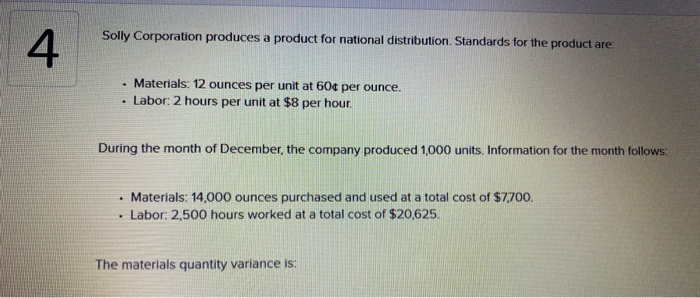

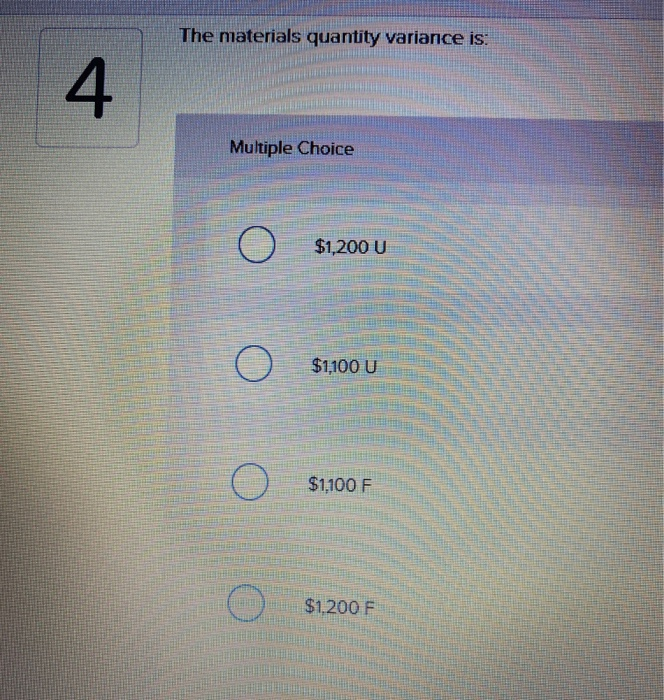

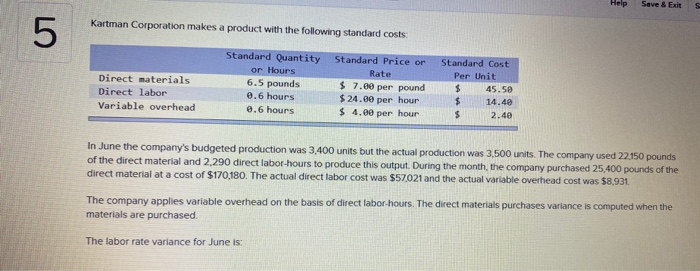

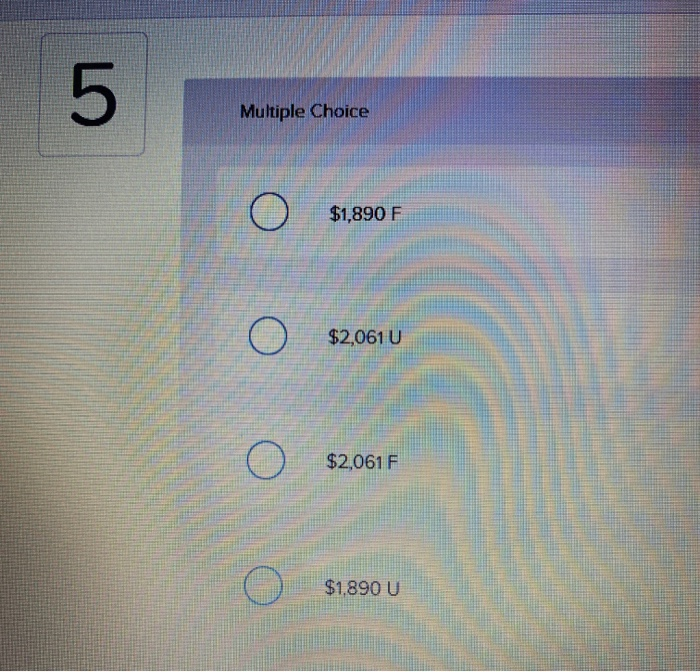

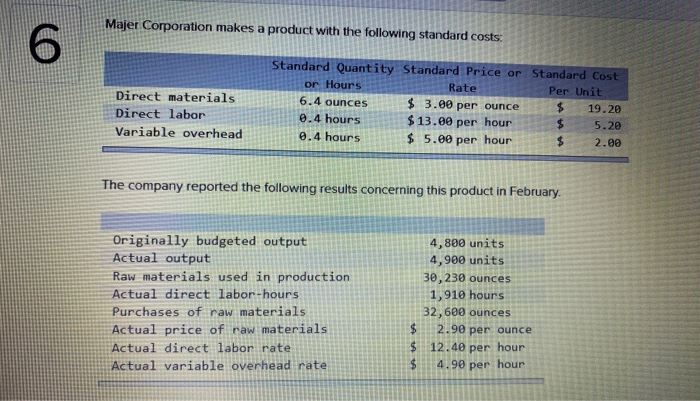

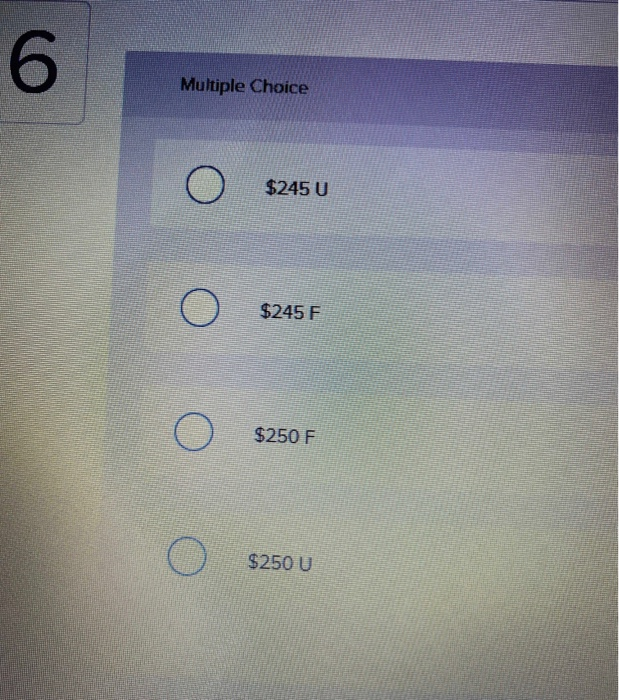

Solly Corporation produces a product for national distribution. Standards for the product are: 4 Materials: 12 ounces per unit at 604 per ounce. Labor: 2 hours per unit at $8 per hour. During the month of December, the company produced 1,000 units. Information for the month follows: Materials: 14,000 ounces purchased and used at a total cost of $7,700. Labor: 2,500 hours worked at a total cost of $20,625. The materials quantity variance is: The materials quantity variance is: 4 Multiple Choice $1,200 U $1,100 U $1,100 F $1.200 F Help Save & Exit Kartman Corporation makes a product with the following standard costs 5 Standard Price or Rate Direct materials Direct labor Variable overhead Standard Quantity or Hours 6.5 pounds 0.6 hours 0.6 hours $ 7.00 per pound $24.ee per hour $ 4.00 per hour Standard Cost Per Unit $ 45.50 $ 14.40 $ 2.40 In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2.290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57021 and the actual variable overhead cost was $8,931 The company applies variable overhead on the basis of direct labor hours. The direct materials purchases variance is computed when the materials are purchased The labor rate variance for June is: 5 Multiple Choice $1,890 F O $2,061 U O $2,061 F $1,890 U Majer Corporation makes a product with the following standard costs 6 Direct materials Direct labor Variable overhead Standard Quantity Standard Price or Standard Cost or Hours Rate Per Unit 6.4 ounces $ 3.00 per ounce 19.20 0.4 hours $13.00 per hour 5.20 0.4 hours $ 5.00 per hour 2.00 The company reported the following results concerning this product in February Originally budgeted output Actual output Raw materials used in production Actual direct labor-hours Purchases of raw materials Actual price of raw materials Actual direct labor rate Actual variable overhead rate 4,800 units 4,900 units 30, 230 ounces 1,910 hours 32,600 ounces $ 2.90 per ounce $ 12.40 per hour 4.90 per hour The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The variable overhead efficiency variance for February is: 6 Multiple Choice $245 U O $245 F o $250 F $250 U