Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve 3 problems independently please thabk you! Negative Growth According to analysts, the growth rate in dividends for Acevedo for the previous five years has

solve 3 problems independently please thabk you!

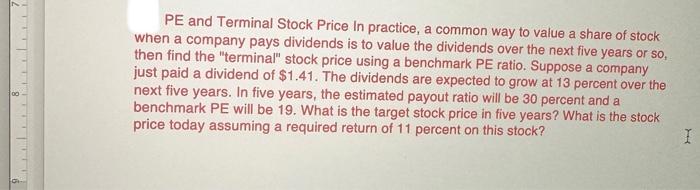

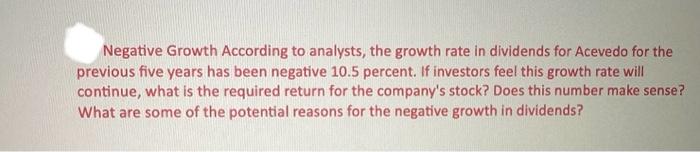

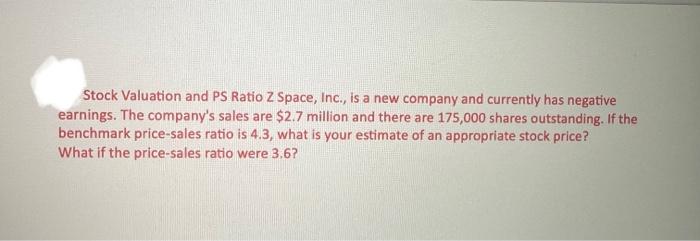

Negative Growth According to analysts, the growth rate in dividends for Acevedo for the previous five years has been negative 10.5 percent. If investors feel this growth rate will continue, what is the required return for the company's stock? Does this number make sense? What are some of the potential reasons for the negative growth in dividends? PE and Terminal Stock Price In practice, a common way to value a share of stock when a company pays dividends is to value the dividends over the next five years or so, then find the "terminal" stock price using a benchmark PE ratio. Suppose a company just paid a dividend of $1.41. The dividends are expected to grow at 13 percent over the next five years. In five years, the estimated payout ratio will be 30 percent and a benchmark PE will be 19. What is the target stock price in five years? What is the stock price today assuming a required return of 11 percent on this stock? Stock Valuation and PS Ratio Z Space, Inc., is a new company and currently has negative earnings. The company's sales are $2.7 million and there are 175,000 shares outstanding. If the benchmark price-sales ratio is 4.3 , what is your estimate of an appropriate stock price? What if the price-sales ratio were 3.6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started