Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solution and answer to all the posted problems complete solution 186 p7-06 N. A dump ap 15 years was replaced The equip sold now tion

solution and answer to all the posted problems

complete solution

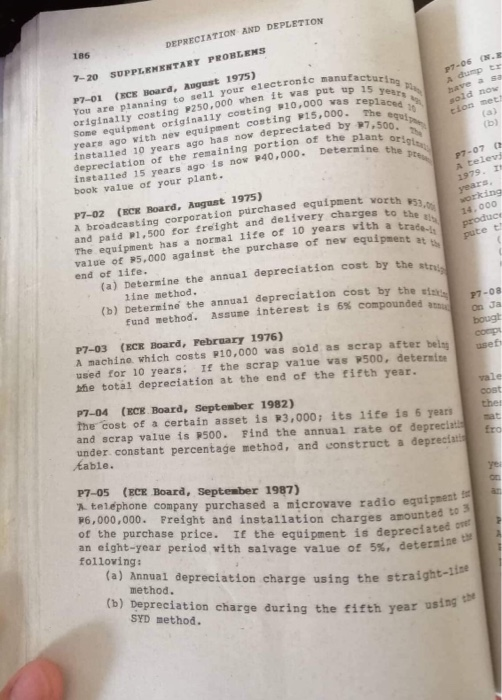

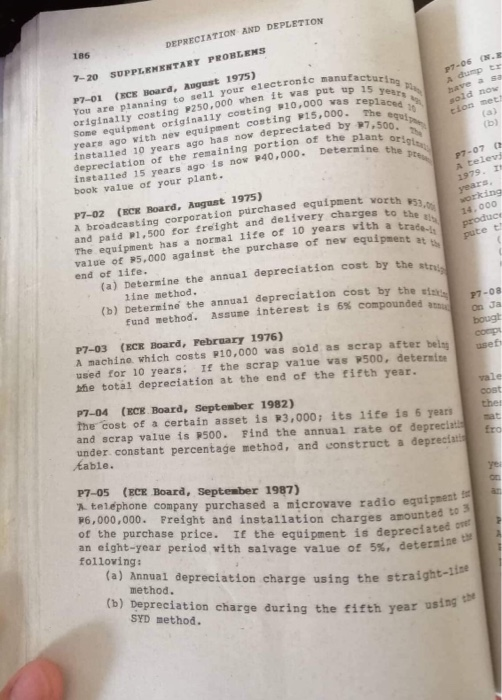

186 p7-06 N. A dump ap 15 years was replaced The equip sold now tion met a) DEPRECIATION AND DEPLETION 7-20 SUPPLEMENTARY PROBLEMS 27-01 (RCE Board, August 1975) You are planning to sell your electronic manufact originally costing P250,000 when it was put 1 Some equipment originally costing F10,000 was e years ago with new equipment Couting 715,000. installed 10 years ago has now depreciated by 27.5 depreciation of the remaining portion of the plant installed 15 years ago is now 740,000. Determine book value of your plant. originally cost originally at costing 1 87.500. years ago aining pop ,000. Deter nt origi in the te P7-07 0 A telev 1979. I years, yorth 53. working 14.000 produce ith a trade- y equipment putet P7-02 (RC Board, August 1975) a broadcasting corporation purchased equipment worth and paid P1,500 for freight and delivery charges to The equipment has a normal life of 10 years with a te value of 25.000 against the purchase of new equipment end of life. (a) Determine the annual depreciation cost by the line method. (b) Determine the annual depreciation cost by the stew fund method. Assume interest is 6% compounded P7-03 (ECE Board, February 1976) Asachine which costs P10,000 was sold as scrap after bels used for 10 years. If the scrap value was 500, determine die total depreciation at the end of the fifth year. On Ja bough corp usef vale cost thel mat P7-04 (ECE Board, September 1982) the cost of a certain asset is P3,000; its life is 5 years and scrap value is P500. Find the annual rate of depreciate under constant percentage method, and construct a deprecat table. adio equipment ounted to 3 depreciated on P7-05 (ECE Board, September 1987) ' telephone company purchased a microwave radio equipam 76,000,000. Freight and installation charges amounted of the purchase price. IE the equipment is depreciated an eight-year period with salvage value of 5%, deter following: (a) Annual depreciation charge using the straight method. (b) Depreciation charge during the fifth year usin, SYD method. etermine the straight-line Par using the Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started