Answered step by step

Verified Expert Solution

Question

1 Approved Answer

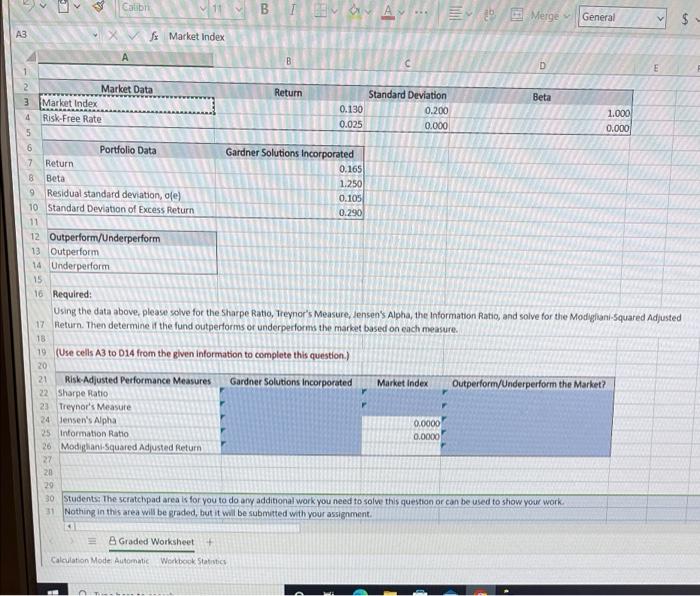

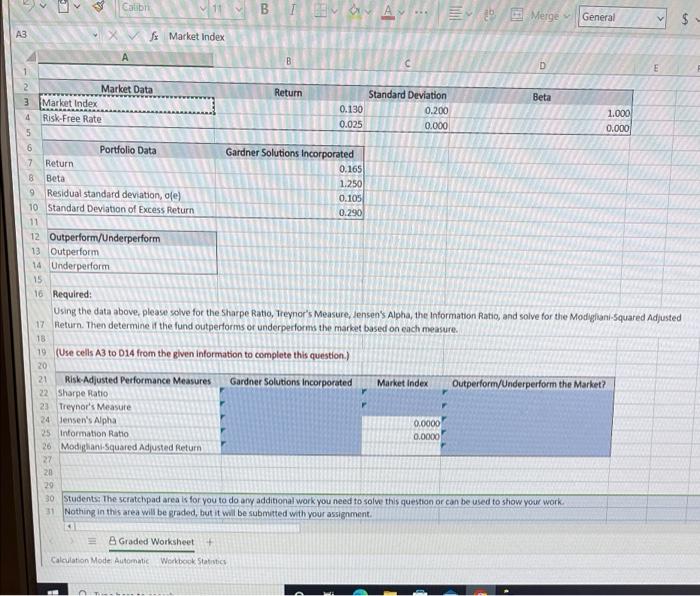

Solve everything and show the cell formulas being used. answer quick 3 Calibre BIGAY. Merge General 3 Market Index A D 1 2 Market Data

Solve everything and show the cell formulas being used. answer quick

3 Calibre BIGAY. Merge General 3 Market Index A D 1 2 Market Data Return Standard Deviation Beta 3 Market Index 0.130 0.200 1.000 4 Risk-Free Rate 0.025 0.000 0.000 5 6 Portfolio Data Gardner Solutions Incorporated 7 Return 0.165 8 Beta 1.250 Residual standard deviation, ofe) 0.105 10 Standard Deviation of Excess Return 0.290 11 12 Outperform/Underperform 13 Outperform 14 Onderperform 15 16 Required: Using the data above, please solve for the Sharpe Ratio, Treynor's Measure, Jensen's Alpha, the Information Ratio, and solve for the Modigliani Squared Adjusted 17 Return. Then determine if the fund outperforms or underperforms the market based on each measure. 18 19 (Use cells A3 to 014 from the given information to complete this question) 20 21 Risk Adjusted Performance Measures Gardner Solutions Incorporated Market Index Outperform/Underperform the Market? 22 Sharpe Ratio 23 Treynor's Measure 24 Jensen's Alpha 0.0000 25: Information Ratio 0.0000 26 Modigliani Squared Adjusted Return 27 20 29 30 Students. The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work 31 Nothing in this area will be graded, but it will be submitted with your assignment. B Graded Worksheet + Calculation Mode Automatic Workbook Statistics 3 Calibre BIGAY. Merge General 3 Market Index A D 1 2 Market Data Return Standard Deviation Beta 3 Market Index 0.130 0.200 1.000 4 Risk-Free Rate 0.025 0.000 0.000 5 6 Portfolio Data Gardner Solutions Incorporated 7 Return 0.165 8 Beta 1.250 Residual standard deviation, ofe) 0.105 10 Standard Deviation of Excess Return 0.290 11 12 Outperform/Underperform 13 Outperform 14 Onderperform 15 16 Required: Using the data above, please solve for the Sharpe Ratio, Treynor's Measure, Jensen's Alpha, the Information Ratio, and solve for the Modigliani Squared Adjusted 17 Return. Then determine if the fund outperforms or underperforms the market based on each measure. 18 19 (Use cells A3 to 014 from the given information to complete this question) 20 21 Risk Adjusted Performance Measures Gardner Solutions Incorporated Market Index Outperform/Underperform the Market? 22 Sharpe Ratio 23 Treynor's Measure 24 Jensen's Alpha 0.0000 25: Information Ratio 0.0000 26 Modigliani Squared Adjusted Return 27 20 29 30 Students. The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work 31 Nothing in this area will be graded, but it will be submitted with your assignment. B Graded Worksheet + Calculation Mode Automatic Workbook Statistics

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started