Solutions for 17-30

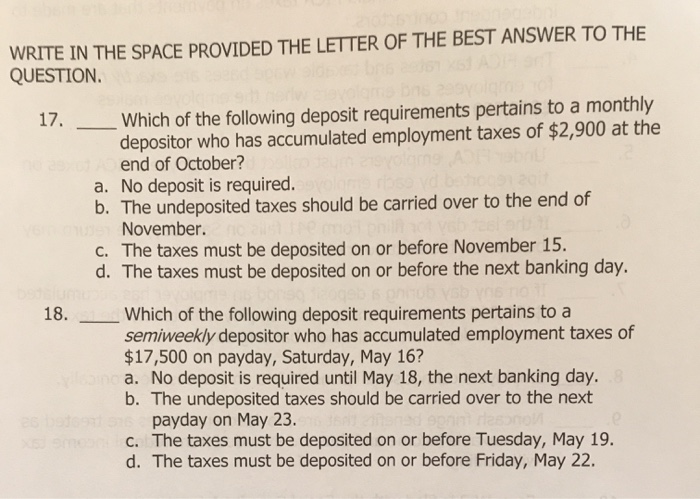

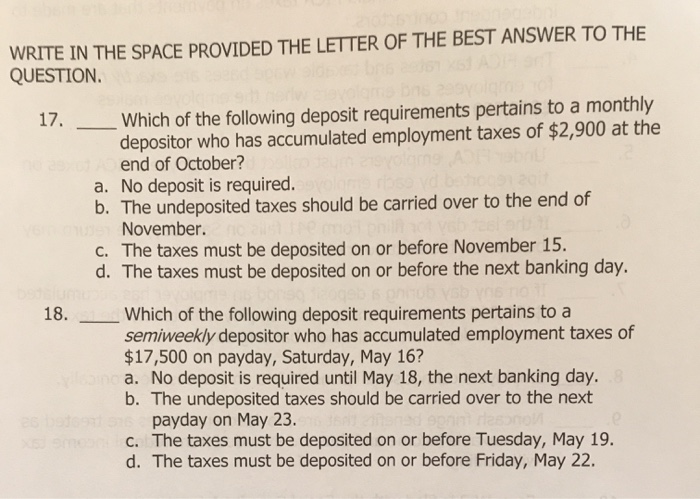

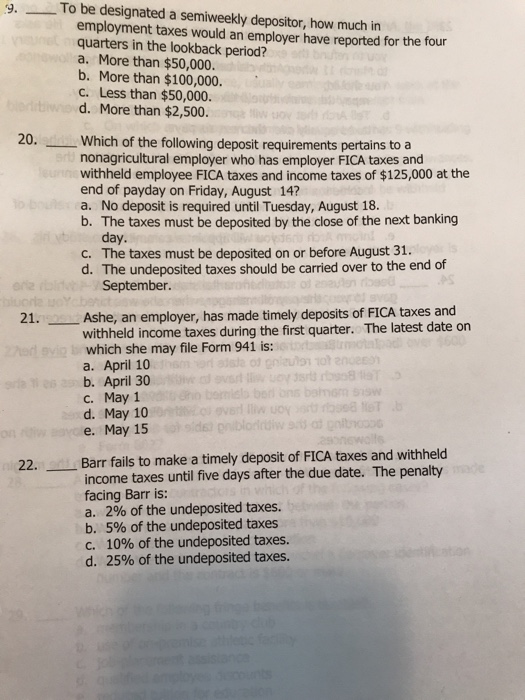

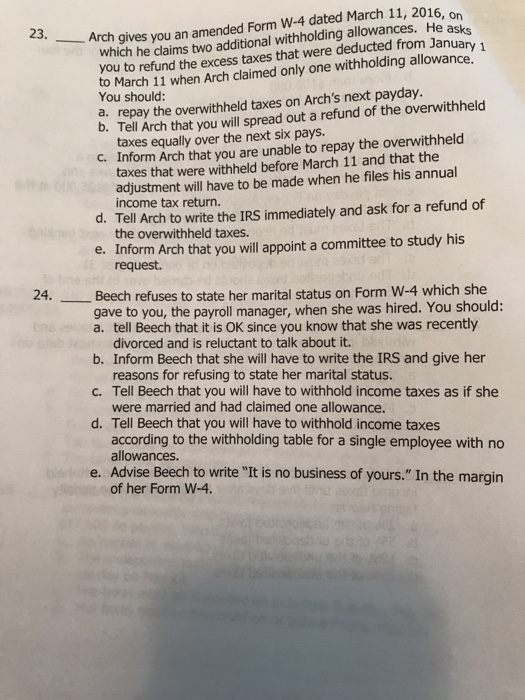

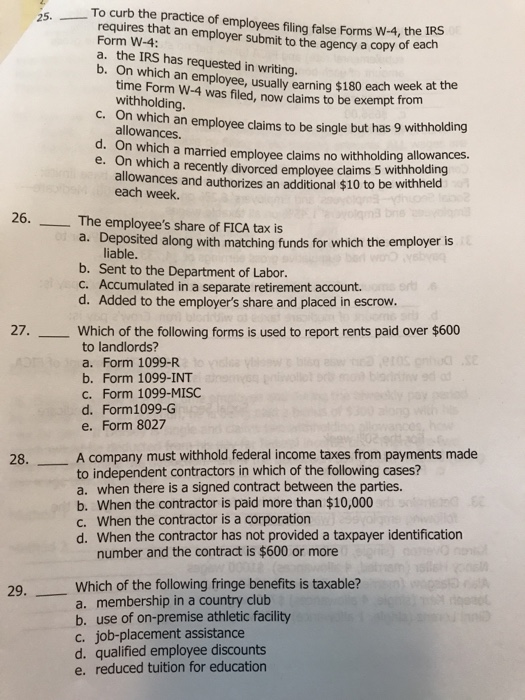

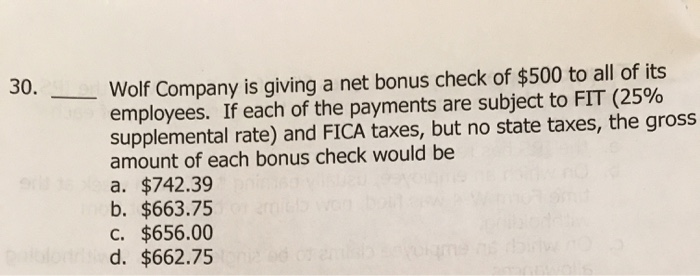

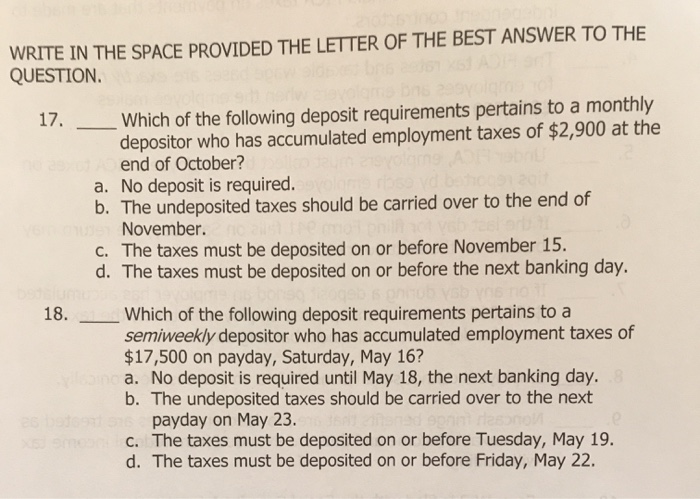

WRITE IN THE SPACE PROVIDED THE LETTER OF THE BEST ANSWER TO THE QUESTION. Which of the following deposit requirements pertains to a monthly depositor who has accumulated employment taxes of $2,900 at the end of October? a. No deposit is required. b. The undeposited taxes should be carried over to the end of November. c. The taxes must be deposited on or before November 15. d. The taxes must be deposited on or before the next banking day. 18.Which of the following deposit requirements pertains to a semiweekly depositor who has accumulated employment taxes of $17,500 on payday, Saturday, May 16? a. No deposit is required until May 18, the next banking day. b. The undeposited taxes should be carried over to the next payday on May 23. c. The taxes must be deposited on or before Tuesday, May 19 d. The taxes must be deposited on or before Friday, May 22. To be designated a semiweekly depositor, how much in 9.--_ d employment taxes would an employer have reported for the four quarters in the lookback period? a. More than $50,000. b. More than $100,000. c. Less than $50,000. d. More than $2,500. 20. Which of the following deposit requirements pertains to a nonagricultural employer who has employer FICA taxes and withheld employee FICA taxes and income taxes of $125,000 at the end of payday on Friday, August 14? a. No deposit is required until Tuesday, August 18. b. The taxes must be deposited by the close of the next banking day. c. The taxes must be deposited on or before August 31. d. The undeposited taxes should be carried over to the end of September. 21.Ashe, an employer, has made timely deposits of FICA taxes and withheld income taxes during the first quarter. The latest date on which she may file Form 941 is: a. April 10 b. April 30 c. May 1 d. May 10 e. May 15 Barr fails to make a timely deposit of FICA taxes and withheld income taxes until five days after the due date. The penalty facing Barr is: a. 2% of the undeposited taxes. b, 5% of the undeposited taxes c. 10% of the undeposited taxes. d, 25% of the undeposited taxes. 22. Arch gives you an amended Form W-4 dated March 11, 2016, which he claims two additional withholding allowances. He as you to refund the excess taxes that were deducted from Janua to March 11 when Arch claimed only one withholding allowance. On 23. You should: a. repay the overwithheld taxes on Arch's next payday. b. Tell Arch that you will spread out a refund of the overwithheld taxes equally over the next six pays. c. Inform Arch that you are unable to repay the overwithheld taxes that were withheld before March 11 and that the adjustment will have to be made when he files his annual income tax return. d. Tell Arch to write the IRS immediately and ask for a refund of the overwithheld taxes. e. Inform Arch that you will appoint a committee to study his request. Beech refuses to state her marital status on Form W-4 which she gave to you, the payroll manager, when she was hired. You should: a. tell Beech that it is OK since you know that she was recently divorced and is reluctant to talk about it. b. Inform Beech that she will have to write the IRS and give her reasons for refusing to state her marital status. c. Tell Beech that you will have to withhold income taxes as if she were married and had claimed one allowance. d. Tell Beech that you will have to withhold income taxes according to the withholding table for a single employee with no allowances. e. Advise Beech to write "It is no business of yours." In the margin of her Form W-4 To curb the practice of employees filing false Forms W-4, the 25.requires that an employer submit to the agency a copy Form W-4: a. the IRS has requested in writing. b. On which an employee, usually e we time Form W-4 was filed, now claims to be exempt from withholding c. On which an employee claims to be single but has 9 withholding allowances d. On whi e. On which a recently divorced employee claims 5 withholding allowances and authorizes an additional $10 to be withheld each week. earning $180 each at the ch a married employee claims no withholding allowances. 26. The employee's share of FICA tax is a. Deposited along with matching funds for which the employer is liable. b. Sent to the Department of Labor. c. Accumulated in a separate retirement account. d. Added to the employer's share and placed in escrow. 27 __ which of the following forms is used to report rents paid over $600 to landlords? a. Form 1099-R b. Form 1099-INT c. Form 1099-MISC d. Form1099-G e. Form 8027 28. A company must withhold federal income taxes from payments made to independent contractors in which of the following cases? a. when there is a signed contract between the parties. b. When the contractor is paid more than $10,000 c. When the contractor is a corporation d. When the contractor has not provided a taxpayer identification number and the contract is $600 or more Which of the following fringe benefits is taxable? a. membership in a country club b. use of on-premise athletic facility c, job-placement assistance d. qualified employee discounts e. reduced tuition for education 29 Wolf Company is giving a net bonus check of $500 to all of its employees. If each of the payments are subject to FIT (25% supplemental rate) and FICA taxes, but no state taxes, the gross amount of each bonus check would be a. $742.39 b. $663.75 C. $656.00 d. $662.75 30