Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solden plc is a UK company which is considering setting up a manufacturing operation to make ski-boot warmers in a country called Ober. The

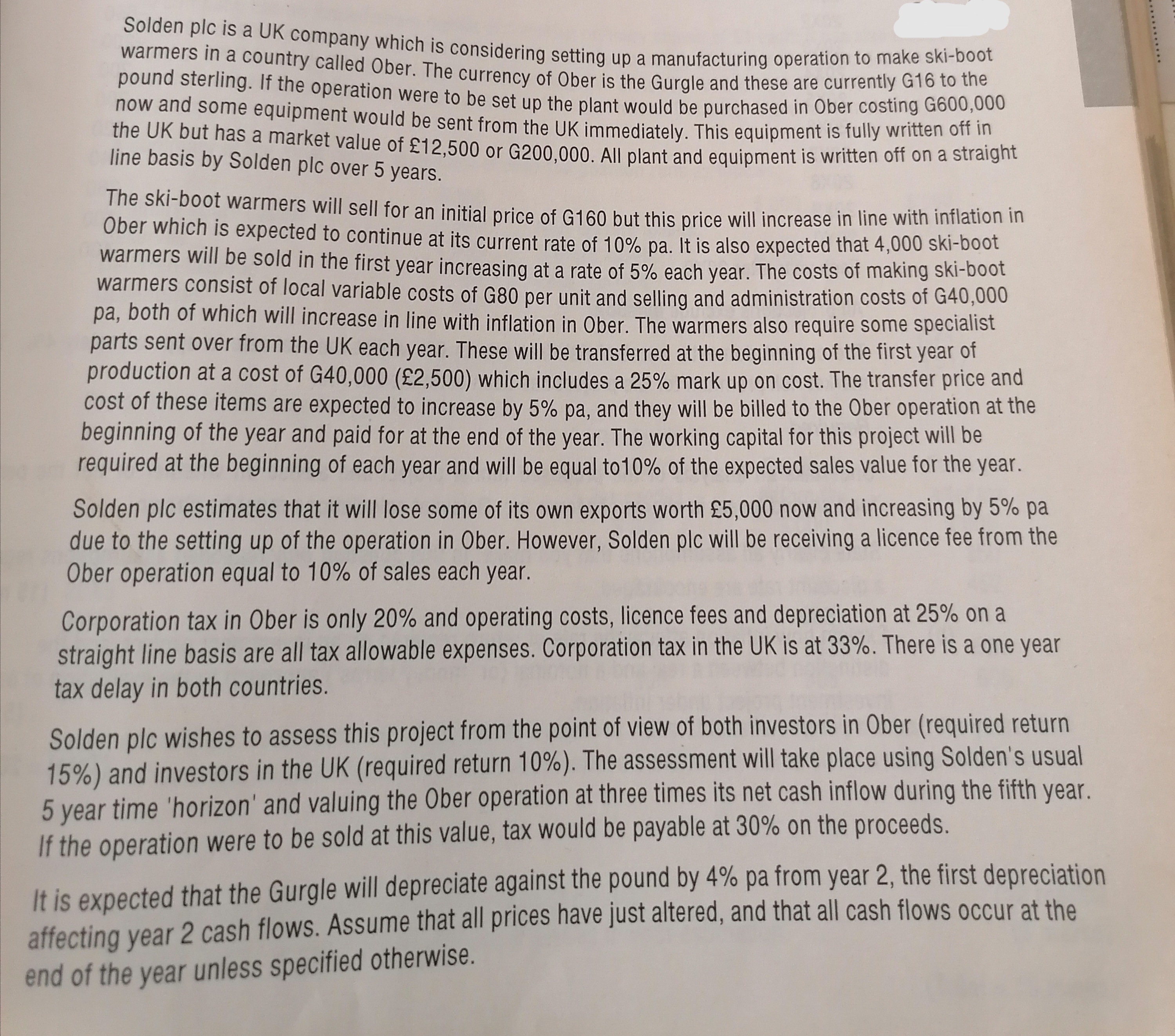

Solden plc is a UK company which is considering setting up a manufacturing operation to make ski-boot warmers in a country called Ober. The currency of Ober is the Gurgle and these are currently G16 to the pound sterling. If the operation were to be set up the plant would be purchased in Ober costing G600,000 now and some equipment would be sent from the UK immediately. This equipment is fully written off in the UK but has a market value of 12,500 or G200,000. All plant and equipment is written off on a straight line basis by Solden plc over 5 years. The ski-boot warmers will sell for an initial price of G160 but this price will increase in line with inflation in Ober which is expected to continue at its current rate of 10% pa. It is also expected that 4,000 ski-boot warmers will be sold in the first year increasing at a rate of 5% each year. The costs of making ski-boot warmers consist of local variable costs of G80 per unit and selling and administration costs of G40,000 pa, both of which will increase in line with inflation in Ober. The warmers also require some specialist parts sent over from the UK each year. These will be transferred at the beginning of the first year of production at a cost of G40,000 (2,500) which includes a 25% mark up on cost. The transfer price and cost of these items are expected to increase by 5% pa, and they will be billed to the Ober operation at the beginning of the year and paid for at the end of the year. The working capital for this project will be required at the beginning of each year and will be equal to 10% of the expected sales value for the year. Solden plc estimates that it will lose some of its own exports worth 5,000 now and increasing by 5% pa due to the setting up of the operation in Ober. However, Solden plc will be receiving a licence fee from the Ober operation equal to 10% of sales each year. Corporation tax in Ober is only 20% and operating costs, licence fees and depreciation at 25% on a straight line basis are all tax allowable expenses. Corporation tax in the UK is at 33%. There is a one year tax delay in both countries. Solden plc wishes to assess this project from the point of view of both investors in Ober (required return 15%) and investors in the UK (required return 10%). The assessment will take place using Solden's usual 5 year time 'horizon' and valuing the Ober operation at three times its net cash inflow during the fifth year. If the operation were to be sold at this value, tax would be payable at 30% on the proceeds. It is expected that the Gurgle will depreciate against the pound by 4% pa from year 2, the first depreciation affecting year 2 cash flows. Assume that all prices have just altered, and that all cash flows occur at the end of the year unless specified otherwise. Required (a) Calculate (to the nearest 100 Gurgles) whether the operation would be worthwhile for investors based in Ober. (12 marks) (b) If all cash surpluses can be remitted to the UK calculate whether Solden plc should set up the operation. Assume no further UK tax is payable on income taxed on Ober. (8 marks) (Total-20 marks)

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Calculation of the worthwhileness of the operation for investors based in Ober 1 Calculate the initial investment G600000 plant and equipme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started