Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve fast please in 2018 master milwrights purchased a miling machine for $ 4600 debiting mili g equipment . during 2018 and 2019 master recorded

solve fast please

in 2018 master milwrights purchased a miling machine for $ 4600 debiting mili g equipment . during 2018 and 2019 master recorded total amortizing of $2600 on the machine . in january 2020, master traded in the machine for a new one with a fair market value of $ 4950 , paying $3400 cash. this exchange transaction has substance. journalize master milweights exchange of machine on january 15.

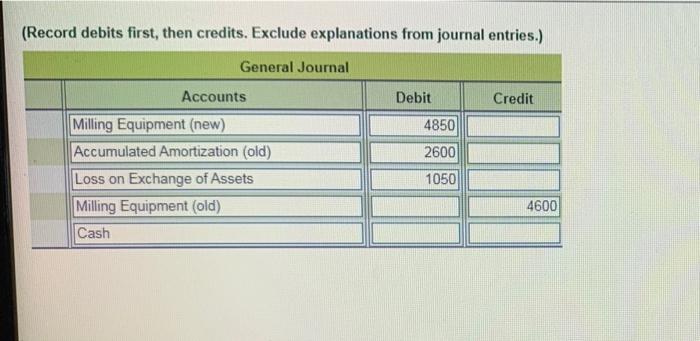

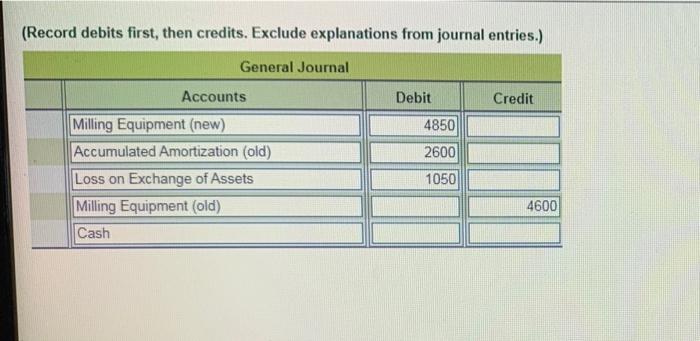

2016 March 2800 bin Mling Fu 2011 2010 Mistercefon the mach2020 Maddi taraw one with a formarea of 33.000 th the chance Junto Moto 15 Record debit est, the decationem Game Acco CH LLL C (Record debits first, then credits. Exclude explanations from journal entries.) General Journal Accounts Debit Credit 4850 2600 Milling Equipment (new) Accumulated Amortization (old) Loss on Exchange of Assets Milling Equipment (old) Cash 1050 4600 do it plz in 10 minutes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started