solve

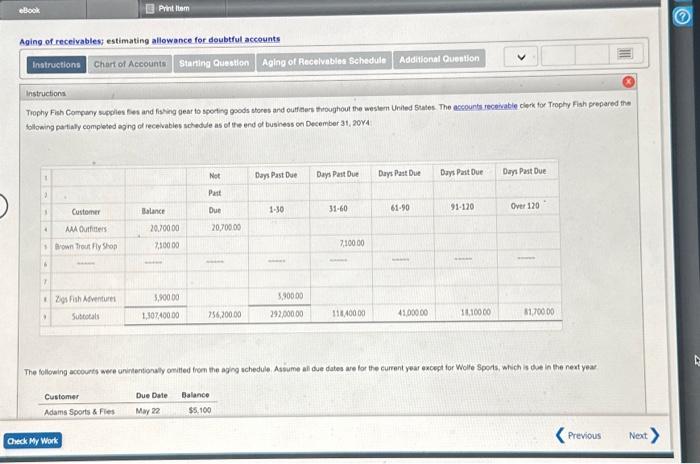

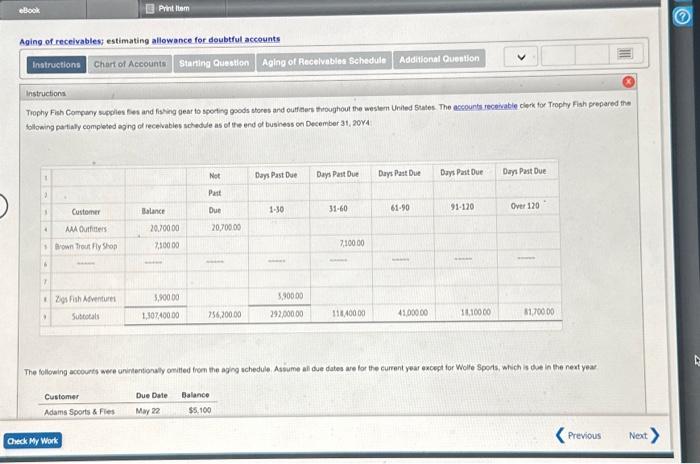

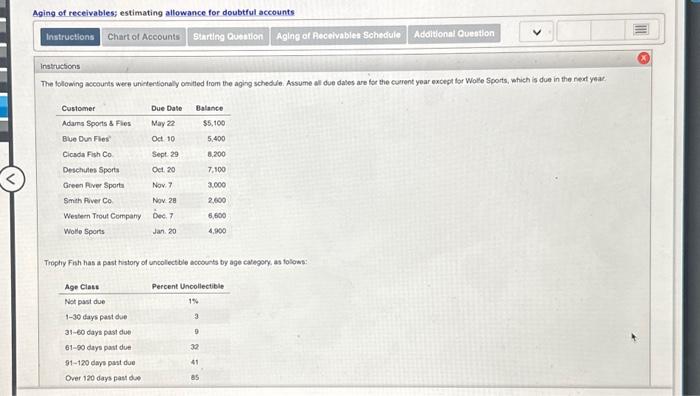

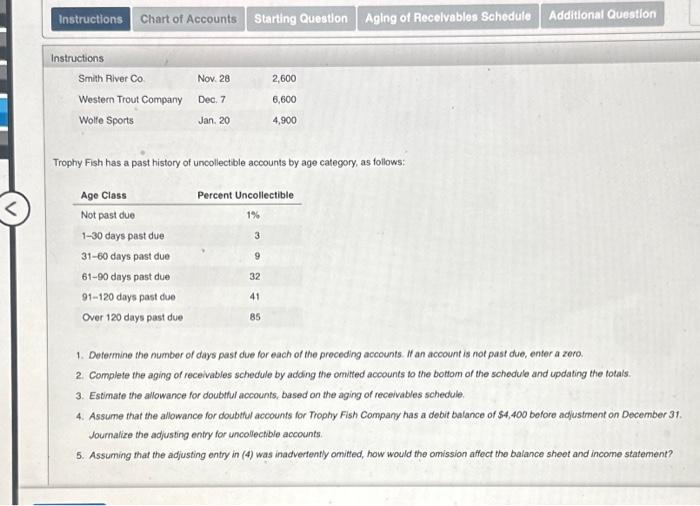

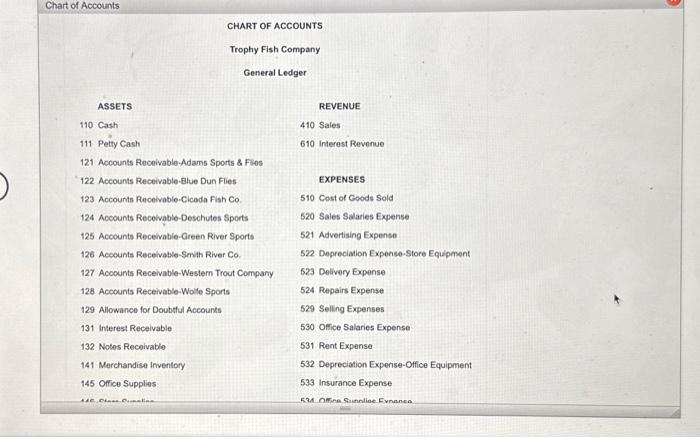

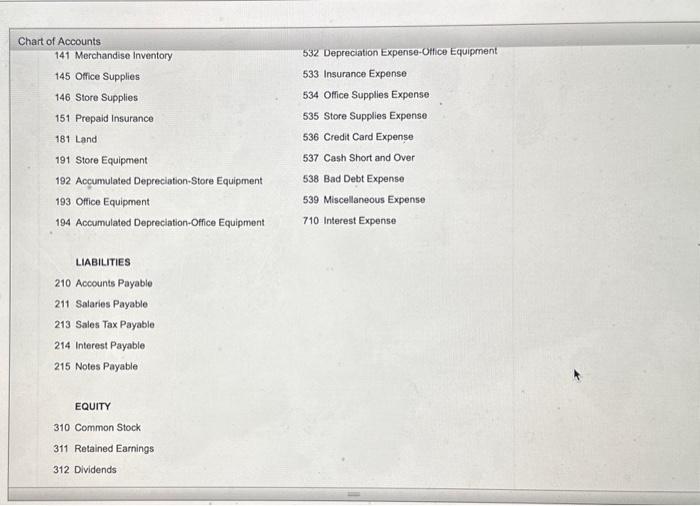

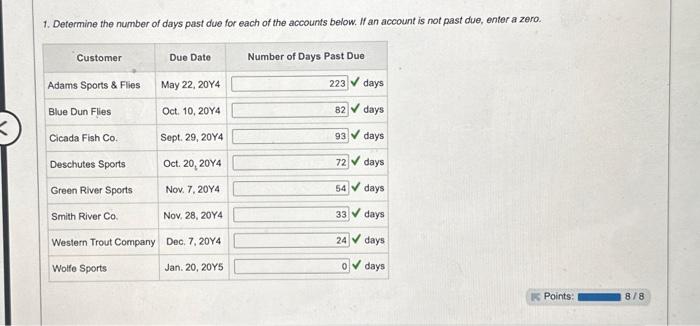

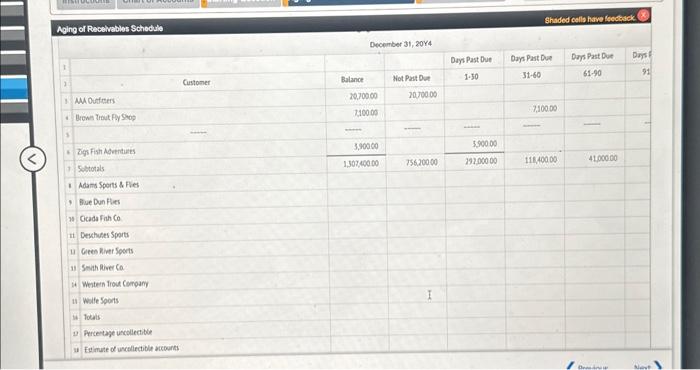

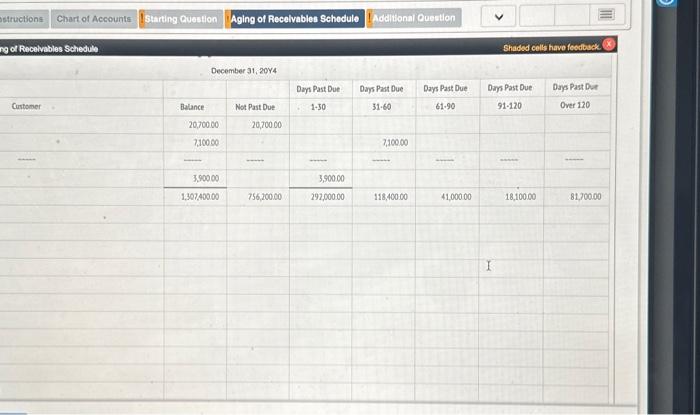

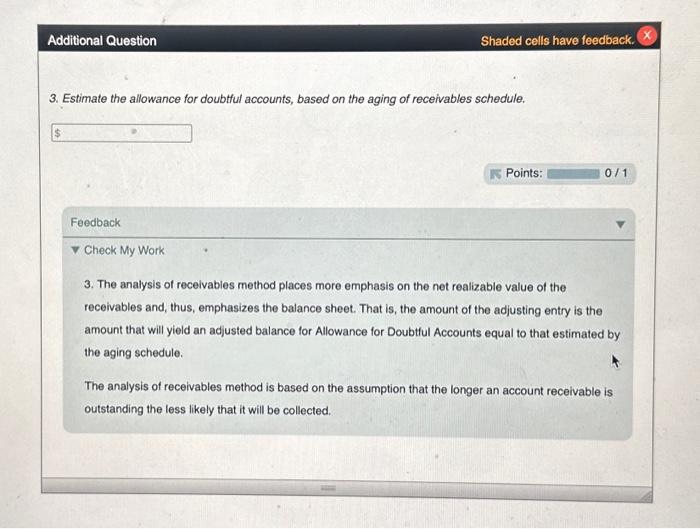

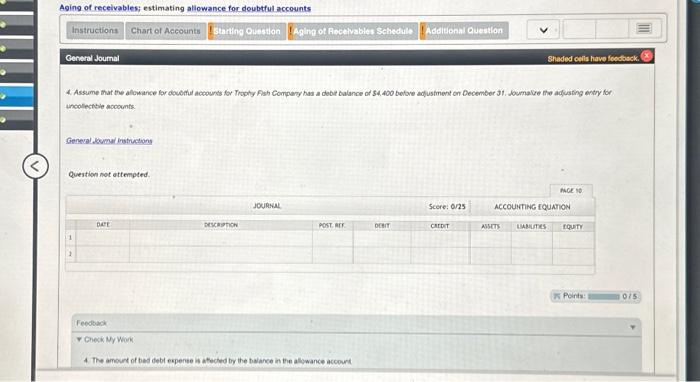

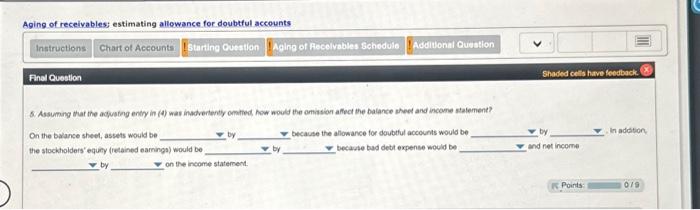

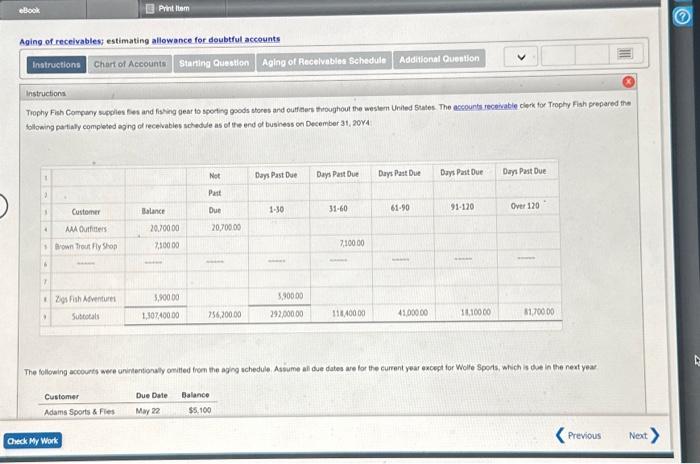

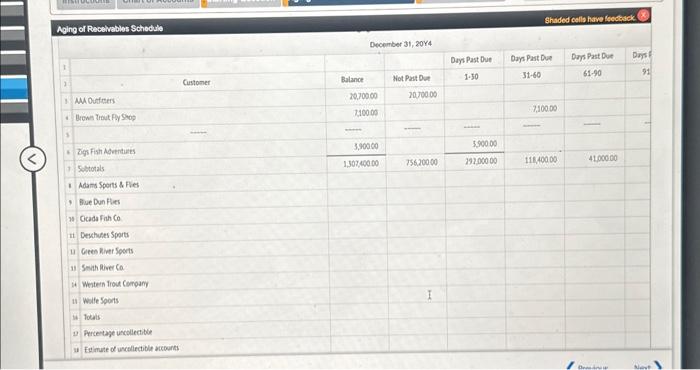

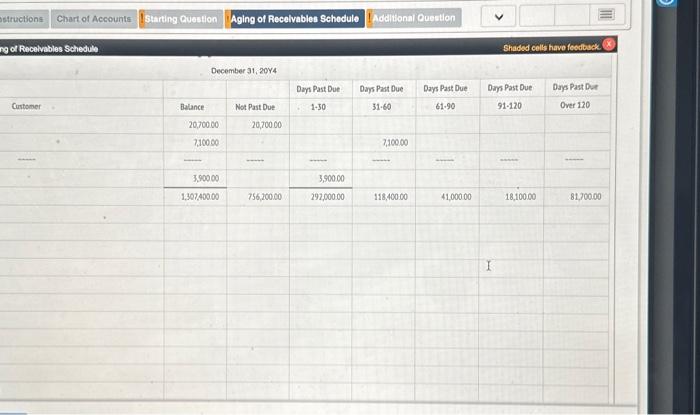

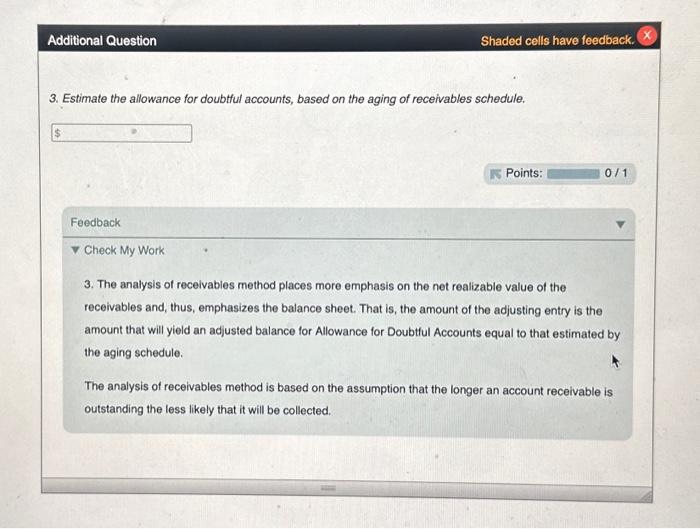

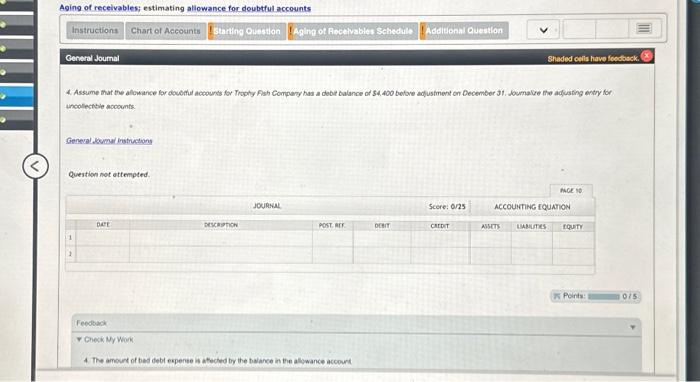

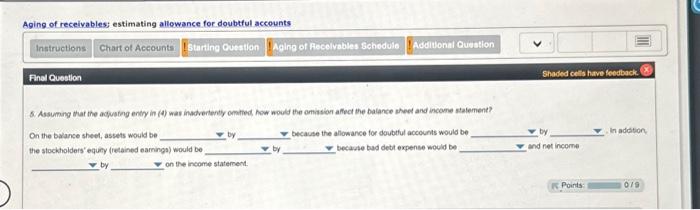

\begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline Iructions & Chart of Accounts & Fisting Question & Aging of Rece & vabies Schodu & (2) 1 Adedilion & Questlon & & \\ \hline \multicolumn{7}{|c|}{ no of Recelvables schedulo. } & \multicolumn{2}{|c|}{ Shadad colls have foodbude x} \\ \hline & & \multicolumn{2}{|c|}{ December 31,20Y4} & & & & & \\ \hline & & & & Den Past Due & Dass Pat Due & Days Past Due. & Dan Past Due & Duspast Der \\ \hline Customer & & Balance & Not Past Due & & 3160 & 61.90 & 91120 & Over 120 \\ \hline & & 20,70000 & 20,70000 & & & & & \\ \hline & & 7,10000 & & & 7,100,00 & & & \\ \hline- & & - & + & + & & - & & + \\ \hline= & & 3,90000 & & 3,500,00 & & & & \\ \hline & & 1,307,400000 & 756,200,00 & 291,000,00 & 118,40000 & 41,00000 & 18,10000 & 81,70000 \\ \hline & . & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & = & 4 & & & & & I & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline \end{tabular} rHADT NE A PCRIATS Trophy Finh has a past history of uncollect ble eccounts by age calegory. as folows: On the balance sheet, assets would be Secause the allowance for doubtul accounts would be In addion the stocktolders' equity (relained sarnings) would be becavise bad dett expense would be and net income y on the income statement. uncolectble acoounts. Question not attempted. Trophy Fish has a past history of uncollectible accounts by age category, as follows: 1. Determine the number of days past due for each of the preceding accounts. If an account is not past due, enter a zero. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. 3. Estimate the allowance for doubthul accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubthl accounts for Trophy Fish Campany has a debit balance of $4,400 before adjustment on December 31 . Journalize the adjusting entry for uncollectible accounts. 5. Assuming that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheot and income statement? 1. Determine the number of days past due for each of the accounts below. If an account is not past due, enter a zero. Chart of Accounts 141 Merchandise Inventory 145 Ofice Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation-Office Equipment 532 Depreciation Expense-OHice Equipment 533 Insurance Expense 534 Office Supplies Expense 535 Store Supplies Expense 536 Credit Card Expense 537 Cash Short and Over 538 Bad Debt Expense 539 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends Trophy Fish Compuny supples fles and fiving gear to spoting goods etores and outfars twoughout the weslem Uniled suates. The aceounts recoivabie cleck for Trophy Fish prepared the following partialy completed aging of receivabies schedule as of the end of business on December 31, 20rd The following accounts were unintertionally omiffed from the agng ochedule. Assume ali due dates are for the current year excegt for Wolle Spods, which is due in the next yea 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. Feedback Check My Work 3. The analysis of receivables method places more emphasis on the net realizable value of the receivables and, thus, emphasizes the balance sheet. That is, the amount of the adjusting entry is the amount that will yield an adjusted balance for Allowance for Doubtful Accounts equal to that estimated by the aging schedule. The analysis of receivables method is based on the assumption that the longer an account receivable is outstanding the less likely that it will be collected