Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Soley is a charity (an NGO) whose constitution requires that it raises funds for educational projects. These projects seek to educate children and support

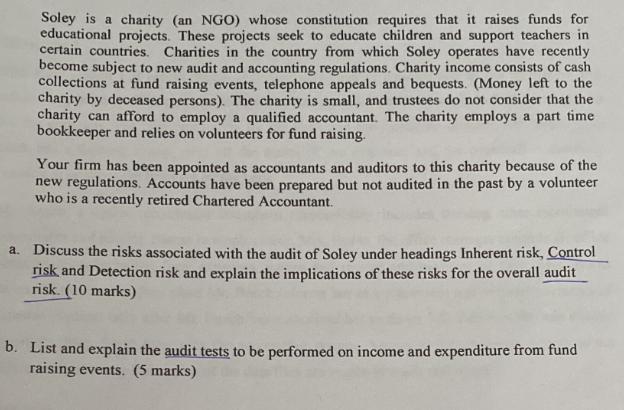

Soley is a charity (an NGO) whose constitution requires that it raises funds for educational projects. These projects seek to educate children and support teachers in certain countries. Charities in the country from which Soley operates have recently become subject to new audit and accounting regulations. Charity income consists of cash collections at fund raising events, telephone appeals and bequests. (Money left to the charity by deceased persons). The charity is small, and trustees do not consider that the charity can afford to employ a qualified accountant. The charity employs a part time bookkeeper and relies on volunteers for fund raising. Your firm has been appointed as accountants and auditors to this charity because of the new regulations. Accounts have been prepared but not audited in the past by a volunteer who is a recently retired Chartered Accountant. a. Discuss the risks associated with the audit of Soley under headings Inherent risk, Control risk and Detection risk and explain the implications of these risks for the overall audit risk. (10 marks) b. List and explain the audit tests to be performed on income and expenditure from fund raising events. (5 marks)

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Inherent Risk Soley faces inherent risks related to their activities including fraud misappropriation of funds improper allocation of expenses and m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started