Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve asap On Monday, the price of a certain share was set at $10. On Tuesday it is estimated that the stock price will be

solve asap

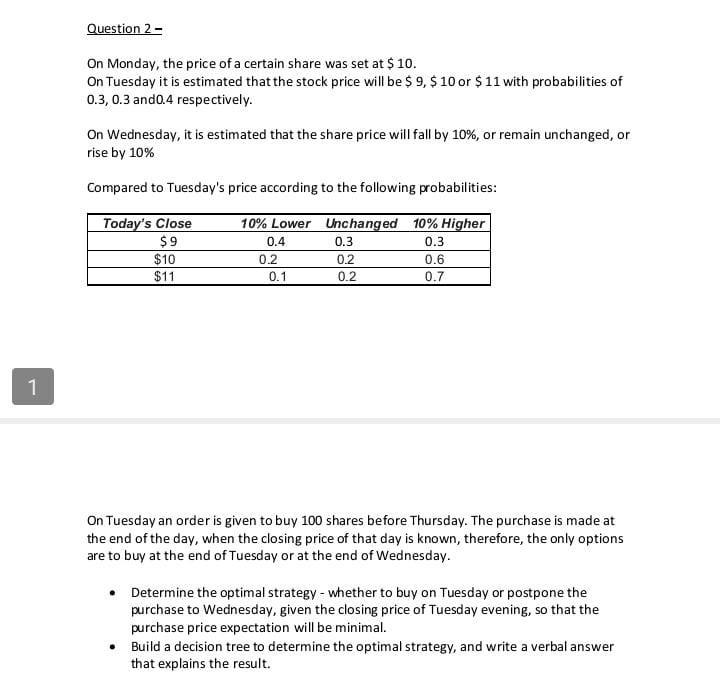

On Monday, the price of a certain share was set at $10. On Tuesday it is estimated that the stock price will be $9,$10 or $11 with probabilities of 0.3,0.3 and 0.4 respectively. On Wednesday, it is estimated that the share price will fall by 10%, or remain unchanged, or rise by 10% Compared to Tuesday's price according to the following probabilities: On Tuesday an order is given to buy 100 shares before Thursday. The purchase is made at the end of the day, when the closing price of that day is known, therefore, the only options are to buy at the end of Tuesday or at the end of Wednesday. - Determine the optimal strategy - whether to buy on Tuesday or postpone the purchase to Wednesday, given the closing price of Tuesday evening, so that the purchase price expectation will be minimal. - Build a decision tree to determine the optimal strategy, and write a verbal answer that explains the result. On Monday, the price of a certain share was set at $10. On Tuesday it is estimated that the stock price will be $9,$10 or $11 with probabilities of 0.3,0.3 and 0.4 respectively. On Wednesday, it is estimated that the share price will fall by 10%, or remain unchanged, or rise by 10% Compared to Tuesday's price according to the following probabilities: On Tuesday an order is given to buy 100 shares before Thursday. The purchase is made at the end of the day, when the closing price of that day is known, therefore, the only options are to buy at the end of Tuesday or at the end of Wednesday. - Determine the optimal strategy - whether to buy on Tuesday or postpone the purchase to Wednesday, given the closing price of Tuesday evening, so that the purchase price expectation will be minimal. - Build a decision tree to determine the optimal strategy, and write a verbal answer that explains the resultStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started