Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solution Almas Ltd, a Shinyanga based mining company, is listed at the local stock exchange. It is expected to earn an operating income of TZS.2.2

solution

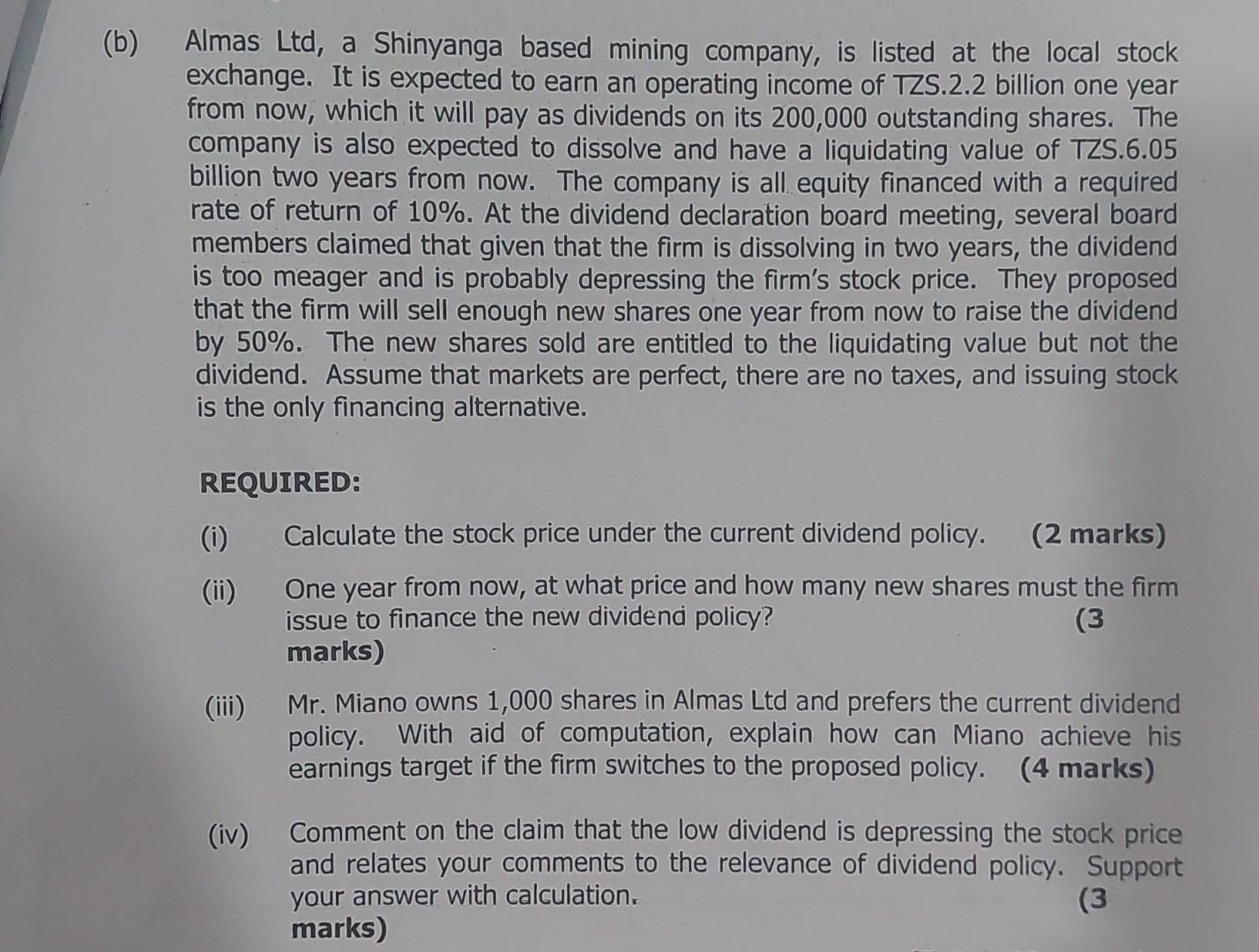

Almas Ltd, a Shinyanga based mining company, is listed at the local stock exchange. It is expected to earn an operating income of TZS.2.2 billion one year from now, which it will pay as dividends on its 200,000 outstanding shares. The company is also expected to dissolve and have a liquidating value of TZS.6.05 billion two years from now. The company is all equity financed with a required rate of return of 10%. At the dividend declaration board meeting, several board members claimed that given that the firm is dissolving in two years, the dividend is too meager and is probably depressing the firm's stock price. They proposed that the firm will sell enough new shares one year from now to raise the dividend by 50%. The new shares sold are entitled to the liquidating value but not the dividend. Assume that markets are perfect, there are no taxes, and issuing stock is the only financing alternative. REQUIRED: (i) Calculate the stock price under the current dividend policy. (2 marks) (ii) One year from now, at what price and how many new shares must the firm issue to finance the new dividend policy? (3 marks) (iii) Mr. Miano owns 1,000 shares in Almas Ltd and prefers the current dividend policy. With aid of computation, explain how can Miano achieve his earnings target if the firm switches to the proposed policy. ( 4 marks) (iv) Comment on the claim that the low dividend is depressing the stock price and relates your comments to the relevance of dividend policy. Support your answer with calculationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started