Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solution Question 4 a) Ulimwengu Printers is a company engaged in the printing business. Of recent they have enjoyed a spell of good performance ahd

solution

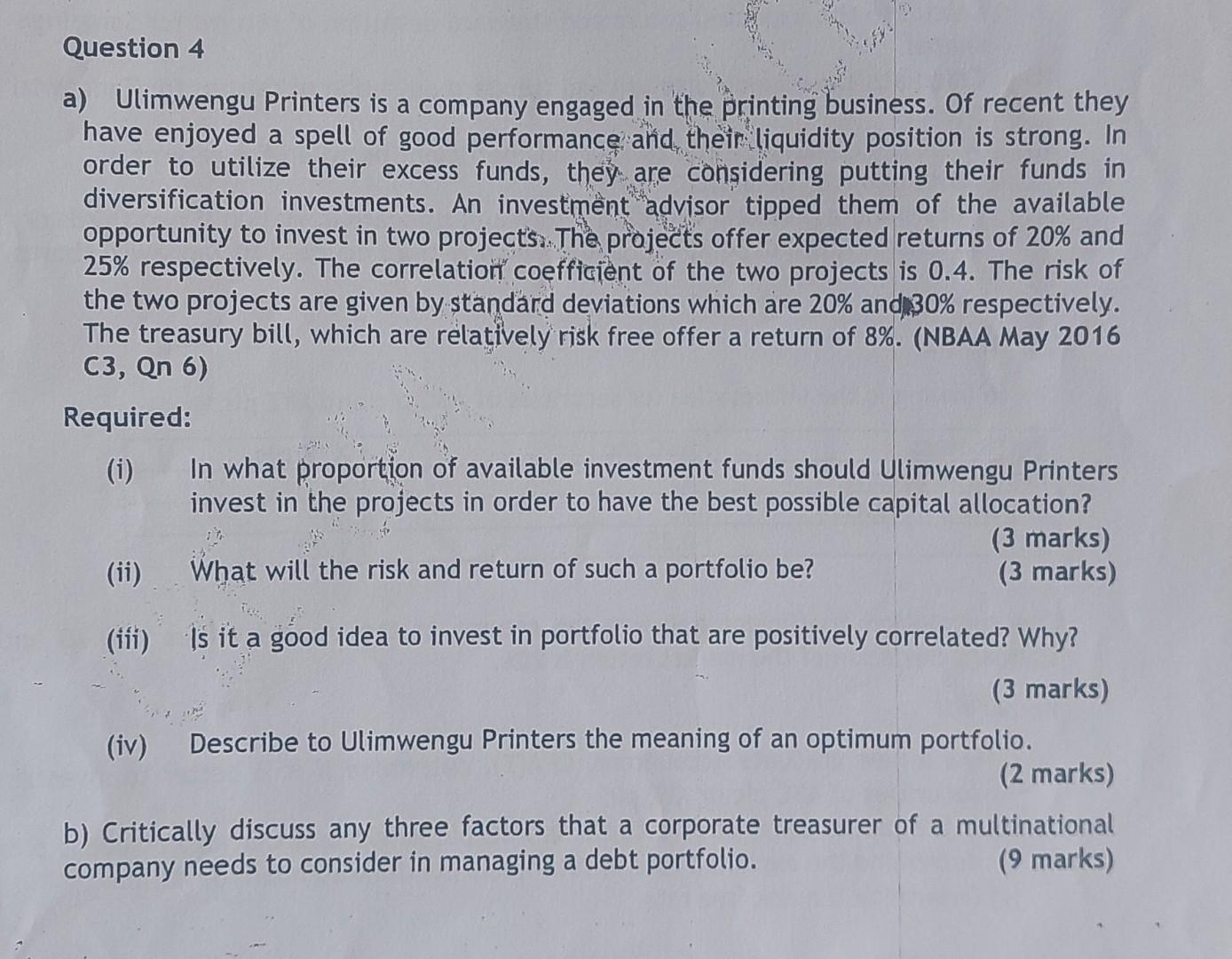

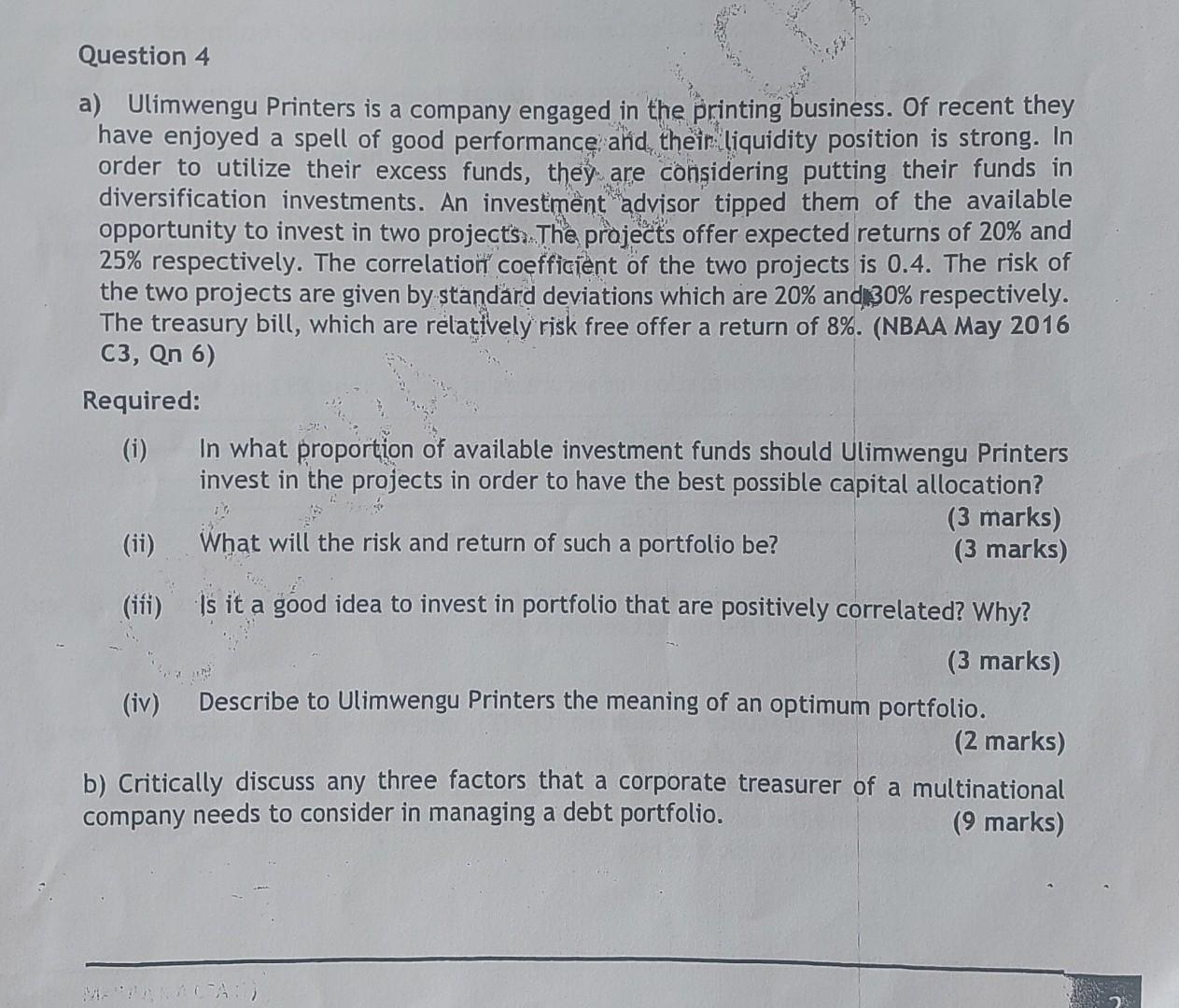

Question 4 a) Ulimwengu Printers is a company engaged in the printing business. Of recent they have enjoyed a spell of good performance ahd their liquidity position is strong. In order to utilize their excess funds, they are considering putting their funds in diversification investments. An investment advisor tipped them of the available opportunity to invest in two project's. The projects offer expected returns of 20% and 25% respectively. The correlation coefficient of the two projects is 0.4 . The risk of the two projects are given by standard deviations which are 20% and 30% respectively. The treasury bill, which are relatively risk free offer a return of 8\%. (NBAA May 2016 (3, Qn 6) Required: (i) In what proportion of available investment funds should Ulimwengu Printers invest in the projects in order to have the best possible capital allocation? (3 marks) (ii) What will the risk and return of such a portfolio be? (3 marks) (iii) Is it a good idea to invest in portfolio that are positively correlated? Why? ( 3 marks) (iv) Describe to Ulimwengu Printers the meaning of an optimum portfolio. (2 marks) b) Critically discuss any three factors that a corporate treasurer of a multinational company needs to consider in managing a debt portfolio. (9 marks) Question 4 a) Ulimwengu Printers is a company engaged in the printing business. Of recent they have enjoyed a spell of good performance and their liquidity position is strong. In order to utilize their excess funds, they are considering putting their funds in diversification investments. An investment advisor tipped them of the available opportunity to invest in two project's. The projects offer expected returns of 20% and 25% respectively. The correlatioir coefficient of the two projects is 0.4 . The risk of the two projects are given by standard deviations which are 20% and 30% respectively. The treasury bill, which are relatively risk free offer a return of 8\%. (NBAA May 2016 C3, Qn 6) Required: (i) In what proportion of available investment funds should Ulimwengu Printers invest in the projects in order to have the best possible capital allocation? (ii) What will the risk and return of such a portfolio be? (3 marks) (3 marks) (iii) Is it a good idea to invest in portfolio that are positively correlated? Why? (3 marks) (iv) Describe to Ulimwengu Printers the meaning of an optimum portfolio. (2 marks) b) Critically discuss any three factors that a corporate treasurer of a multinational company needs to consider in managing a debt portfolio. (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started