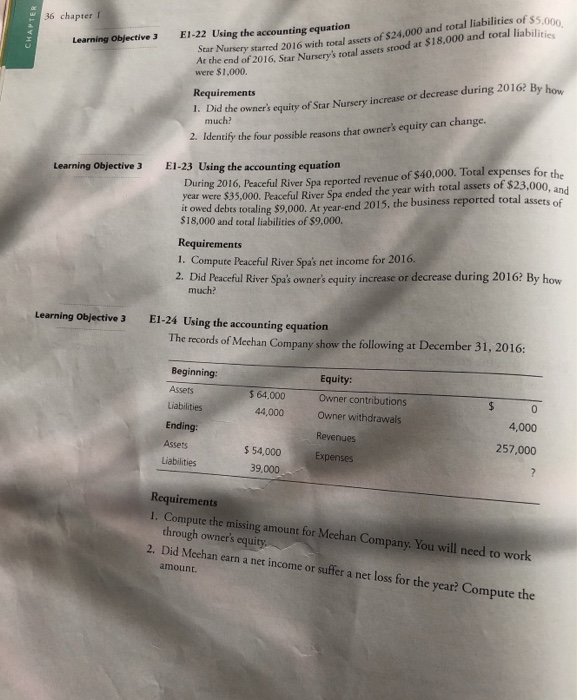

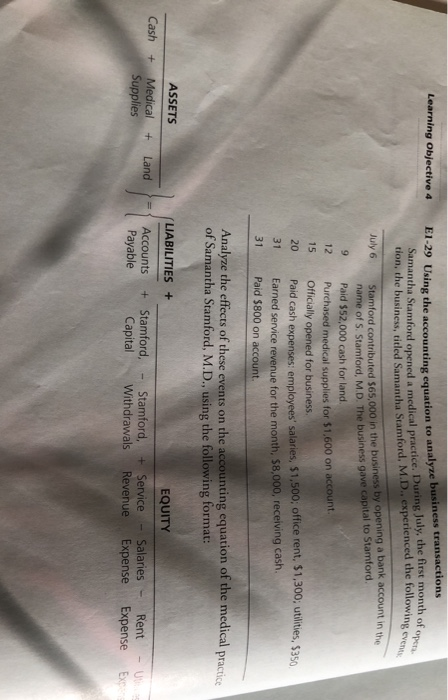

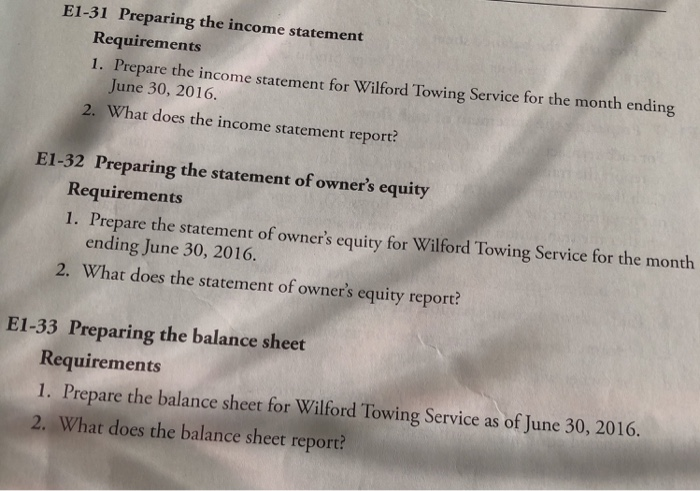

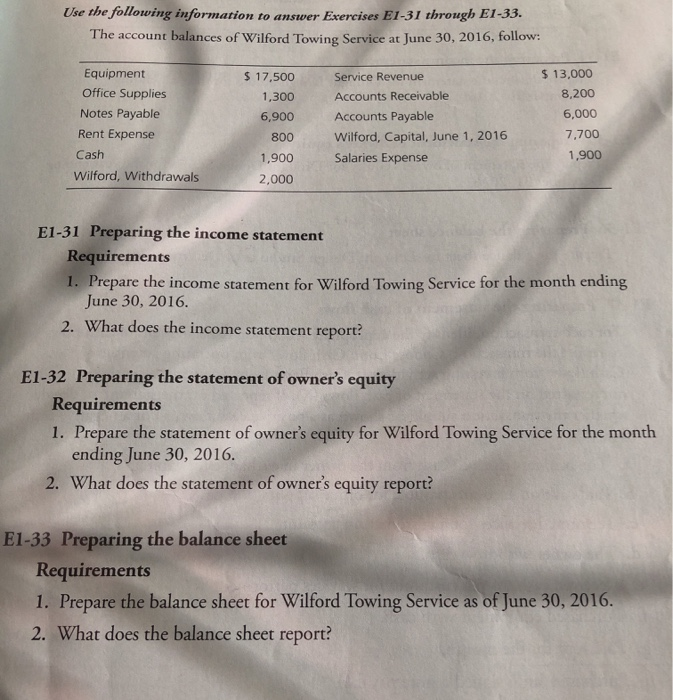

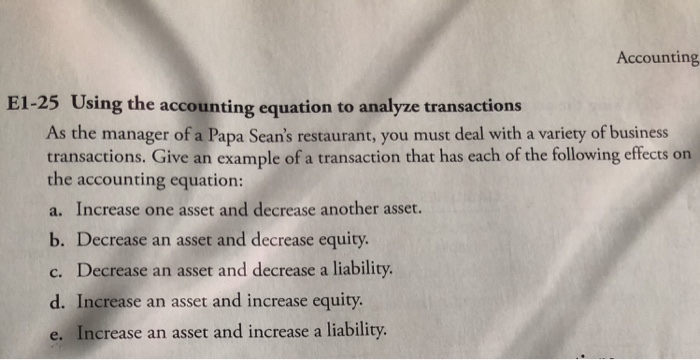

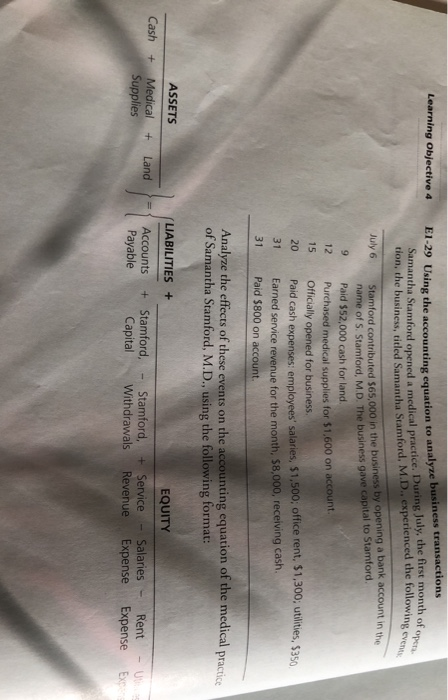

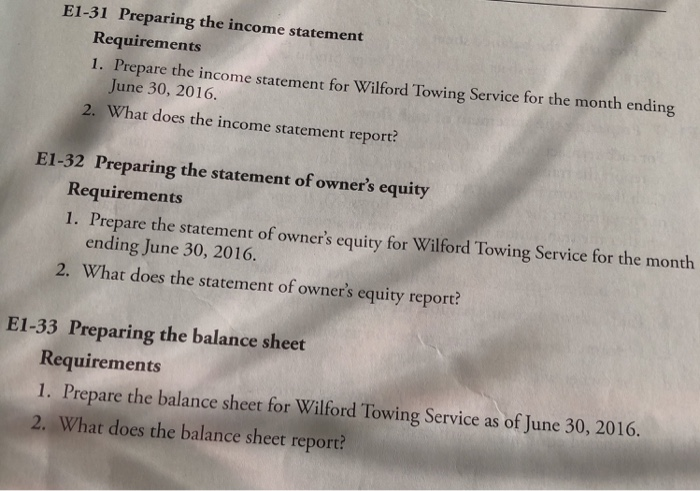

36 chapter 1 CHAPTER ting equation Learning Objective 3 $24,000 18.000 and E1-22 Using the accounting equation 000 and total liabilities of $5.00 Star Nursery starred 2016 with total assets of $24,000 an chd of 2016, Star Nursery total assets stood at $18,000 and total liabilir At the end of 2016, Star Nurs were $1.000. Requirements 1. Did the owner's equity of Star Nursery increase or decrease during 2016? By be much? 2. Identify the four possible reasons that owner's equity can change. E1-23 Using the accounting equation During 2016, Peaceful River Spa reported revenue of $40,000. Total expenses for the year were $35,000. Peaceful River Spa ended the year with total assets of $23,000, an it owed debes totaling $9.000. At year-end 2015, the business reported total assets of $18,000 and total liabilities of $9,000. Requirements 1. Compute Peaceful River Spa's net income for 2016. 2. Did Peaceful River Spa's owner's equity increase or decrease during 2016? By how much? Learning Objective 3 E1-24 Using the accounting equation The records of Mechan Company show the following at December 31, 2016: Beginning: $ 64,000 44,000 Equity: Owner contributions Owner withdrawals Assets Liabilities Ending: Assets Liabilities 4,000 257,000 Revenues Expenses $ 54,000 39,000 Requirements 1. Compute the missing amount for Meehan Company. You will need to work through owner's equity. 2. Did Meehan earn a net income or suffer a net loss for the year? Compute the amount. Accounting E1-25 Using the accounting equation to analyze transactions As the manager of a Papa Sean's restaurant, you must deal with a variety of business transactions. Give an example of a transaction that has each of the following effects on the accounting equation: a. Increase one asset and decrease another asset. b. Decrease an asset and decrease equity. c. Decrease an asset and decrease a liability. d. Increase an asset and increase equity. e. Increase an asset and increase a liability. Learning Objective 4 E1-29 Using the accounting equation to me accounting equation to analyze business transactions Samantha Stamford opened a medical practice. During July, the first month of on the business, titled Samantha Stamford, M.D.. experienced the following ev following events Stamford contributed $65.000 in the business by opening a bank account in the name of S. Stamford, MD. The business gave capital to Stamford, Paid $52,000 cash for land. Purchased medical supplies for $1,600 on account. Officially opened for business Pald cash expenses employees' salaries, $1.500, office rent, $1,300; utilities, $350 Earned service revenue for the month, $8,000, receiving cash. Paid $800 on account. 31 31 Analyze the effects of these events on the accounting equation of the medical practice of Samantha Stamford, M.D., using the following format: Cash + ASSETS Medical Supplies + Land (LIABILITIES + Accounts + Payable Stamford, Capital - Stamford, Withdrawals + EQUITY Service - Salaries - Revenue Expense Rent Expense - Ex E1-31 Preparing the income statement Requirements 1. Prepare the income statement for Wilford Towing Service for the month ending June 30, 2016. 2. What does the income statement report? E1-32 Preparing the statement of owner's equity Requirements 1. Prepare the statement of owner's equity for Wilford Towing Service for the month ending June 30, 2016. 2. What does the statement of owner's equity report? E1-33 Preparing the balance sheet Requirements 1. Prepare the balance sheet for Wilford Towing Service as of June 30, 2016. 2. What does the balance sheet report? Use the following information to answer Exercises E1-31 through E1-33. The account balances of Wilford Towing Service at June 30, 2016, follow: Equipment Office Supplies Notes Payable Rent Expense Cash Wilford, Withdrawals $ 17,500 1,300 6,900 800 1,900 2,000 Service Revenue Accounts Receivable Accounts Payable Wilford, Capital, June 1, 2016 Salaries Expense $ 13,000 8,200 6,000 7,700 1,900 E1-31 Preparing the income statement Requirements 1. Prepare the income statement for Wilford Towing Service for the month ending June 30, 2016. 2. What does the income statement report? E1-32 Preparing the statement of owner's equity Requirements 1. Prepare the statement of owner's equity for Wilford Towing Service for the month ending June 30, 2016. 2. What does the statement of owner's equity report? E1-33 Preparing the balance sheet Requirements 1. Prepare the balance sheet for Wilford Towing Service as of June 30, 2016. 2. What does the balance sheet report