Answered step by step

Verified Expert Solution

Question

1 Approved Answer

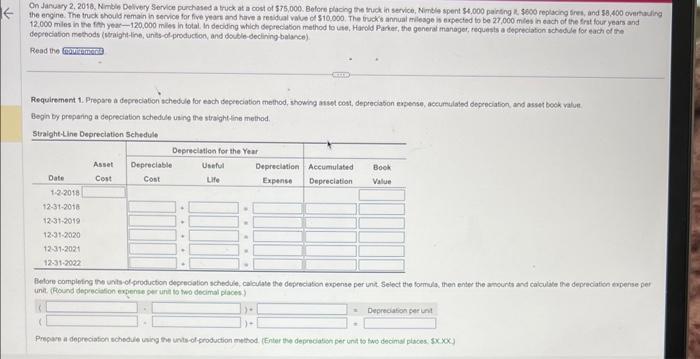

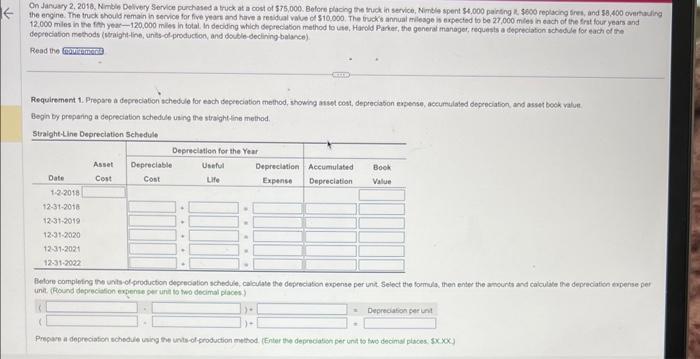

Solve all requirements. Thank you!:) deprociabon methods (wraight-line, units of productoo, and double-decining balance). Read the Requirement 1. Propare a depreciation tchedule for each sepreciation

Solve all requirements. Thank you!:)

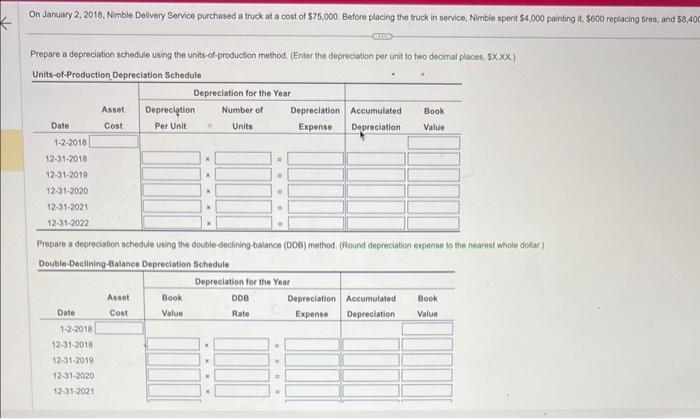

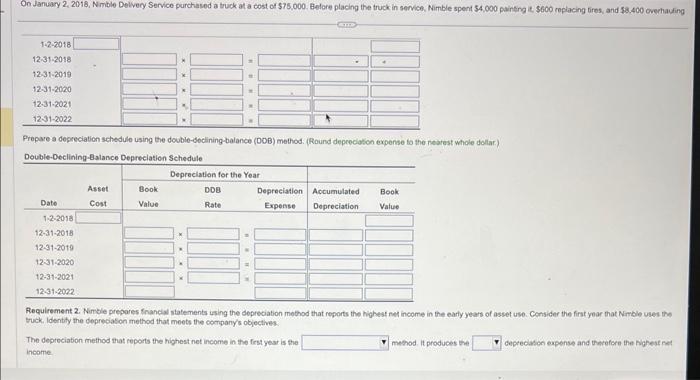

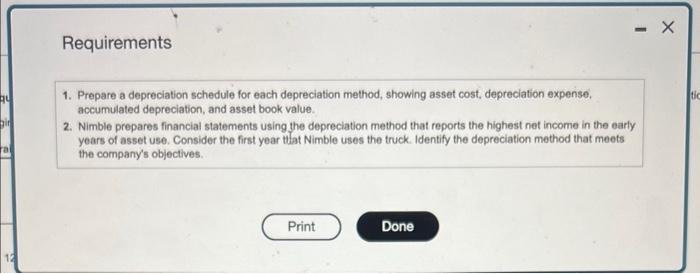

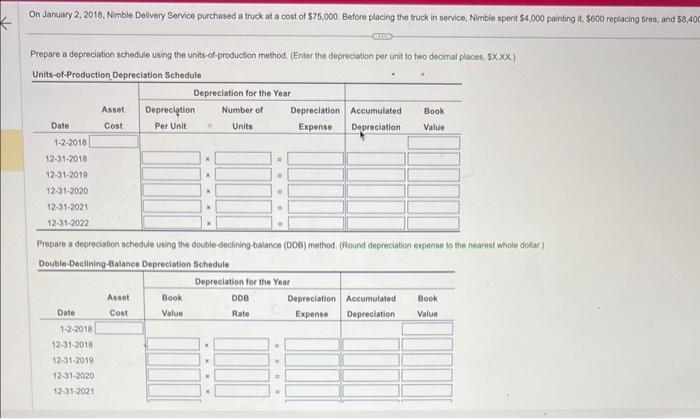

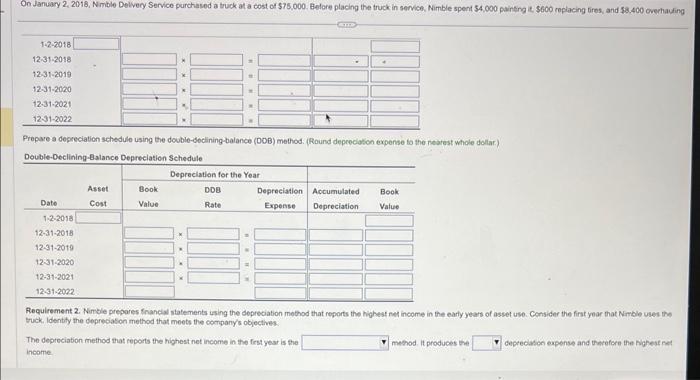

deprociabon methods (wraight-line, units of productoo, and double-decining balance). Read the Requirement 1. Propare a depreciation tchedule for each sepreciation method, showing aist cost, depreciafion elipense, aceumulaied depreciation, and asset book valut Begin by preparing a depreciation schedule using the straight line method. On January 2, 2018, Nimble Delivery Service purchased a truck at a cost of $75,000. Before placing the truck in service, Nimble spent \$4,000 painting it, \$600 replacing tires, and $6,40 Prepare a depreciation schedule using the units-of-production method. (Enter the depreciation per unit to two decimal places, $,.) Units-of-Production Denreciation Sechadula Prepare a depreciation schedule using the double-decining-balance (DDE) method. (Round depreciation expense to the nearest whole dolar.) Double-Declining-Batance Depreciation Schedule Prepase a degreciation schedule using the double-declining-balance (DOB) method: (Round depreclatch expense to the nearest whole dollar.) Double-Declining-Balance Denreciation Schedule Requirement 2. Nimble prepores tnancial statements issing the dopreciation mothod that reports the highest net income in the early years of asset use. Consider the firat year that Nimble uses the truck. Identify the depreciason method that meets the company's objectives. The depreciation method that reports the highest net income in the first year is the method. It produces the Gecrecasco expense and therefore the Righest net income. Requirements 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense. accumulated depreciation, and asset book value. 2. Nimble prepares financial statements using the depreciation method that reports the highest net income in the early years of asset use. Consider the first year that Nimble uses the truck. Identify the depreciation method that meets the company's objectives

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started