Answered step by step

Verified Expert Solution

Question

1 Approved Answer

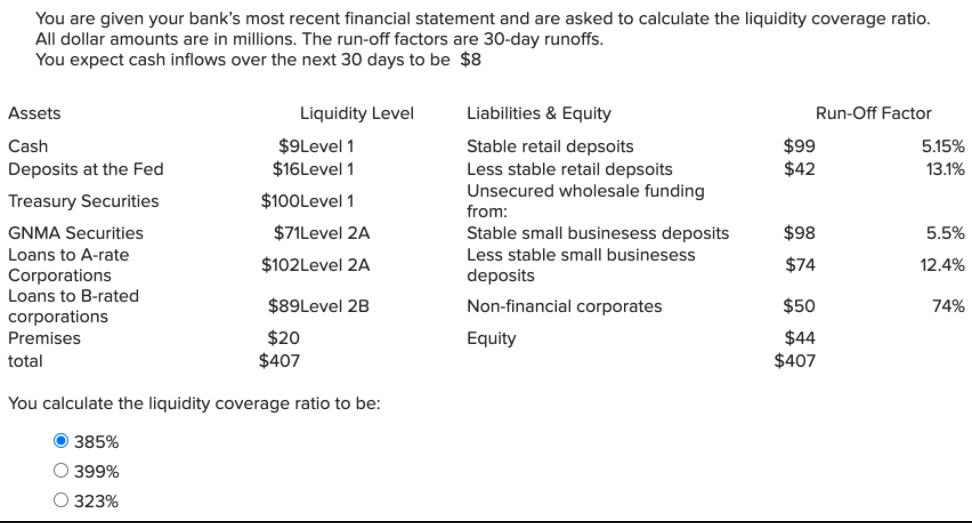

You are given your bank's most recent financial statement and are asked to calculate the liquidity coverage ratio. All dollar amounts are in millions.

You are given your bank's most recent financial statement and are asked to calculate the liquidity coverage ratio. All dollar amounts are in millions. The run-off factors are 30-day runoffs. You expect cash inflows over the next 30 days to be $8 Assets Cash Deposits at the Fed Treasury Securities GNMA Securities Loans to A-rate Corporations Loans to B-rated corporations Premises total Liquidity Level $9Level 1 $16Level 1 $100Level 1 $71Level 2A $102Level 2A $89Level 2B $20 $407 You calculate the liquidity coverage ratio to be: 385% O 399% O 323% Liabilities & Equity Stable retail depsoits Less stable retail depsoits Unsecured wholesale funding from: Stable small businesess deposits Less stable small businesess deposits Non-financial corporates Equity Run-Off Factor $99 $42 $98 $74 $50 $44 $407 5.15% 13.1% 5.5% 12.4% 74%

Step by Step Solution

★★★★★

3.53 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 323 CALCULATION 9 16 100 71 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started