Answered step by step

Verified Expert Solution

Question

1 Approved Answer

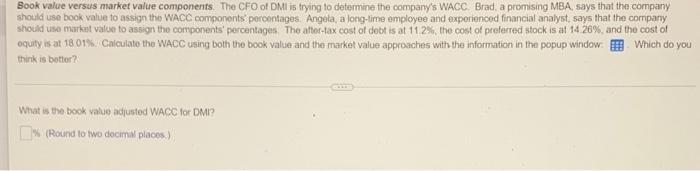

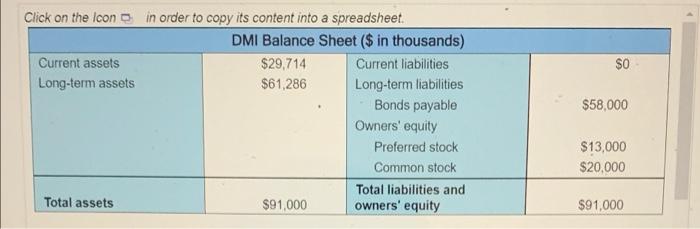

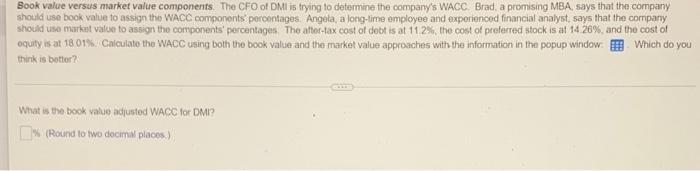

solve ALL parts! Sook value versus market value components. The CFO of DMI is trying to determine the company's WACC Brad, a promising MBA says

solve ALL parts!

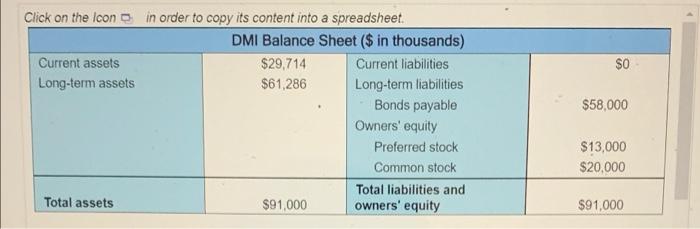

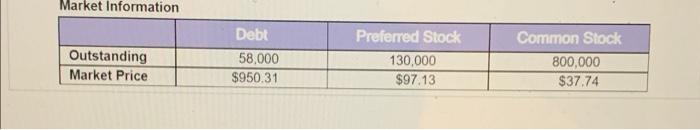

Sook value versus market value components. The CFO of DMI is trying to determine the company's WACC Brad, a promising MBA says that the company should use book value to assign the WACC components' percentages. Angela, a long-time employee and exporienced financial analyst , says that the company should use market value to assign the components' percentages. The attor-tax cost of debt is at 11.2%, the cost of preferred stock is at 14 26% and the cost of oquity is at 18.01% Calculate the WACC using both the book value and the market value approaches with the information in the popup window. Which do you think is better? What is the book value adjusted WACC for DMI? (Round to two decimal places) SO Click on the Icon in order to copy its content into a spreadsheet. DMI Balance Sheet ($ in thousands) Current assets $29,714 Current liabilities Long-term assets $61,286 Long-term liabilities Bonds payable Owners' equity Preferred stock Common stock Total liabilities and Total assets $91,000 owners' equity $58,000 $13,000 $20,000 $91,000 Market Information Outstanding Market Price Debt 58,000 $950.31 Preferred Stock 130,000 $97.13 Common Stock 800,000 $37.74

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started