Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve and show your solution Problem 1-12 (AICPA Adapted) Eliot Company reported the following liablities on December 31, 2020: Accounts payable and accrued interest 12%

solve and show your solution

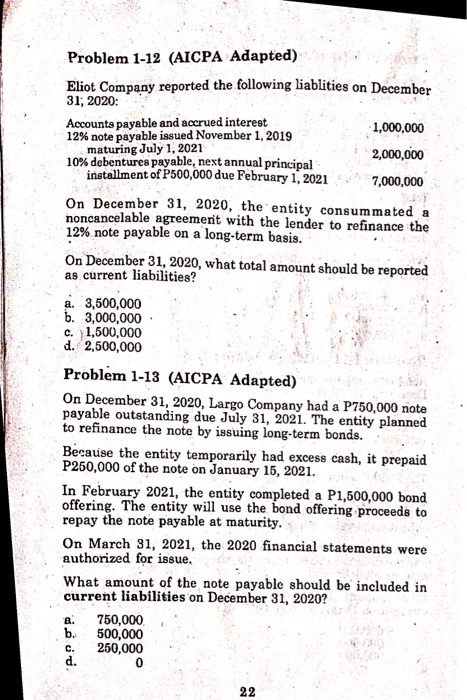

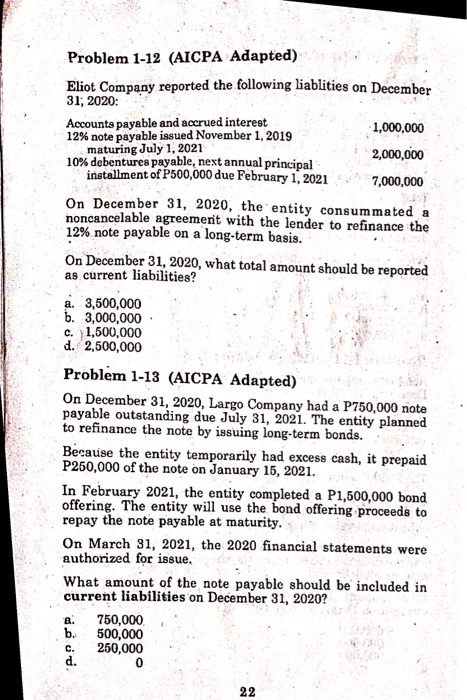

Problem 1-12 (AICPA Adapted) Eliot Company reported the following liablities on December 31, 2020: Accounts payable and accrued interest 12% note payable issued November 1, 2019 1,000,000 maturing July 1, 2021 2,000,000 10% debentures payable, next annual principal installment of P500,000 due February 1, 2021 7 ,000,000 On December 31, 2020, the entity consummated a noncancelable agreement with the lender to refinance the 12% note payable on a long-term basis. On December 31, 2020, what total amount should be reported as current liabilities? a. 3,500,000 b. 3,000,000 C. 1,500,000 d. 2,500,000 Problem 1-13 (AICPA Adapted) On December 31, 2020, Largo Company had a P750,000 note payable outstanding due July 31, 2021. The entity planned to refinance the note by issuing long-term bonds. Because the entity temporarily had excess cash, it prepaid P250,000 of the note on January 15, 2021. In February 2021, the entity completed a P1,500,000 bond offering. The entity will use the bond offering proceeds to repay the note payable at maturity. On March 31, 2021, the 2020 financial statements were authorized for issue. What amount of the note payable should be included in current liabilities on December 31, 2020? 750,000 b. 500,000 c. 250,000 22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started