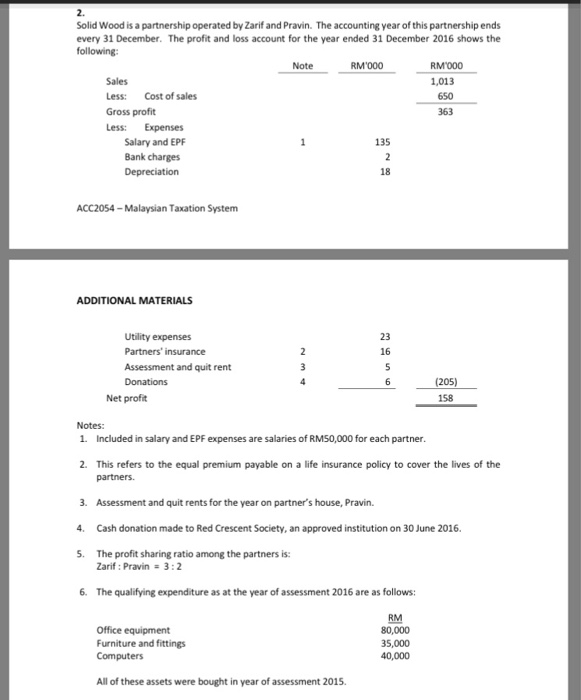

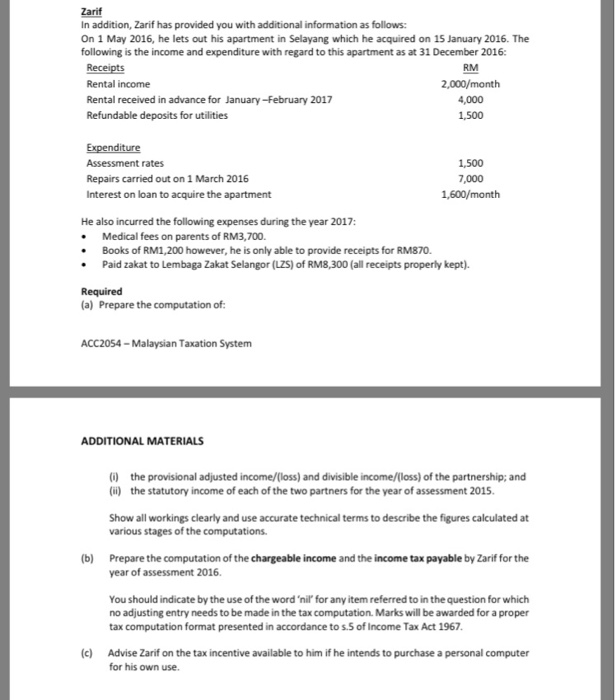

Solid Wood is a partnership operated by Zarif and Pravin. The accounting year of this partnership ends every 31 December. The profit and loss account for the year ended 31 December 2016 shows the Note RM 000 Less: Cost of sales Gross profit Less: Expenses 1,013 650 363 Salary and EPF Bank charges 135 18 ACC2054-Malaysian Taxation System ADDITIONAL MATERIALS Utility expenses Partners' insurance Assessment and quit rent 23 16 (205) 158 Net profit Notes: 1. Included in salary and EPF expenses are salaries of RM50,000 for each partner 2. This refers to the equal premium payable on a life insurance policy to cover the lives of the 3. Assessment and quit rents for the year on partner's house, Pravin. 4. Cash donation made to Red Crescent Society, an approved institution on 30 June 2016 5. The profit sharing ratio among the partners is: Zarif : Pravin= 3:2 6. The qualifying expenditure as at the year of assessment 2016 are as follows: Office equipment Furniture and fittings RM 80,000 35,000 All of these assets were bought in year of assessment 2015. Solid Wood is a partnership operated by Zarif and Pravin. The accounting year of this partnership ends every 31 December. The profit and loss account for the year ended 31 December 2016 shows the Note RM 000 Less: Cost of sales Gross profit Less: Expenses 1,013 650 363 Salary and EPF Bank charges 135 18 ACC2054-Malaysian Taxation System ADDITIONAL MATERIALS Utility expenses Partners' insurance Assessment and quit rent 23 16 (205) 158 Net profit Notes: 1. Included in salary and EPF expenses are salaries of RM50,000 for each partner 2. This refers to the equal premium payable on a life insurance policy to cover the lives of the 3. Assessment and quit rents for the year on partner's house, Pravin. 4. Cash donation made to Red Crescent Society, an approved institution on 30 June 2016 5. The profit sharing ratio among the partners is: Zarif : Pravin= 3:2 6. The qualifying expenditure as at the year of assessment 2016 are as follows: Office equipment Furniture and fittings RM 80,000 35,000 All of these assets were bought in year of assessment 2015