Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve 3,4, and 5 PROBLEMS AND CASE STUDIES pe 1. PRACTICE PROBLEMS Consider an asset which is currently worth P1,000. An investor plans to sell

solve 3,4, and 5

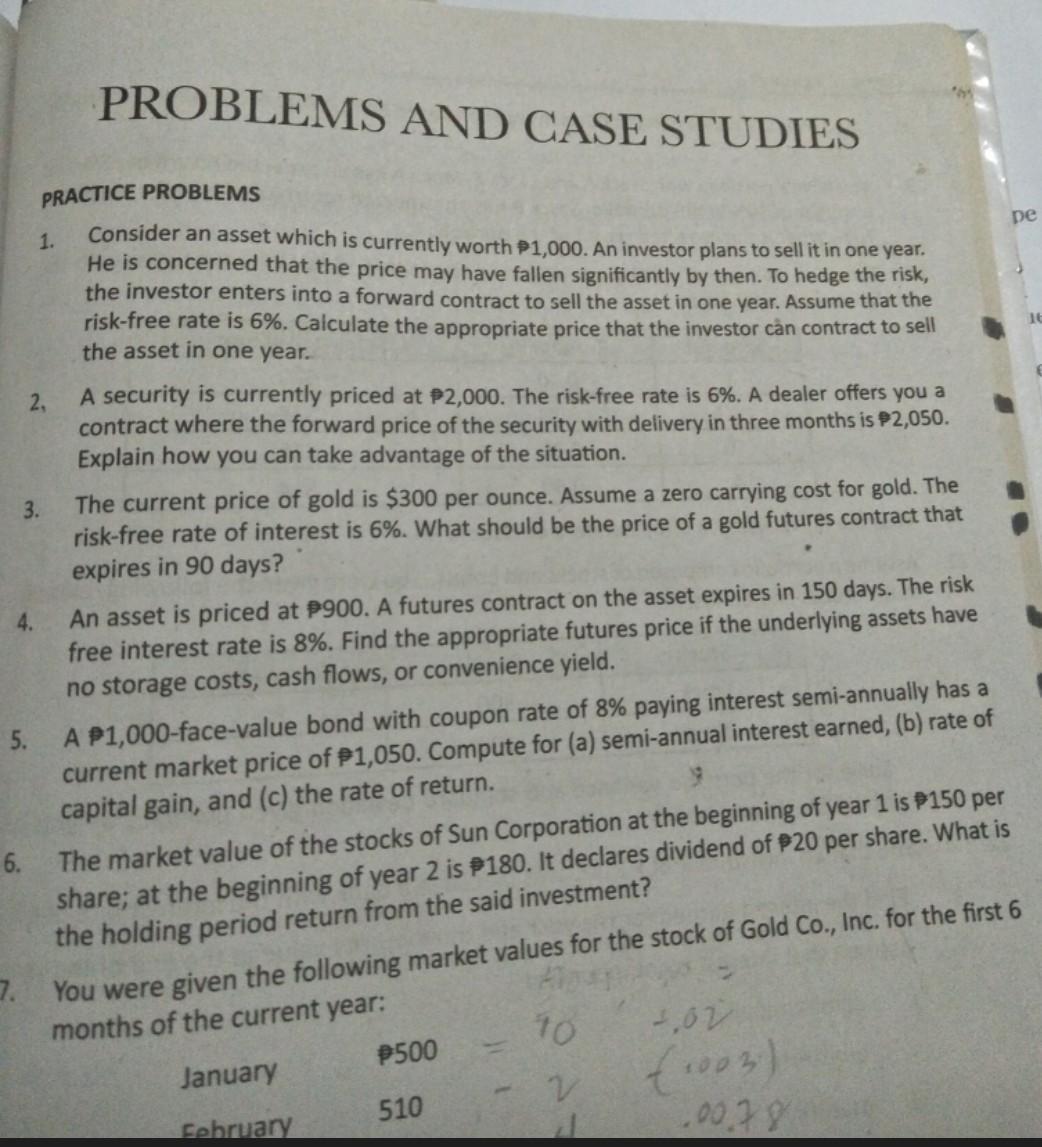

PROBLEMS AND CASE STUDIES pe 1. PRACTICE PROBLEMS Consider an asset which is currently worth P1,000. An investor plans to sell it in one year. He is concerned that the price may have fallen significantly by then. To hedge the risk, the investor enters into a forward contract to sell the asset in one year. Assume that the risk-free rate is 6%. Calculate the appropriate price that the investor can contract to sell the asset in one year. 16 2, A security is currently priced at P2,000. The risk-free rate is 6%. A dealer offers you a contract where the forward price of the security with delivery in three months is $2,050. Explain how you can take advantage of the situation. 3. The current price of gold is $300 per ounce. Assume a zero carrying cost for gold. The risk-free rate of interest is 6%. What should be the price of a gold futures contract that expires in 90 days? 4. An asset is priced at p900. A futures contract on the asset expires in 150 days. The risk free interest rate is 8%. Find the appropriate futures price if the underlying assets have no storage costs, cash flows, or convenience yield. 5. A P1,000-face-value bond with coupon rate of 8% paying interest semi-annually has a current market price of P1,050. Compute for (a) semi-annual interest earned, (b) rate of capital gain, and (c) the rate of return. 6. The market value of the stocks of Sun Corporation at the beginning of year 1 is P150 per share; at the beginning of year 2 is $180. It declares dividend of P20 per share. What is the holding period return from the said investment? 7. You were given the following market values for the stock of Gold Co., Inc. for the first 6 months of the current year: 10 tor January v 510 February 00.79 P500 (1003)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started