Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve all par value $1,000 coupon rate 5% per year payment schedule semiannual maturity date 5 %2 years For this bond, your required rate of

solve all

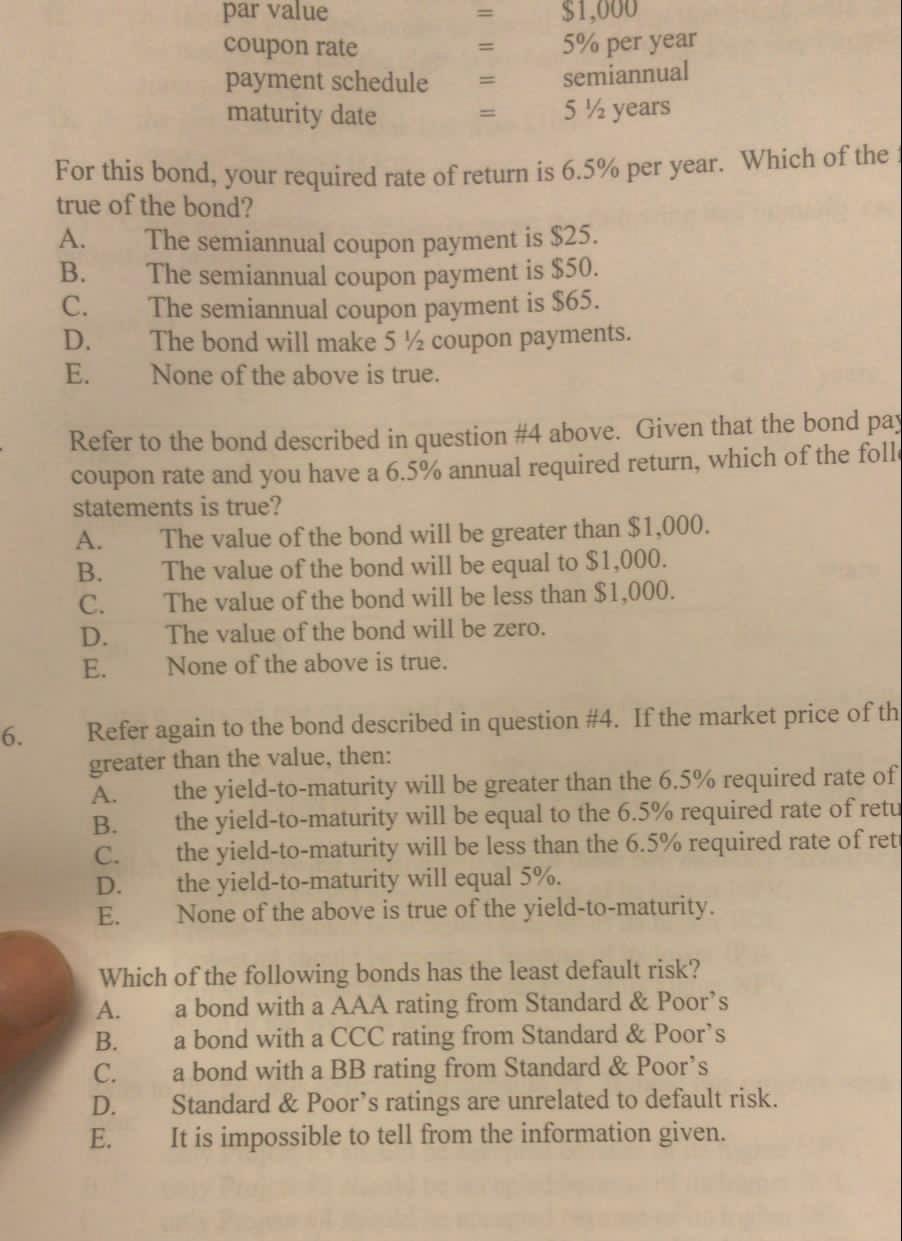

par value $1,000 coupon rate 5% per year payment schedule semiannual maturity date 5 %2 years For this bond, your required rate of return is 6.5% per year. Which of the true of the bond? A. The semiannual coupon payment is $25. B. The semiannual coupon payment is $50. C. The semiannual coupon payment is $65. D. The bond will make 5 1/2 coupon payments. E. None of the above is true. Refer to the bond described in question #4 above. Given that the bond pa coupon rate and you have a 6.5% annual required return, which of the foll statements is true? A. The value of the bond will be greater than $1,000. B. The value of the bond will be equal to $1,000. C. The value of the bond will be less than $1,000. D. The value of the bond will be zero. E. None of the above is true. 6. Refer again to the bond described in question #4. If the market price of th greater than the value, then: A. the yield-to-maturity will be greater than the 6.5% required rate of B. the yield-to-maturity will be equal to the 6.5% required rate of retu C. the yield-to-maturity will be less than the 6.5% required rate of ret D. the yield-to-maturity will equal 5%. E. None of the above is true of the yield-to-maturity. Which of the following bonds has the least default risk? A. a bond with a AAA rating from Standard & Poor's B. a bond with a CCC rating from Standard & Poor's C. a bond with a BB rating from Standard & Poor's D. Standard & Poor's ratings are unrelated to default risk. E. It is impossible to tell from the information givenStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started