Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve all questions 2. A bank sells a three against six $3,000,000 FRA for a three- month period beginning three months from today and ending

solve all questions

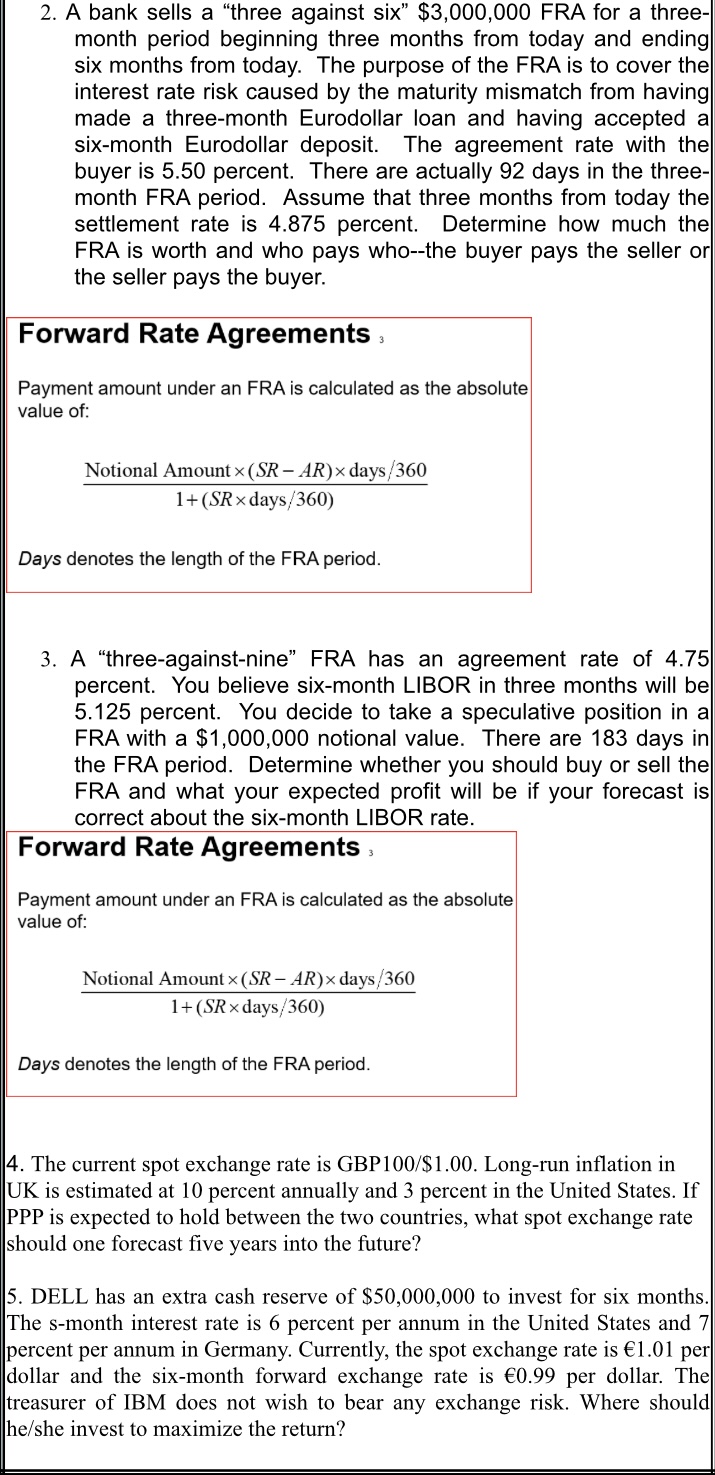

2. A bank sells a "three against six" $3,000,000 FRA for a three- month period beginning three months from today and ending six months from today. The purpose of the FRA is to cover the interest rate risk caused by the maturity mismatch from having made a three-month Eurodollar loan and having accepted a six-month Eurodollar deposit. The agreement rate with the buyer is 5.50 percent. There are actually 92 days in the three- month FRA period. Assume that three months from today the settlement rate is 4.875 percent. Determine how much the FRA is worth and who pays who--the buyer pays the seller or the seller pays the buyer. Forward Rate Agreements Payment amount under an FRA is calculated as the absolute value of: Notional Amount x (SR AR) x days ,/360 1+(SRxdays/360) Days denotes the length of the FRA period. 3. A "three-against-nine" FRA has an agreement rate of 4.75 percent. You believe six-month LIBOR in three months will be 5.125 percent. You decide to take a speculative position in a FRA with a $1 notional value. There are 183 days in the FRA period. Determine whether you should buy or sell the FRA and what your expected profit will be if your forecast is correct about the six-month LIBOR rate. Forward Rate Agreements Payment amount under an FRA is calculated as the absolute value of: Notional Amount x (SR AR) x days/360 1 + (SR x days/ 360) Days denotes the length of the FRA period. 4. The current spot exchange rate is GBPIOO/SI .00. Long-run inflation in UK is estimated at 10 percent annually and 3 percent in the United States. If PPP is expected to hold between the two countries, what spot exchange rate should one forecast five years into the future? 5. DELL has an extra cash reserve of $50,000,000 to invest for six months. The s-month interest rate is 6 percent per annum in the United States and 7 percent per annum in Germany. Currently, the spot exchange rate is 1.01 per dollar and the six-month forward exchange rate is 0.99 per dollar. The treasurer of IBM does not wish to bear any exchange risk. Where should he/she invest to maximize the return?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started