Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sole Proprietorship No separate income tax on the business, profits and losses pass through to the single owner who reports on their individual income tax

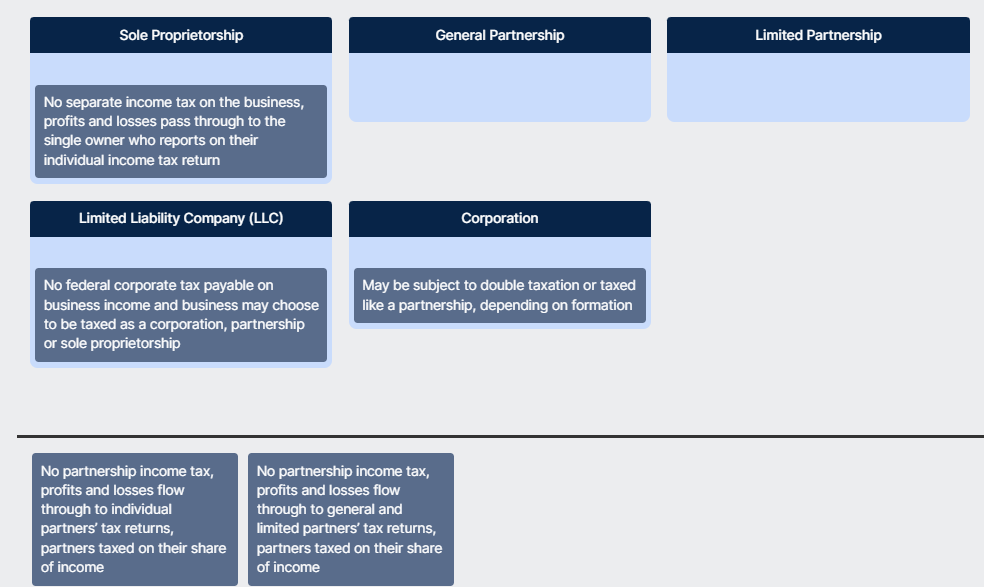

Sole Proprietorship

No separate income tax on the business, profits and losses pass through to the single owner who reports on their individual income tax return

Limited Liability Company LLC

No federal corporate tax payable on business income and business may choose to be taxed as a corporation, partnership or sole proprietorship

General Partnership

Limited Partnership

Corporation

May be subject to double taxation or taxed like a partnership, depending on formation

No partnership income tax, profits and losses flow through to individual partners' tax returns, partners taxed on their share

No partnership income tax, profits and losses flow through to general and limited partners' tax returns, partners taxed on their share of income of income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started