Question

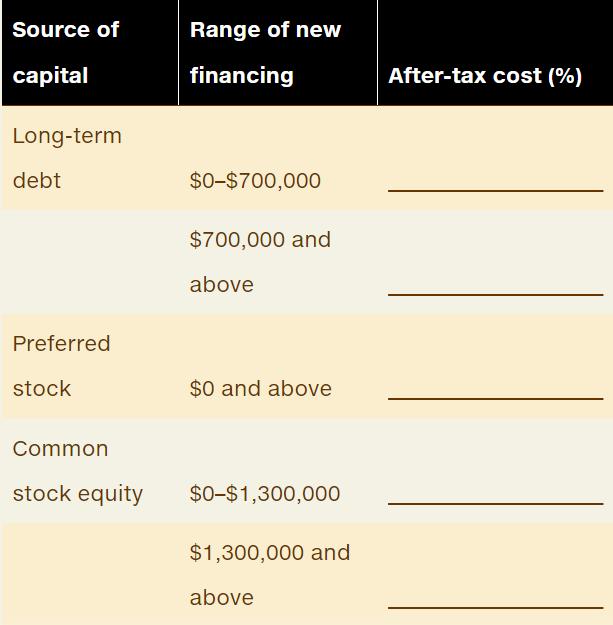

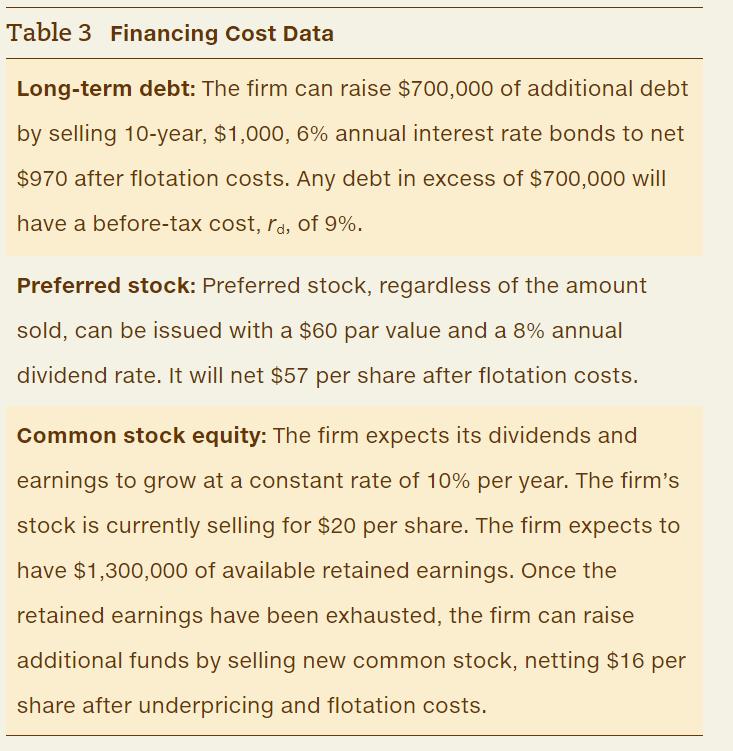

solve after-tax cost % and explain using formulas: Information needed to answer, assume a 21% tax rate when needed: Source of capital Long-term debt Preferred

solve after-tax cost % and explain using formulas:

Information needed to answer, assume a 21% tax rate when needed:

Source of capital Long-term debt Preferred stock Common stock equity Range of new financing $0-$700,000 $700,000 and above $0 and above $0-$1,300,000 $1,300,000 and above After-tax cost (%)

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Longterm Debt up to 700000 The beforetax cost of debt rd 6 Aftertax cost of debt rd 1 Tax Ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cornerstones Of Cost Management

Authors: Don R. Hansen, Maryanne M. Mowen

3rd Edition

9781305147102, 1285751787, 1305147103, 978-1285751788

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App