Answered step by step

Verified Expert Solution

Question

1 Approved Answer

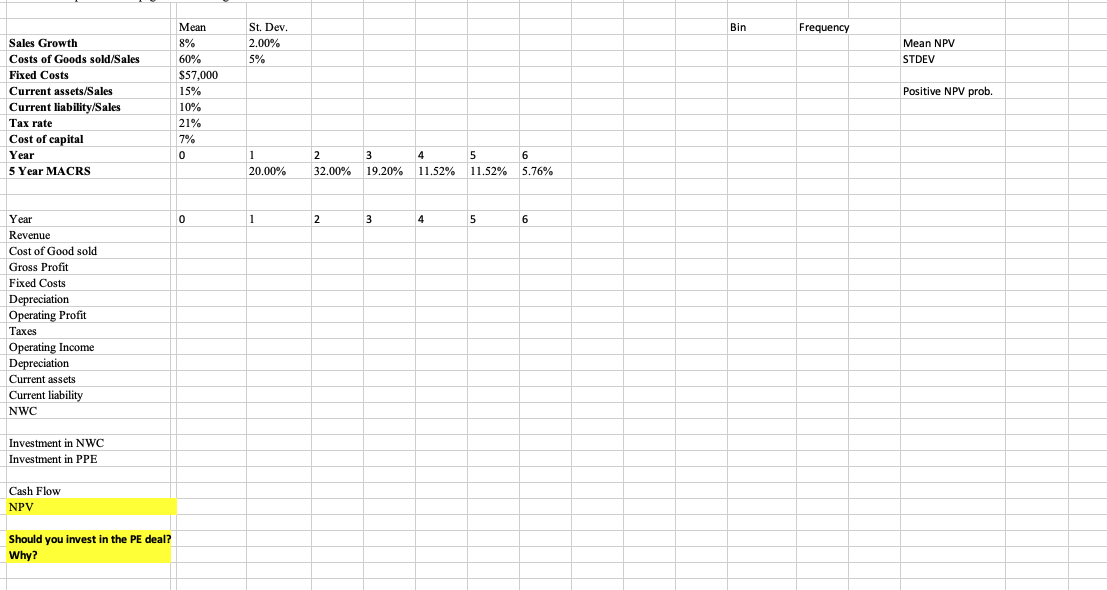

SOLVE ALL IN EXCEL AND PROVIDE FORMULAS. Sales for the first year is estimated at $ 2 0 0 , 0 0 0 , of

SOLVE ALL IN EXCEL AND PROVIDE FORMULAS. Sales for the first year is estimated at $ of course, the sales in Solve subsequent years are uncertain. The forecast revenue will grow each year, but the actual growth rate is uncertain. Estimate the revenue to be distributed normally with a mean of and a standard deviation of Costs of goods sold each year are uncertain as well but are forecasted as a percentage of sales. COGS as a percentage of sales is estimated to be distributed normally with a mean of

and a standard deviation of Fixed costs estimated at $ per year. Current assets are

forecasted using of the annual firm revenue and current liabilities are forecasted using

of the annual revenue. Estimate the private equity target will require an initial investment in net

working capital of $ and initial investment for new equipment of $ Use the year

MACRS schedule to depreciate the equipment. The forecast the equipment will have no salvage

value of the th year. The cost of capital for this deal is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started