Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve as soon as possible Q.Wo.3. I that and 1 tad are two construction companies in Pakistan. Both companies have the Qilue assels that produce

solve as soon as possible

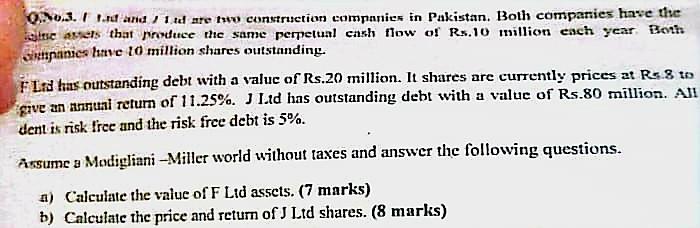

Q.Wo.3. I that and 1 tad are two construction companies in Pakistan. Both companies have the Qilue assels that produce the same perpetual cash fiow of R.s.10 million each year Both Siapanics have 10 million shares outstanding. FLid has nutstanding debt with a value of Rs. 20 million. It shares are currently prices at Res 8 to give an annual return of 11.25%. J L.t has outstanding debt with a value of Rs. 80 million. All dent is risk free and the risk free debt is 5%. ssume a Modigliani -Miller world without taxes and answer the following questions. a) Calculate the value of F Lid assets. ( 7 marks) b) Calculate the price and return of J Lid shares. ( 8 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started