Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve b c d part please move out of their houses because they have been deemed unsafe to live in due to the structural damage.

solve b c d part please

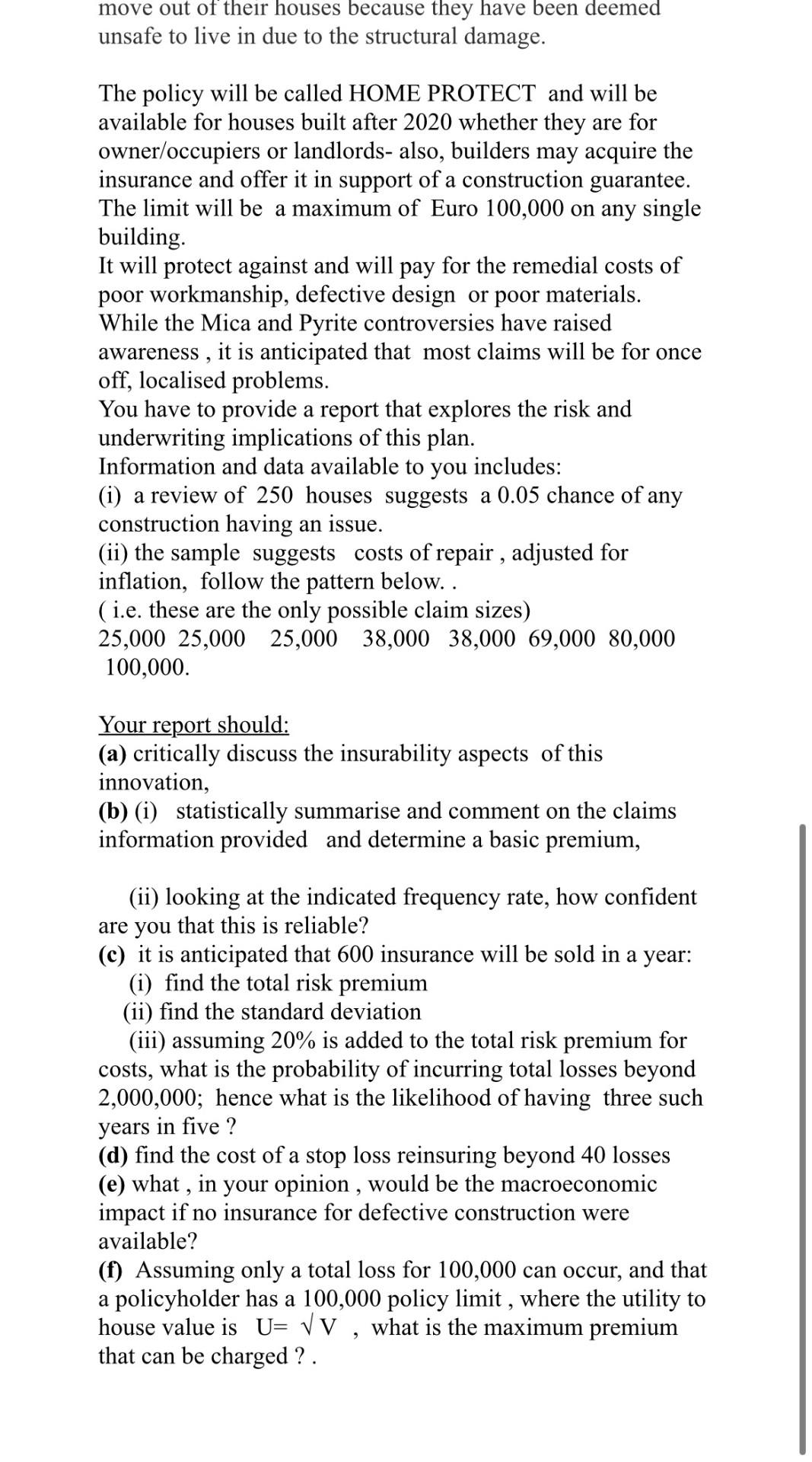

move out of their houses because they have been deemed unsafe to live in due to the structural damage. The policy will be called HOME PROTECT and will be available for houses built after 2020 whether they are for owner/occupiers or landlords- also, builders may acquire the insurance and offer it in support of a construction guarantee. The limit will be a maximum of Euro 100,000 on any single building. It will protect against and will pay for the remedial costs of poor workmanship, defective design or poor materials. While the Mica and Pyrite controversies have raised awareness, it is anticipated that most claims will be for once off, localised problems. You have to provide a report that explores the risk and underwriting implications of this plan. Information and data available to you includes: (i) a review of 250 houses suggests a 0.05 chance of any construction having an issue. (ii) the sample suggests costs of repair , adjusted for inflation, follow the pattern below.. ( i.e. these are the only possible claim sizes) 25,000 25,000 25,000 38,000 38,000 69,000 80,000 100,000. Your report should: (a) critically discuss the insurability aspects of this innovation, (b) (i) statistically summarise and comment on the claims information provided and determine a basic premium, a (ii) looking at the indicated frequency rate, how confident are you that this is reliable? (c) it is anticipated that 600 insurance will be sold in a year: (i) find the total risk premium (ii) find the standard deviation (iii) assuming 20% is added to the total risk premium for costs, what is the probability of incurring total losses beyond 2,000,000; hence what is the likelihood of having three such years in five ? (d) find the cost of a stop loss reinsuring beyond 40 losses (e) what , in your opinion , would be the macroeconomic impact if no insurance for defective construction were available? (f) Assuming only a total loss for 100,000 can occur, and that a policyholder has a 100,000 policy limit , where the utility to house value is U= V V , what is the maximum premium that can be charged ?. move out of their houses because they have been deemed unsafe to live in due to the structural damage. The policy will be called HOME PROTECT and will be available for houses built after 2020 whether they are for owner/occupiers or landlords- also, builders may acquire the insurance and offer it in support of a construction guarantee. The limit will be a maximum of Euro 100,000 on any single building. It will protect against and will pay for the remedial costs of poor workmanship, defective design or poor materials. While the Mica and Pyrite controversies have raised awareness, it is anticipated that most claims will be for once off, localised problems. You have to provide a report that explores the risk and underwriting implications of this plan. Information and data available to you includes: (i) a review of 250 houses suggests a 0.05 chance of any construction having an issue. (ii) the sample suggests costs of repair , adjusted for inflation, follow the pattern below.. ( i.e. these are the only possible claim sizes) 25,000 25,000 25,000 38,000 38,000 69,000 80,000 100,000. Your report should: (a) critically discuss the insurability aspects of this innovation, (b) (i) statistically summarise and comment on the claims information provided and determine a basic premium, a (ii) looking at the indicated frequency rate, how confident are you that this is reliable? (c) it is anticipated that 600 insurance will be sold in a year: (i) find the total risk premium (ii) find the standard deviation (iii) assuming 20% is added to the total risk premium for costs, what is the probability of incurring total losses beyond 2,000,000; hence what is the likelihood of having three such years in five ? (d) find the cost of a stop loss reinsuring beyond 40 losses (e) what , in your opinion , would be the macroeconomic impact if no insurance for defective construction were available? (f) Assuming only a total loss for 100,000 can occur, and that a policyholder has a 100,000 policy limit , where the utility to house value is U= V V , what is the maximum premium that can be charged

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started