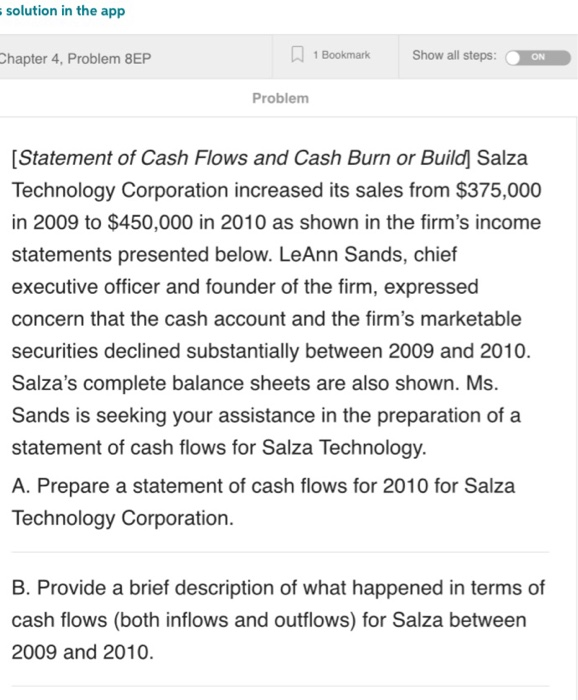

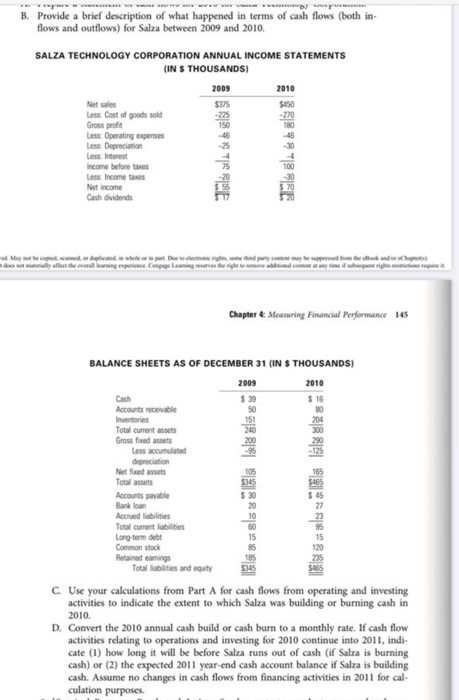

solution in the app Chapter 4, Problem 8EP 1 Bookmark Show all steps: ON Problem [Statement of Cash Flows and Cash Burn or Build] Salza Technology Corporation increased its sales from $375,000 in 2009 to $450,000 in 2010 as shown in the firm's income statements presented below. LeAnn Sands, chief executive officer and founder of the firm, expressed concern that the cash account and the firm's marketable securities declined substantially between 2009 and 2010. Salza's complete balance sheets are also shown. Ms. Sands is seeking your assistance in the preparation of a statement of cash flows for Salza Technology. A. Prepare a statement of cash flows for 2010 for Salza Technology Corporation. B. Provide a brief description of what happened in terms of cash flows (both inflows and outflows) for Salza between 2009 and 2010. B. Provide a brief description of what happened in terms of cash flows (both in- flows and outflows) for Salza between 2009 and 2010. SALZA TECHNOLOGY CORPORATION ANNUAL INCOME STATEMENTS (IN S THOUSANDS) 2009 2010 $450 Net sales Less Cost of goods sold Gross profit Less Operating expenses Depreciation Less Interest Income before to Les Income taxes Net income Cash dividends 393** TRUE **" BE way all Chapter 4 Measuring Financial Performance 145 BALANCE SHEETS AS OF DECEMBER 31 (IN S THOUSANDS) 2009 2010 $ 16 Accounts receivable Inventories Total current assets Gross foxed assets Less accumulated depreciation Netfand assets Total assets Accounts payable Bank loan Accredibilities Total current abilities Long-term debt Common stock Retained earnings Total abilities and equity ***|88|19949218 78 219 2258 185 3345 C. Use your calculations from Part A for cash flows from operating and investing activities to indicate the extent to which Salza was building or burning cash in 2010. D. Convert the 2010 annual cash build or cash burn to a monthly rate. If cash flow activities relating to operations and investing for 2010 continue into 2011, indi- cate (1) how long it will be before Salza runs out of cash (if Salza is burning cash) or (2) the expected 2011 year-end cash account balance if Salza is building cash. Assume no changes in cash flows from financing activities in 2011 for cal- culation purposes. solution in the app Chapter 4, Problem 8EP 1 Bookmark Show all steps: ON Problem [Statement of Cash Flows and Cash Burn or Build] Salza Technology Corporation increased its sales from $375,000 in 2009 to $450,000 in 2010 as shown in the firm's income statements presented below. LeAnn Sands, chief executive officer and founder of the firm, expressed concern that the cash account and the firm's marketable securities declined substantially between 2009 and 2010. Salza's complete balance sheets are also shown. Ms. Sands is seeking your assistance in the preparation of a statement of cash flows for Salza Technology. A. Prepare a statement of cash flows for 2010 for Salza Technology Corporation. B. Provide a brief description of what happened in terms of cash flows (both inflows and outflows) for Salza between 2009 and 2010. B. Provide a brief description of what happened in terms of cash flows (both in- flows and outflows) for Salza between 2009 and 2010. SALZA TECHNOLOGY CORPORATION ANNUAL INCOME STATEMENTS (IN S THOUSANDS) 2009 2010 $450 Net sales Less Cost of goods sold Gross profit Less Operating expenses Depreciation Less Interest Income before to Les Income taxes Net income Cash dividends 393** TRUE **" BE way all Chapter 4 Measuring Financial Performance 145 BALANCE SHEETS AS OF DECEMBER 31 (IN S THOUSANDS) 2009 2010 $ 16 Accounts receivable Inventories Total current assets Gross foxed assets Less accumulated depreciation Netfand assets Total assets Accounts payable Bank loan Accredibilities Total current abilities Long-term debt Common stock Retained earnings Total abilities and equity ***|88|19949218 78 219 2258 185 3345 C. Use your calculations from Part A for cash flows from operating and investing activities to indicate the extent to which Salza was building or burning cash in 2010. D. Convert the 2010 annual cash build or cash burn to a monthly rate. If cash flow activities relating to operations and investing for 2010 continue into 2011, indi- cate (1) how long it will be before Salza runs out of cash (if Salza is burning cash) or (2) the expected 2011 year-end cash account balance if Salza is building cash. Assume no changes in cash flows from financing activities in 2011 for cal- culation purposes