Answered step by step

Verified Expert Solution

Question

1 Approved Answer

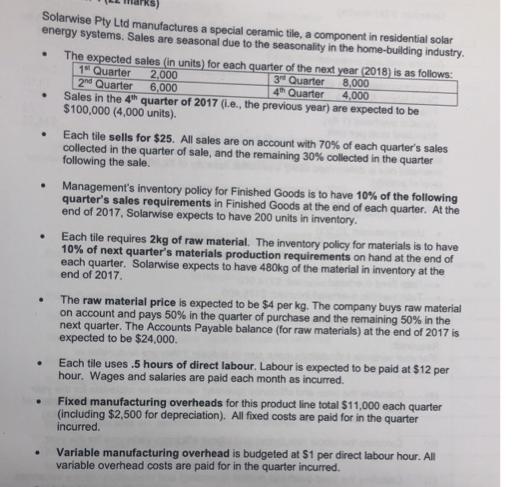

Solarwise Pty Ltd manufactures a special ceramic tile, a component in residential solar energy systems. Sales are seasonal due to the seasonality in the

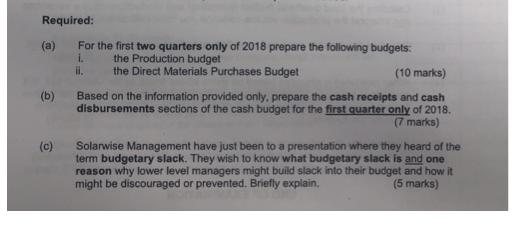

Solarwise Pty Ltd manufactures a special ceramic tile, a component in residential solar energy systems. Sales are seasonal due to the seasonality in the home-building industry. . . . . . . . The expected sales (in units) for each quarter of the next year (2018) is as follows: 1st Quarter 3rd Quarter 8,000 2nd Quarter 2,000 6,000 4th Quarter 4,000 Sales in the 4th quarter of 2017 (i.e., the previous year) are expected to be $100,000 (4,000 units). Each tile sells for $25. All sales are on account with 70% of each quarter's sales collected in the quarter of sale, and the remaining 30% collected in the quarter following the sale. Management's inventory policy for Finished Goods is to have 10% of the following quarter's sales requirements in Finished Goods at the end of each quarter. At the end of 2017, Solarwise expects to have 200 units in inventory. Each tile requires 2kg of raw material. The inventory policy for materials is to have 10% of next quarter's materials production requirements on hand at the end of each quarter. Solarwise expects to have 480kg of the material in inventory at the end of 2017. The raw material price is expected to be $4 per kg. The company buys raw material on account and pays 50% in the quarter of purchase and the remaining 50% in the next quarter. The Accounts Payable balance (for raw materials) at the end of 2017 is expected to be $24,000. Each tile uses .5 hours of direct labour. Labour is expected to be paid at $12 per hour. Wages and salaries are paid each month as incurred. Fixed manufacturing overheads for this product line total $11,000 each quarter (including $2,500 for depreciation). All fixed costs are paid for in the quarter incurred. Variable manufacturing overhead is budgeted at $1 per direct labour hour. All variable overhead costs are paid for in the quarter incurred. Required: (a) (b) (c) For the first two quarters only of 2018 prepare the following budgets: the Production budget i. ii. the Direct Materials Purchases Budget (10 marks) Based on the information provided only, prepare the cash receipts and cash disbursements sections of the cash budget for the first quarter only of 2018. (7 marks) Solarwise Management have just been to a presentation where they heard of the term budgetary slack. They wish to know what budgetary slack is and one reason why lower level managers might build slack into their budget and how it might be discouraged or prevented. Briefly explain. (5 marks)

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started