Solve and show complete solution and explanation

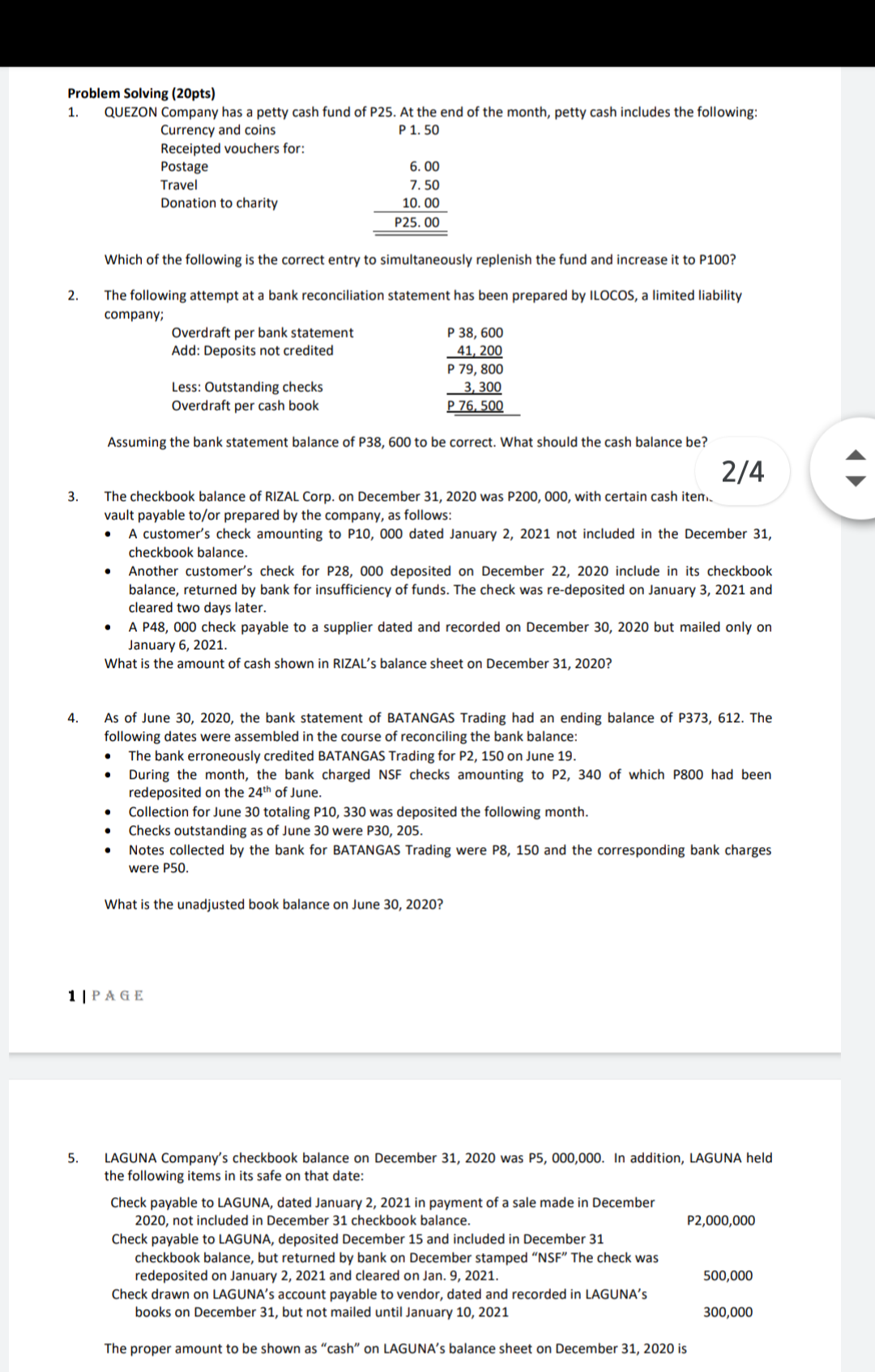

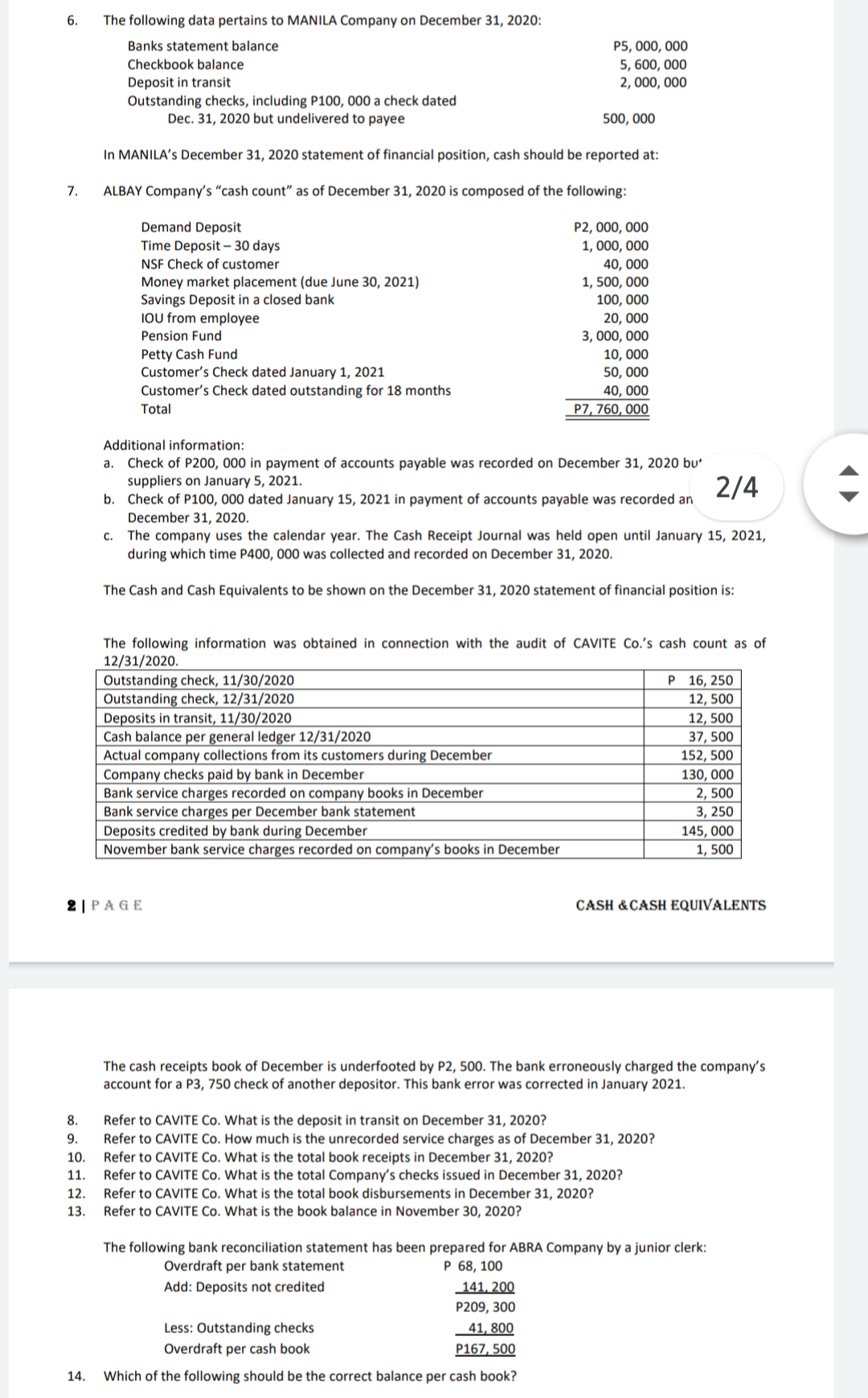

Problem Solving (20pts) 1. QUEZON Company has a petty cash fund of P25. At the end of the month, petty cash includes the following: Currency and coins P 1. 50 Receipted vouchers for: Postage 6. 00 Travel 7. 50 Donation to charity 10. 00 P25. 00 Which of the following is the correct entry to simultaneously replenish the fund and increase it to P100? 2. The following attempt at a bank reconciliation statement has been prepared by ILOCOS, a limited liability company; Overdraft per bank statement P 38, 600 Add: Deposits not credited 41, 200 P 79, 800 Less: Outstanding checks 3, 300 Overdraft per cash book P 76, 500 Assuming the bank statement balance of P38, 600 to be correct. What should the cash balance be? 2/4 3. The checkbook balance of RIZAL Corp. on December 31, 2020 was P200, 000, with certain cash item. vault payable to/or prepared by the company, as follows: A customer's check amounting to P10, 000 dated January 2, 2021 not included in the December 31, checkbook balance. Another customer's check for P28, 000 deposited on December 22, 2020 include in its checkbook balance, returned by bank for insufficiency of funds. The check was re-deposited on January 3, 2021 and cleared two days later. A P48, 000 check payable to a supplier dated and recorded on December 30, 2020 but mailed only on January 6, 2021. What is the amount of cash shown in RIZAL's balance sheet on December 31, 2020? 4. As of June 30, 2020, the bank statement of BATANGAS Trading had an ending balance of P373, 612. The following dates were assembled in the course of reconciling the bank balance: The bank erroneously credited BATANGAS Trading for P2, 150 on June 19. During the month, the bank charged NSF checks amounting to P2, 340 of which P800 had been redeposited on the 24th of June. Collection for June 30 totaling P10, 330 was deposited the following month. Checks outstanding as of June 30 were P30, 205. Notes collected by the bank for BATANGAS Trading were P8, 150 and the corresponding bank charges were P50. What is the unadjusted book balance on June 30, 2020? 1 |PAGE 5. LAGUNA Company's checkbook balance on December 31, 2020 was P5, 000,000. In addition, LAGUNA held the following items in its safe on that date: Check payable to LAGUNA, dated January 2, 2021 in payment of a sale made in December 2020, not included in December 31 checkbook balance. P2,000,000 Check payable to LAGUNA, deposited December 15 and included in December 31 checkbook balance, but returned by bank on December stamped "NSF" The check was redeposited on January 2, 2021 and cleared on Jan. 9, 2021. 500,000 Check drawn on LAGUNA's account payable to vendor, dated and recorded in LAGUNA's books on December 31, but not mailed until January 10, 2021 300,000 The proper amount to be shown as "cash" on LAGUNA's balance sheet on December 31, 2020 is6. The following data pertains to MANILA Company on December 31, 2020: Banks statement balance P5, 000, 000 Checkbook balance 5, 600, 000 Deposit in transit 2, 000, 000 Outstanding checks, including P100, 000 a check dated Dec. 31, 2020 but undelivered to payee 500, 000 In MANILA's December 31, 2020 statement of financial position, cash should be reported at: 7 . ALBAY Company's "cash count" as of December 31, 2020 is composed of the following: Demand Deposit P2, 000, 000 Time Deposit - 30 days 1, 000, 000 NSF Check of customer 40, 000 Money market placement (due June 30, 2021) 1, 500, 000 Savings Deposit in a closed bank 100, 000 OU from employee 20, 000 Pension Fund 3, 000, 000 Petty Cash Fund 10, 000 Customer's Check dated January 1, 2021 50, 000 Customer's Check dated outstanding for 18 months 40, 000 Total P7, 760, 000 Additional information: a. Check of P200, 000 in payment of accounts payable was recorded on December 31, 2020 bu* suppliers on January 5, 2021. b. Check of P100, 000 dated January 15, 2021 in payment of accounts payable was recorded an 2/4 December 31, 2020. c. The company uses the calendar year. The Cash Receipt Journal was held open until January 15, 2021, during which time P400, 000 was collected and recorded on December 31, 2020. The Cash and Cash Equivalents to be shown on the December 31, 2020 statement of financial position is: The following information was obtained in connection with the audit of CAVITE Co.'s cash count as of 12/31/2020. Outstanding check, 11/30/2020 P 16, 250 Outstanding check, 12/31/2020 12, 500 Deposits in transit, 11/30/2020 12, 500 Cash balance per general ledger 12/31/2020 37, 500 Actual company collections from its customers during December 152, 500 Company checks paid by bank in December 130, 000 Bank service charges recorded on company books in December 2, 500 Bank service charges per December bank statement 3, 250 Deposits credited by bank during December 145, 000 November bank service charges recorded on company's books in December 1, 500 2|PAGE CASH & CASH EQUIVALENTS The cash receipts book of December is underfooted by P2, 500. The bank erroneously charged the company's account for a P3, 750 check of another depositor. This bank error was corrected in January 2021. Refer to CAVITE Co. What is the deposit in transit on December 31, 2020? Refer to CAVITE Co. How much is the unrecorded service charges as of December 31, 2020? 10. Refer to CAVITE Co. What is the total book receipts in December 31, 2020? 11. Refer to CAVITE Co. What is the total Company's checks issued in December 31, 2020? 12. Refer to CAVITE Co. What is the total book disbursements in December 31, 2020? 13. Refer to CAVITE Co. What is the book balance in November 30, 2020? The following bank reconciliation statement has been prepared for ABRA Company by a junior clerk: Overdraft per bank statement P 68, 100 Add: Deposits not credited 141. 200 P209, 300 Less: Outstanding checks 41, 800 Overdraft per cash book P167, 500 14. Which of the following should be the correct balance per cash book