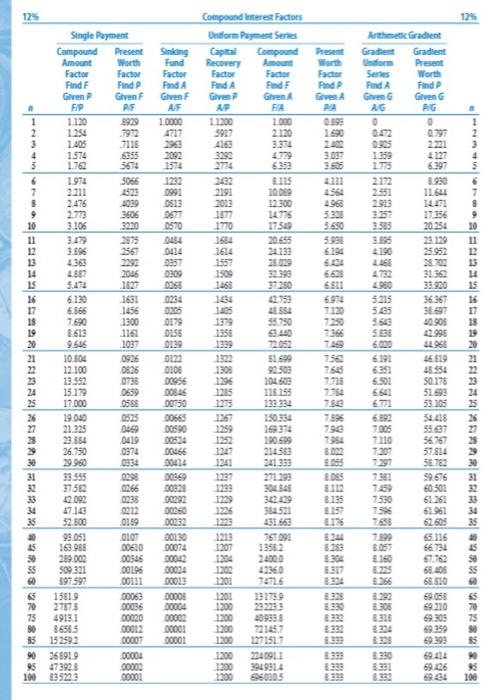

SOLVE

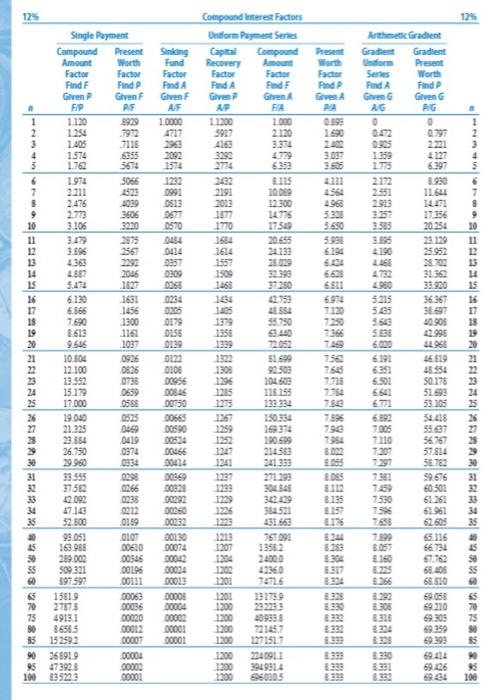

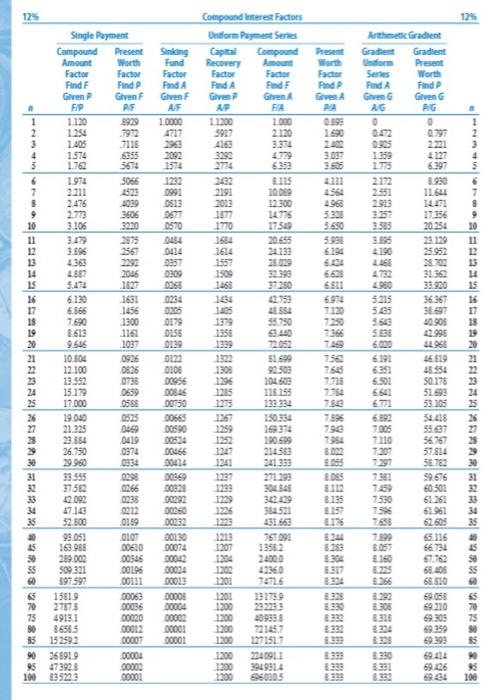

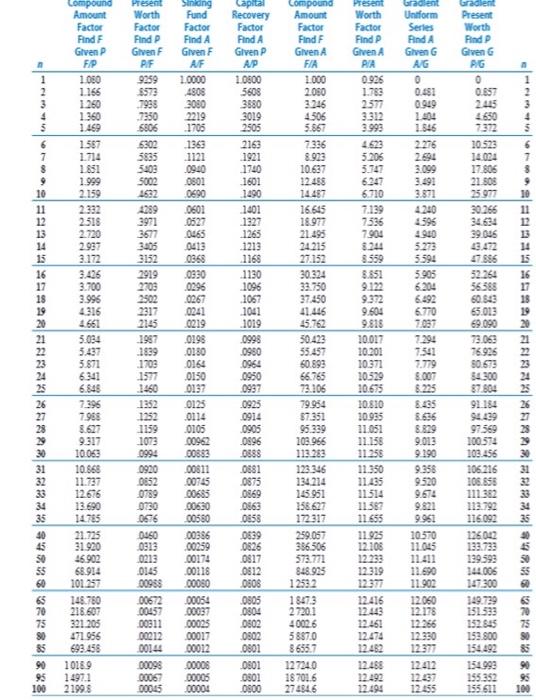

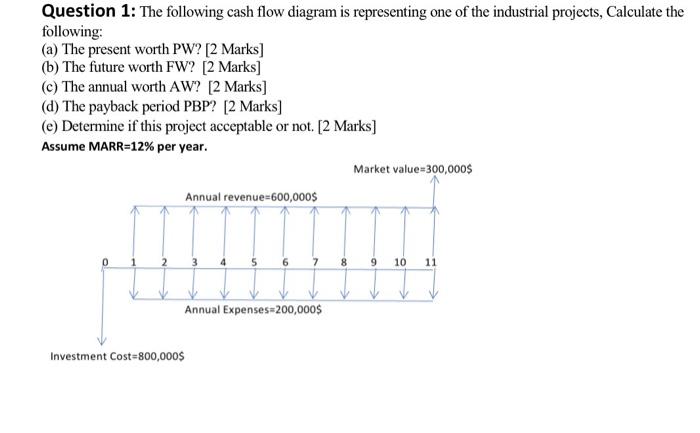

12% Worth Factor Pand Sinking Fund Factor Find A Glven AF 10000 4717 Authmetic Gradient Gradient Gradient Uniform Present Series Worth Find A Find Given Given AG PG 1.590 2400 0.02 0905 2 4 5 3.505 411 4554 1966 0.797 2221 4127 6.397 8.930 11.611 1471 17356 20254 28 129 23952 28702 31.362 33.920 6 7 $ 9 10 3.936 6194 604 6511 69 7120 Compound interest Factors Untform Payment Series Capital Compound Recovery Amount Factor Factor Pind A Find F Given Ghren AP FA 11200 1.000 597 2.120 3374 3192 4779 2774 6352 3115 2191 10.09 2013 12.300 1977 14776 1770 17589 1684 20655 1614 28.029 1509 32399 1868 37250 134 1405 25854 1379 35,790 1956 3.10 1389 72052 61.699 1305 92.309 1296 104.500 1205 118.155 1275 130.334 1259 16374 190.699 1207 214583 1241 241333 1237 271293 1233 1229 1225 351521 31.663 1219 757291 1207 13582 1204 24000 1200 42360 1201 2172 2.551 2923 3157 3.383 3.990 4190 2466 4732 4980 5.213 5.195 5.50 5.30 6.00 6191 6351 6501 14 15 16 17 15 12% Single Payment Compound Present Amount Worth Factor Factor Find F Find Given P Given FIP PAF 1 1.120 1929 2 1.254 .7972 3 1405 7115 4 1574 6355 5 1.762 3674 6 1.974 5066 7 2211 8 2.476 1039 9 2.773 3606 10 3.106 3220 11 3.896 3561 13 2293 14 4.687 2046 15 3.474 1027 16 6.130 1651 17 6.566 1456 18 7.690 1300 19 8.612 116 20 9.646 1037 21 10.601 0926 12.100 0826 23 13.552 0738 24 15.119 0659 25 17.000 0568 26 19.040 21.325 23.654 0419 26.750 0974 30 29.960 31 33555 0298 32 37582 0266 33 2092 0738 34 47 148 0212 35 32.500 0119 30 93.051 0107 15 169.988 00610 289.002 00346 509 321 00106 60 $97.997 00111 65 15819 00063 70 27875 00036 75 49131 00020 90 86585 00012 35 152592 00007 % 266919 00001 95 473925 00002 100 335223 0000! $0.900 2.995 7366 2092 1574 1232 0991 0813 0677 0570 0434 0114 0857 0309 0366 0234 | 0305 0179 0158 0129 0122 0108 00956 00846 00750 00565 00590 00624 00456 00414 00369 00923 0292 00060 00232 00130 00074 00043 30024 00013 00006 20 7505 7.738 2254 780 7.90 7954 BOM 16.319 18554 50.178 51999 53.105 54.418 55.637 56767 57.814 5672 39.676 60.500 61.261 6.992 7005 2110 7207 2297 7301 7459 7530 7594 25 29 30 3.135 3.157 3176 334 33 34 35 40 3057 3150 62.505 65116 66.734 67.763 66.606 68.510 3.304 50 3.266 3334 8335 3330 60 65 1301 00002 00001 00001 1200 1200 1200 1200 3308 3316 8234 232233 109338 221457 171527 2240911 3949914 5950105 69.210 6303 69.359 69.393 75 SO 3. 1200 1200 3330 3331 3322 69426 69484 Present Worth Factor Find P Given F PF 9259 $573 Sinong Fund Factor Find A Given F Capital Recovery Factor Find A Glven P Compound Amount Factor Find F Given A FIA Gradient Uniform Series Find A Given G AG Present Worth Factor Find P Given A PIA 0.926 1.783 2.577 3.312 3.993 Present Worth Pind P Given G PG 0 0.657 AF AP 1.000 1 0.581 0.949 7 5.206 3.747 7350 5806 6302 5835 5403 5002 1632 4289 3971 3677 1 2 3 $ 5 6 7 $ 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 50 45 50 55 60 9 10 11 12 13 14 15 16 Compound Amount Factor Find F Given P FIP 1050 1.166 1.250 1.360 1.469 1567 1714 1851 1.999 2.159 2332 2516 2.720 2.997 3.172 3.435 3.700 3.996 4316 4.661 5.034 5.437 5.871 6.341 6.846 7396 7985 8.627 9.317 10.063 10.868 11.737 12.676 13.690 14.785 21.725 31.920 46.902 68.914 101.257 145.750 216.607 321.205 171.956 693.456 10169 1497.1 2199.5 4650 7372 30.523 14.084 17.806 21-508 35977 30.266 34.634 39.046 13.472 47.886 52.254 56.568 60543 65.012 69.090 73.063 76.926 50.593 54.300 1.0000 4808 3080 2219 1705 1363 1121 0940 0801 0690 0601 0527 0465 0413 0368 0820 0296 0267 0241 0219 0198 0180 0164 0150 0137 0125 0114 0105 00962 00883 00811 00745 00683 90630 00550 00386 00259 00174 00116 00050 00054 00037 .00025 00017 00012 00006 00005 00004 3152 2919 2703 2502 2317 2145 1987 1829 1703 1577 1460 1252 1252 1159 1073 0994 0920 0852 0789 0730 0676 0450 0313 0213 0145 00958 00672 00457 00311 00212 00144 00098 00067 00015 1.0500 5608 3580 3019 2505 2163 1921 1740 1601 1490 1401 1327 1265 1213 1168 .1130 1096 1067 1041 1019 0998 .0980 0964 0950 0937 0923 0914 0903 0896 0888 .0881 0875 0869 0563 0858 0639 0826 0817 0812 0808 0805 0804 0802 0802 .0801 0801 0801 0800 2.050 3.246 4506 5.867 2336 8.923 10.637 12.458 14.487 16.615 18977 21.495 24.215 27.152 30.324 33.750 37.450 41.446 45.762 50422 55457 50.893 66.765 73.106 79.954 $7351 95.329 103.966 113.263 123.346 134.214 145.951 156,627 172317 259.057 336,506 573.771 848.925 12532 1847.3 27201 40026 58870 8655.7 127240 187016 274846 1.546 2.276 2.694 3.099 3.191 3.871 4.240 4596 4.940 5.273 5.591 5.905 6204 6.492 6.770 7.037 7 294 7.541 7.779 8.007 6.225 8.35 5636 8.829 9.013 9.190 9.358 9.520 21 22 23 24 25 26 6.710 7.139 7536 7.904 3.244 3.559 8.551 9.122 9.372 9.504 9.818 10.017 10.201 10.371 20.529 10.675 10.810 30.935 11.051 11.156 11258 11.350 11.435 11.514 11.387 11.655 11.925 12.106 12.233 12.319 12377 12.416 12.443 12.461 12.474 12.482 12.466 12.492 12.494 91.184 94.439 97.569 100.574 103.456 106.216 108.855 111.382 112.792 116092 12602 132.733 139.599 144.006 147.300 349.739 151.533 152.845 153.800 154.492 154.999 155 352 155 611 30 31 32 33 34 35 50 S0 9.961 10.570 11045 11 411 11.690 11.902 12060 12.176 12 266 12330 12 377 12412 12.437 12.455 70 75 80 85 90 95 100 70 75 SO 85 90 95 100 Question 1: The following cash flow diagram is representing one of the industrial projects, Calculate the following: (a) The present worth PW? [2 marks] (b) The future worth FW? [2 Marks] (c) The annual worth AW? [2 marks] (d) The payback period PBP? [2 marks] (e) Determine if this project acceptable or not[2 Marks) Assume MARR=12% per year. Market value=300,000$ Annual revenue=600,000$ 7 8 9 10 11 Annual Expenses 200,000$ Investment Cost=800,000$