Answered step by step

Verified Expert Solution

Question

1 Approved Answer

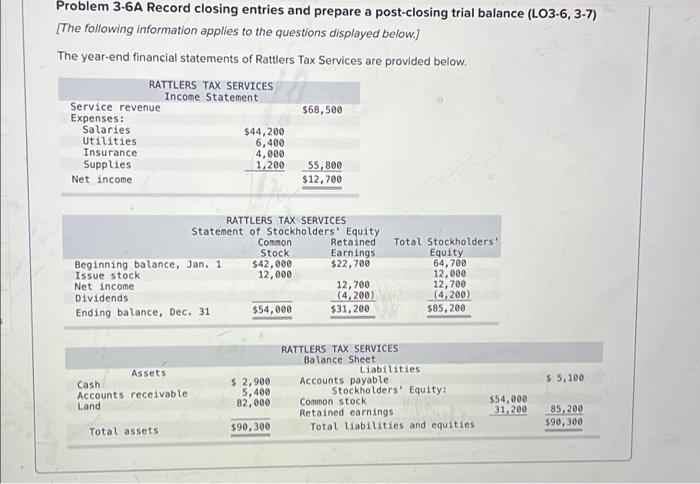

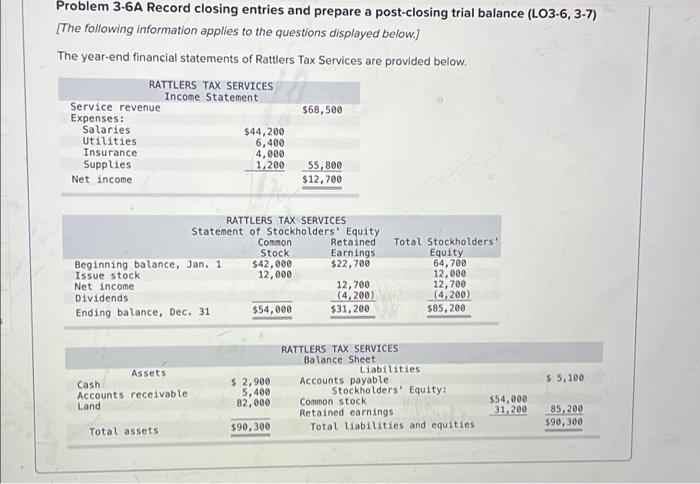

solve both parts please Problem 3-6A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) [The following information applies to the questions displayed

solve both parts please

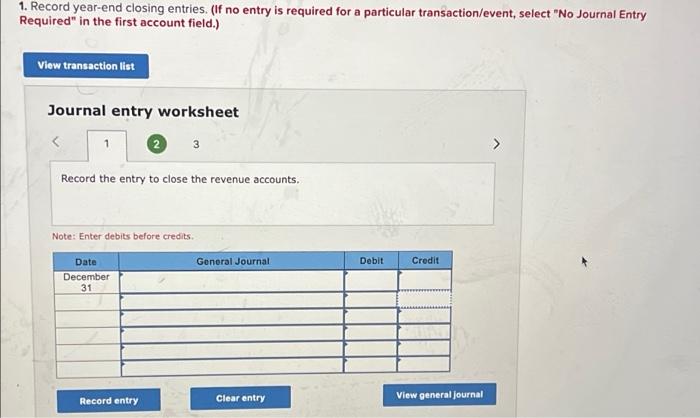

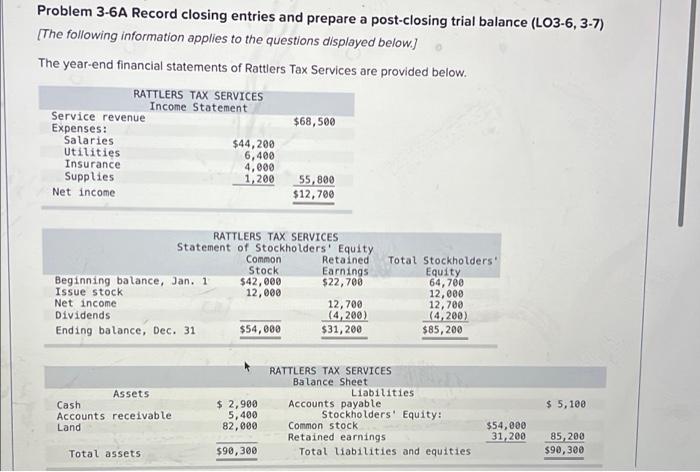

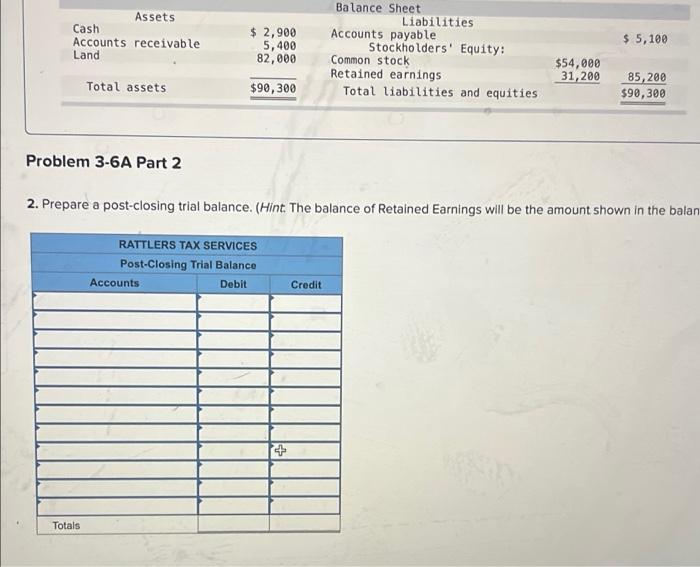

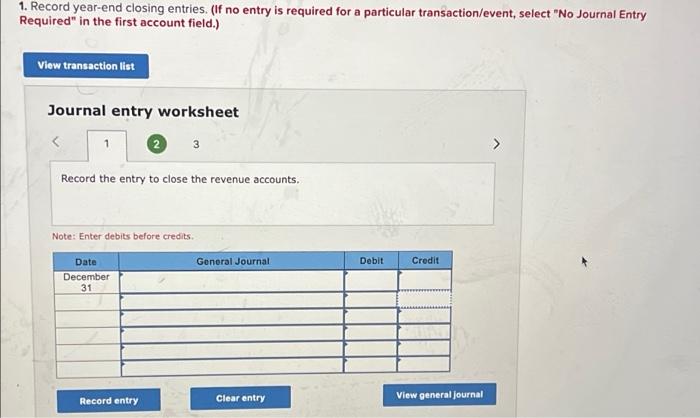

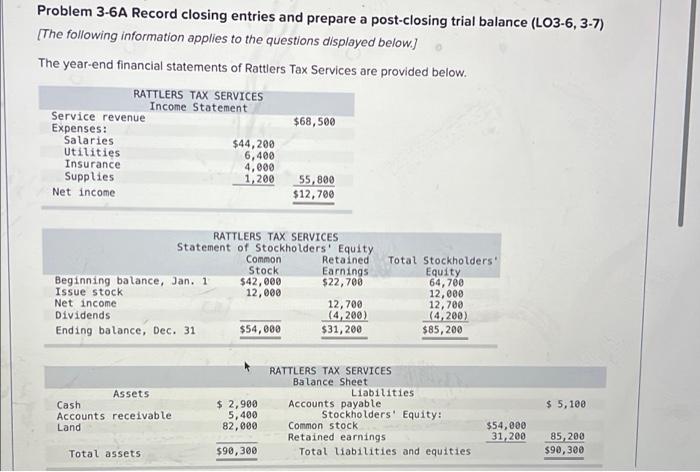

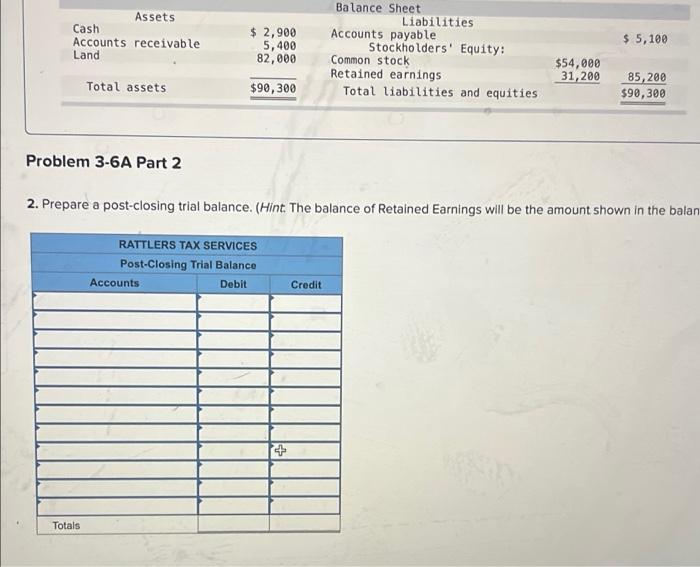

Problem 3-6A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) [The following information applies to the questions displayed below.) The year-end financial statements of Rattlers Tax Services are provided below, RATTLERS TAX SERVICES Income Statement Service revenue $68,500 Expenses: Salaries $44,200 Utilities Insurance 4,800 Supplies 1,200 55,800 Net income $12,700 6,400 RATTLERS TAX SERVICES Statement of Stockholders' Equity Common Retained Stock Earnings Beginning balance, Jan. 1 $42.000 $22,700 Issue stock 12,000 Net income 12,700 Dividends (4,200) Ending balance, Dec. 31 $54,000 $31,200 Total Stockholders! Equity 64,760 12,000 12,700 (4,200) $85,200 $ 5,100 Assets Cash Accounts receivable Land $ 2,900 5,400 82,000 RATTLERS TAX SERVICES Balance Sheet Liabilities Accounts payable Stockholders' Equity: Common stock Retained earnings Total liabilities and equities $54,000 31,200 85,200 $90,300 Total assets 590,300 1. Record year-end closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 3 Record the entry to close the revenue accounts. Note: Enter debits before credits General Journal Debit Credit Date December 31 Record entry Clear entry View general Journal Problem 3-6A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) [The following information applies to the questions displayed below.) The year-end financial statements of Rattlers Tax Services are provided below. RATTLERS TAX SERVICES Income Statement Service revenue Expenses: $68,500 Salaries $44,200 Utilities 6,400 Insurance 4,000 Supplies 1,200 55,800 Net income $12,700 RATTLERS TAX SERVICES Statement of Stockholders' Equity Common Retained Stock Earnings Beginning balance, Jan. 1 $42,000 $22,700 Issue stock 12,000 Net income 12,700 Dividends (4,200) Ending balance, Dec. 31 $54,000 $31,200 Total Stockholders Equity 64,700 12,000 12,700 (4,200) $85,200 Assets Cash Accounts receivable Land RATTLERS TAX SERVICES Balance Sheet Liabilities Accounts payable Stockholders' Equity: Common stock Retained earnings Total liabilities and equities $ 2,990 5,400 82,000 $ 5,100 $54,000 31,200 85,200 $90,300 Total assets $90,300 Assets Cash Accounts receivable Land $ 2,900 5,400 82,000 $ 5,100 Balance Sheet Liabilities Accounts payable Stockholders' Equity: Common stock Retained earnings Total liabilities and equities $54,000 31,200 Total assets $90,300 85,200 $90,300 Problem 3-6A Part 2 2. Prepare a post-closing trial balance. (Hint. The balance of Retained Earnings will be the amount shown in the balan RATTLERS TAX SERVICES Post-Closing Trial Balance Accounts Debit Credit Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started