Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve 1 & 2 Investment science Chapter 11 1. (Slock lattice) A slock with current value S(0) = 100 has an expected growth rate of

Solve 1 & 2

Investment science Chapter 11

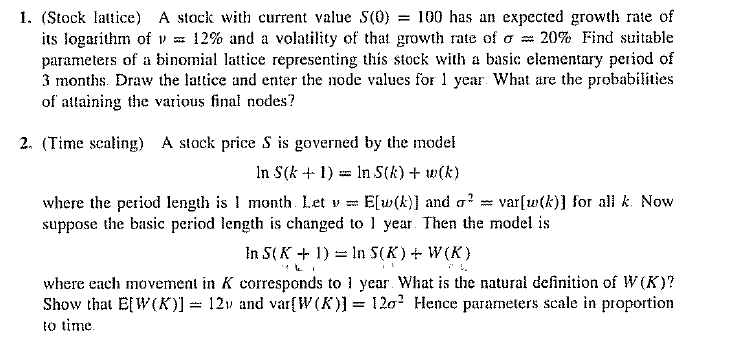

1. (Slock lattice) A slock with current value S(0) = 100 has an expected growth rate of its logarithm of v = 12% and a volatility of that growth rate of sigma = 20% Find suitable parameters of a binomial lattice representing this stock with a basic elementary period of 3 months. Draw the lattice and enter the node values for 1 year What are the probabilities of attaining the various final nodes? (Time scaling) A slock price S is governed by the model In S(k + 1) = In S(k) + w(k) where the period length is 1 month Let v = E[w(k)] and sigma2 = var[w(k)] for all k Now suppose the basic period length is changed to 1 year Then the model is In S(K + 1) = In S(K) + W(K) where each movement in K corresponds to 1 year What is the natural definition of W(K)? Show that E[W(E)] = 12v and var[W(K)] = I2sigma2 Hence parameters scale in proportion to time

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started