SolarFlex Ltd. is a small but very innovative manufacturer of cutting-edge solar panels, based in Lake Country, B.C. A significant portion of the company's success is due to technologically superior product design. Solarflex has invented a flexible photovoltaic panel that utilizes solar energy much more efficiently than traditional panels. Due to its flexible properties, SolarFlex's panels are also very resistant to weathering and the normal wear and tear associated with traditional panels. This has made SolarFlex panels especially popular among certain green-minded companies and individual consumers. SolarFlex's management team, led by company founder Rozanne (Roz) Zahen, is made up of a number of high-profile executives that have extensive experience in the energy industry. Many equity investors and analysts believe the firm is poised to experience exponential growth in the coming years because of the growing popularity of environmentally friendly products and green engineering. However, a number of key industry experts warn that the market for SolarFlex's new technology is much riskier than what many believe. They point out that the market is always risky for high-tech start ups, especially those with new and unproven technology. SolarFlex produces the Flex 1000 solar panel at a small factory located in the outskirts of Lake Country. The factory has equipment and machinery; some of which was purchased from a leading industry manufacturer and the rest was leased from various suppliers. Currently, SolarFlex purchases about 60% of the parts that make up the Flex 1000 photovoltaic panel. Ms. Zahen and the rest of the SolarFlex management team has decided that it must reconfigure its manufacturing process in order to remain competitive. They are considering a plan to increase the number of purchased parts (to about 80% ) and to reduce the complexity of the manufacturing process. This would allow SolarFlex to discontinue use of the leased equipment and to generate cash by selling some of the purchased equipment currently used in the plant. The manufacturing and general, selling and administration (GSA) costs for producing and selling 380,000 units of the Flex 1000 are as follows: Ige under either plan) Required: 1. Complete the following_quantitative analysis: a. Calculate the breakeven point in both units and dollars for the Flex 1000 panel, both before and after the proposed reengineering project. Assume all setup costs are included in fixed factory overhead. b. Determine the number of sales units at which Solarflex would be indifferent between the current manufacturing plan and the proposed plan. c. Perform a sensitivity analysis for each alternative showing the projected operating income as volume ranges from 250,000 units to 550,000 units, in increments of 50,000 units. d. Using the results from the sensitivity analysis conducted in c. above, construct, in a single graph, the profitvolume equation for each alternative. e. Calculate and interpret the degree of operating leverage (DOL) for each decision alternative at Q=400,000 units and at Q=600,000 units. 2. Prepare a written memo (maximum of 750 words) to your client, Roz Zahen, the CEO at SolarFlex Ltd. Your memo should include the following: a. A brief written summary of your quantitative analysis, including key observations. b. A summary of any qualitative issues that Ms. Zahen and the management team should consider regarding their plan to possibly purchase more parts. c. A recommendation on which alternative they should select, including the reasons why. d. A maximum of two pages of exhibits presenting your quantitative analysis from Requirement \#1