Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve All Answers,I give a positive rating Rollers company is incorporated on January 1, 2018. Company is authorized to issue 160,000 shares of $6 par

Solve All Answers,I give a positive rating

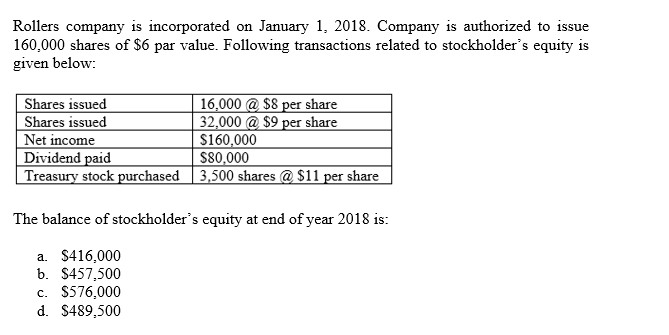

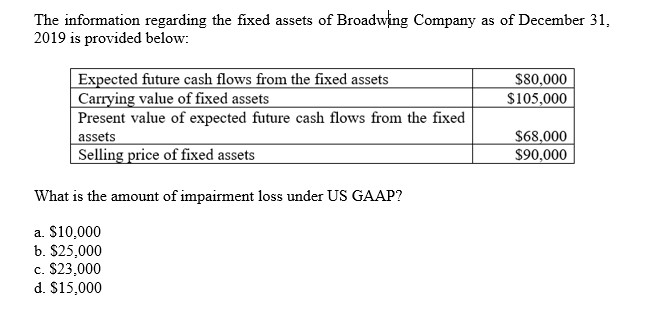

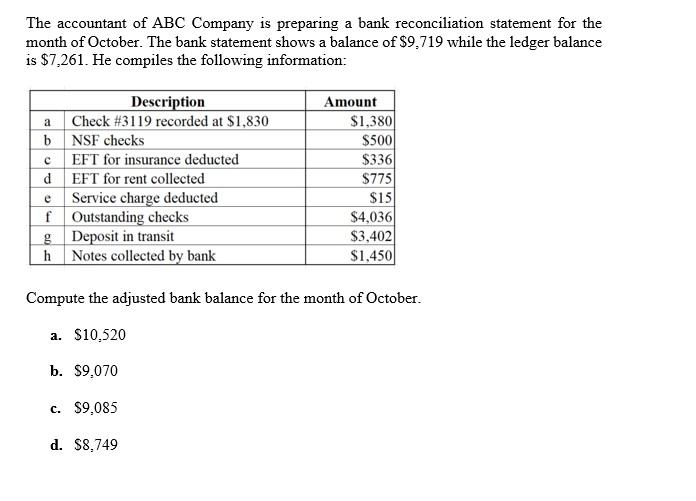

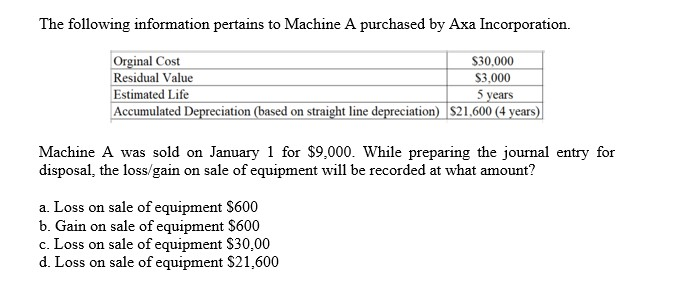

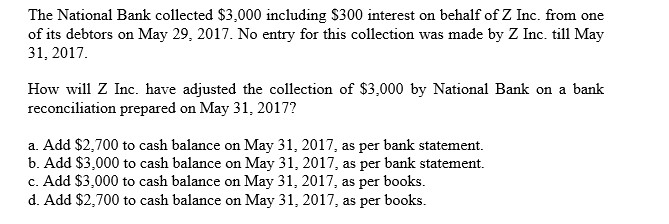

Rollers company is incorporated on January 1, 2018. Company is authorized to issue 160,000 shares of $6 par value. Following transactions related to stockholder's equity is given below: Shares issued Shares issued Net income Dividend paid | Treasury stock purchased 16.000 a $8 per share 32,000 @ $9 per share $160,000 $80,000 3,500 shares @ $11 per share The balance of stockholder's equity at end of year 2018 is: a. $416,000 b. $457,500 c. $576,000 d. $489,500 The information regarding the fixed assets of Broadwing Company as of December 31, 2019 is provided below: $80,000 $105,000 Expected future cash flows from the fixed assets Carrying value of fixed assets Present value of expected future cash flows from the fixed assets Selling price of fixed assets $68,000 $90,000 What is the amount of impairment loss under US GAAP? a. $10,000 b. $25,000 c. $23,000 d. $15,000 The accountant of ABC Company is preparing a bank reconciliation statement for the month of October. The bank statement shows a balance of $9,719 while the ledger balance is $7,261. He compiles the following information: c Description a Check #3119 recorded at $1,830 b NSF checks EFT for insurance deducted d EFT for rent collected e Service charge deducted f Outstanding checks Lg Deposit in transit h Notes collected by bank Amount $1,380 $500 $336 $775 $15 $4,036 $3,402 $1,450 Compute the adjusted bank balance for the month of October. a. $10,520 b. $9,070 c. $9,085 d. $8,749 The following information pertains to Machine A purchased by Axa Incorporation. Orginal Cost $30,000 Residual Value $3,000 Estimated Life 5 years Accumulated Depreciation (based on straight line depreciation) $21,600 (4 years) Machine A was sold on January 1 for $9,000. While preparing the journal entry for disposal, the loss/gain on sale of equipment will be recorded at what amount? a. Loss on sale of equipment $600 b. Gain on sale of equipment $600 c. Loss on sale of equipment $30.00 d. Loss on sale of equipment $21,600 The National Bank collected $3,000 including $300 interest on behalf of Z Inc. from one of its debtors on May 29, 2017. No entry for this collection was made by Z Inc. till May 31, 2017 How will Z Inc. have adjusted the collection of $3,000 by National Bank on a bank reconciliation prepared on May 31, 2017? a. Add $2,700 to cash balance on May 31, 2017, as per bank statement. b. Add $3,000 to cash balance on May 31, 2017, as per bank statement. c. Add $3,000 to cash balance on May 31, 2017, as per books d. Add $2,700 to cash balance on May 31, 2017, as per booksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started