Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solutions Ltd. sponsors a defined benefit pension plan for its employees. At the beginning of 20X3, there is an accrued SFP pension liability of

![]()

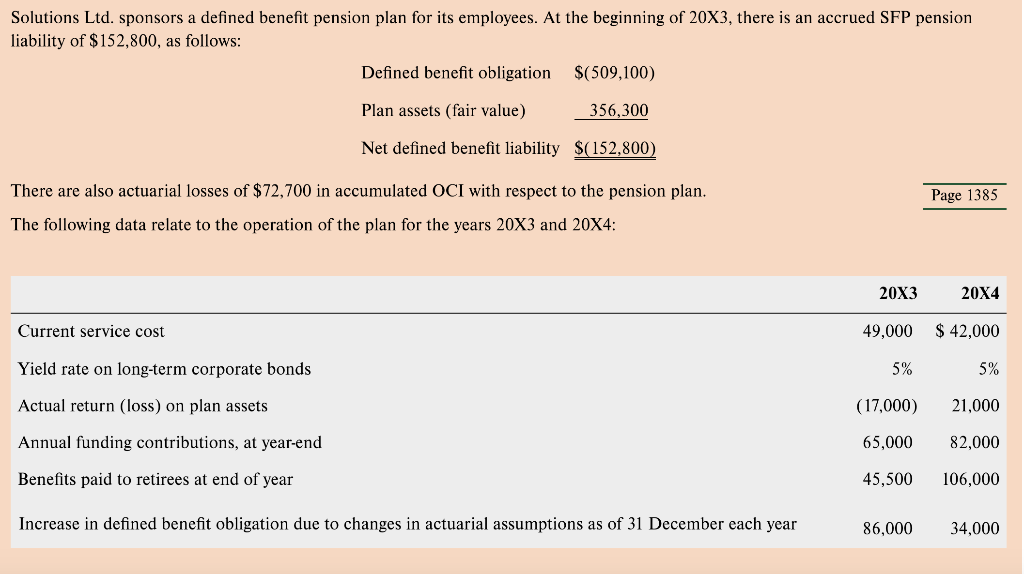

Solutions Ltd. sponsors a defined benefit pension plan for its employees. At the beginning of 20X3, there is an accrued SFP pension liability of $152,800, as follows: Defined benefit obligation $(509,100) Plan assets (fair value) 356,300 Net defined benefit liability $(152,800) There are also actuarial losses of $72,700 in accumulated OCI with respect to the pension plan. Page 1385 The following data relate to the operation of the plan for the years 20X3 and 20X4: 20X3 20X4 Current service cost 49,000 $ 42,000 Yield rate on long-term corporate bonds 5% 5% Actual return (loss) on plan assets (17,000) 21,000 Annual funding contributions, at year-end 65,000 82,000 Benefits paid to retirees at end of year 45,500 106,000 Increase in defined benefit obligation due to changes in actuarial assumptions as of 31 December each year 86,000 34,000 Required: Prepare a spreadsheet that summarizes relevant pension data for 20X3 and 20X4. As part of the spreadsheet, calculate pension expense, the net defined benefit accrued benefit asset/liability, and accumulated OCI for 20X3 and 20X4.

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

DBO 20X3 20X4 Opening Balance 509100 624055 Interest Cost 25455 31203 Current Service Cost 490...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started