solve

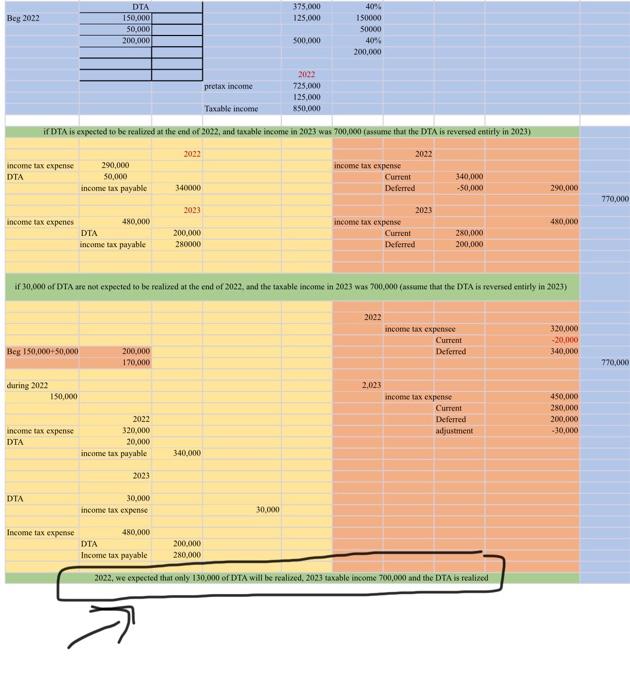

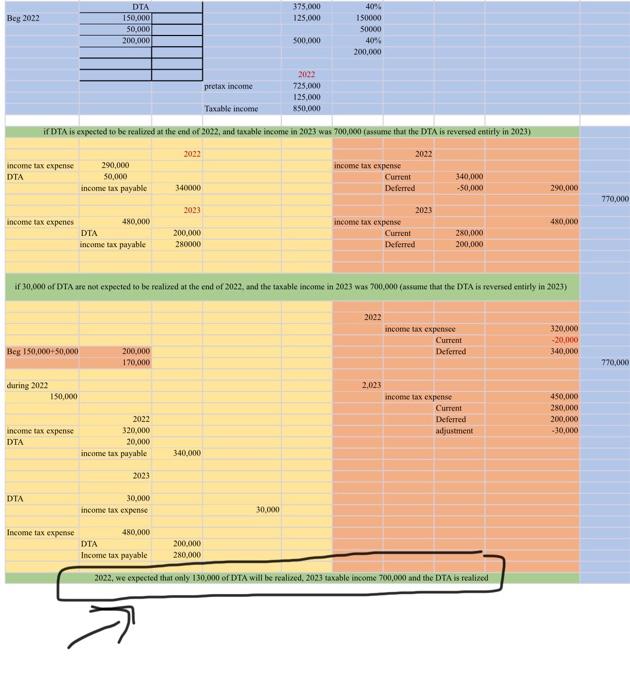

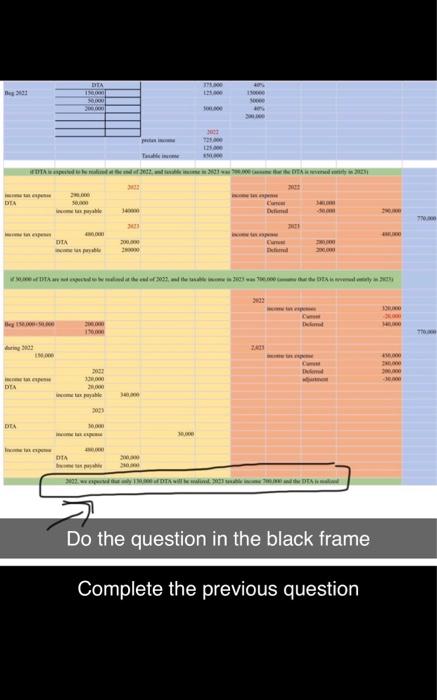

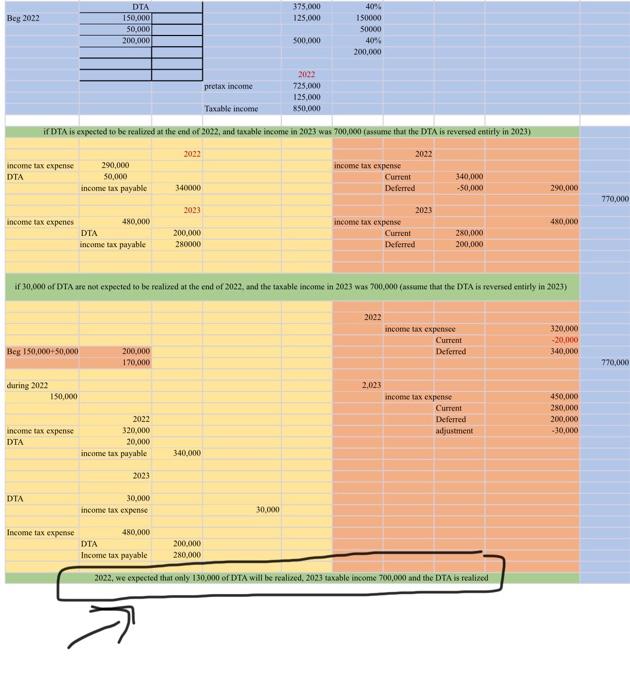

DTA 150,000 50.000 200,000 375.000 125.000 Beg 2022 404 150000 50000 40% 200,000 500.000 2022 protax income 725.000 125,000 Taxable income 850,000 FDTA is expected to be realized at the end of 2022, and taxable income in 2023 was 700,000 (assume that the DTA is reversed entirly in 2023) 2022 2022 income tax expense 290,000 income tax expense DTA 50,000 Current 340,000 income tax payable 340000 Deferred -50,000 290,000 770,000 2023 income tax expenes 480,000 480,000 DTA income tax payable 2023 income tax expense Current Deferred 200,000 280000 280,000 200,000 if 30,000 of DTA are not expected to be realized at the end of 2022, and the taxable income in 2023 was 700,000 (assume that the DTA is reversed entirly in 2023) 2002 income tax expense Current Deferred 320,000 -20,000 340,000 Beg 150,000+50,000 200.000 170,000 770,000 2,023 during 2022 150,000 income tax expense Current Deferred adjustment 450,000 280,000 200,000 -30,000 income tax expense DTA 2022 320,000 20,000 income tax payable 340,000 2023 DTA 30,000 income tax expense 30.000 Income tax expense 480,000 DTA 200.000 Income tax payable 280,000 2022. we expected that only 130,000 of DTA will be realized. 2023 taxable income 700,000 and the DTA is realized DYTA TS 300 ton DTA es Defined 7. NE Defne WITA dd the 2003, at the 20th cry OO ON LO OVOCE ELL 303 IN 30.000 DIA . DITA Do the question in the black frame Complete the previous question DTA 150,000 50.000 200,000 375.000 125.000 Beg 2022 404 150000 50000 40% 200,000 500.000 2022 protax income 725.000 125,000 Taxable income 850,000 FDTA is expected to be realized at the end of 2022, and taxable income in 2023 was 700,000 (assume that the DTA is reversed entirly in 2023) 2022 2022 income tax expense 290,000 income tax expense DTA 50,000 Current 340,000 income tax payable 340000 Deferred -50,000 290,000 770,000 2023 income tax expenes 480,000 480,000 DTA income tax payable 2023 income tax expense Current Deferred 200,000 280000 280,000 200,000 if 30,000 of DTA are not expected to be realized at the end of 2022, and the taxable income in 2023 was 700,000 (assume that the DTA is reversed entirly in 2023) 2002 income tax expense Current Deferred 320,000 -20,000 340,000 Beg 150,000+50,000 200.000 170,000 770,000 2,023 during 2022 150,000 income tax expense Current Deferred adjustment 450,000 280,000 200,000 -30,000 income tax expense DTA 2022 320,000 20,000 income tax payable 340,000 2023 DTA 30,000 income tax expense 30.000 Income tax expense 480,000 DTA 200.000 Income tax payable 280,000 2022. we expected that only 130,000 of DTA will be realized. 2023 taxable income 700,000 and the DTA is realized DYTA TS 300 ton DTA es Defined 7. NE Defne WITA dd the 2003, at the 20th cry OO ON LO OVOCE ELL 303 IN 30.000 DIA . DITA Do the question in the black frame Complete the previous