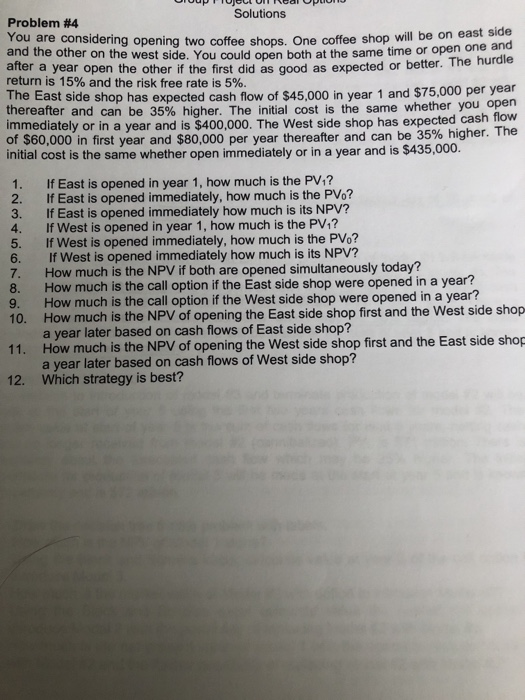

Solutions Problem #4 One coffee shop will be on east side and You are considering opening two coffee shops. and the other on the west side. You could open both at the same time or open one after a year open the other if the first did as good as expected or better. return is 15% and the risk free rate is 5% The East side shop has expected cash flow of $45,000 in year 1 and $75,000 per year thereafter and can be 35% higher. The initial cost is the same whether you open immediately or in a year and is $400,000. The West side shop has expected cash flow of $60,000 in first year and $80,000 per year thereafter and can be 35% higher. The initial cost is the same whether open immediately or in a year and is $435,000. The hurdle 1. If East is opened in year 1, how much is the PV1? 2. If East is opened immediately, how much is the PVo? 3. If East is opened immediately how much is its NPV? 4. If West is opened in year 1, how much is the PV1? est is opened immediately, how much is the PVo? If West is opened immediately how much is its NPV? How much is the NPV if both are opened simultaneously today? How much is the call option if the East side shop were opened in a year? How much is the call option if the West side shop were opened in a year? How much is the NPV of opening the East side shop first and the West side shop a year later based on cash flows of East side shop? How much is the NPV of opening the West side shop first and the East side shop a year later based on cash flows of West side shop? Which strategy is best? 6. 7. 8. 9. 10. 11. 12. Solutions Problem #4 One coffee shop will be on east side and You are considering opening two coffee shops. and the other on the west side. You could open both at the same time or open one after a year open the other if the first did as good as expected or better. return is 15% and the risk free rate is 5% The East side shop has expected cash flow of $45,000 in year 1 and $75,000 per year thereafter and can be 35% higher. The initial cost is the same whether you open immediately or in a year and is $400,000. The West side shop has expected cash flow of $60,000 in first year and $80,000 per year thereafter and can be 35% higher. The initial cost is the same whether open immediately or in a year and is $435,000. The hurdle 1. If East is opened in year 1, how much is the PV1? 2. If East is opened immediately, how much is the PVo? 3. If East is opened immediately how much is its NPV? 4. If West is opened in year 1, how much is the PV1? est is opened immediately, how much is the PVo? If West is opened immediately how much is its NPV? How much is the NPV if both are opened simultaneously today? How much is the call option if the East side shop were opened in a year? How much is the call option if the West side shop were opened in a year? How much is the NPV of opening the East side shop first and the West side shop a year later based on cash flows of East side shop? How much is the NPV of opening the West side shop first and the East side shop a year later based on cash flows of West side shop? Which strategy is best? 6. 7. 8. 9. 10. 11. 12