Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve for b&c please Value of a mixed stream Harte Systems, Inc., a maker of electronic survillance equipment, is considering selling the rights to market

solve for b&c please

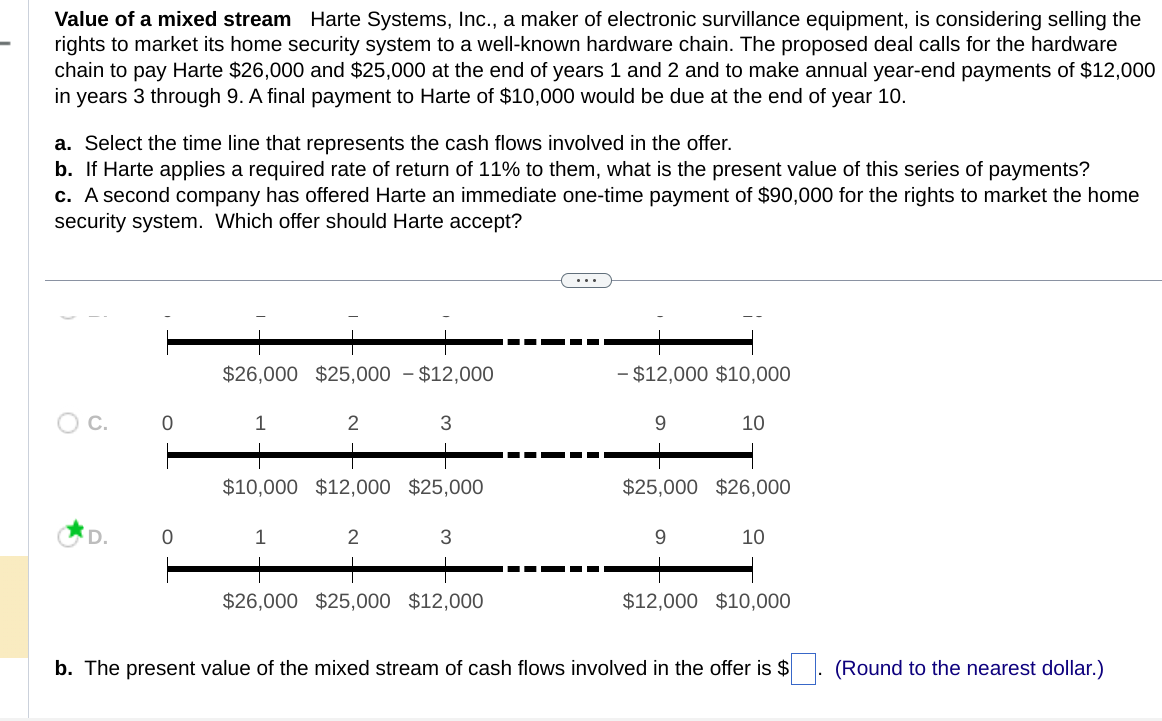

Value of a mixed stream Harte Systems, Inc., a maker of electronic survillance equipment, is considering selling the rights to market its home security system to a well-known hardware chain. The proposed deal calls for the hardware chain to pay Harte $26,000 and $25,000 at the end of years 1 and 2 and to make annual year-end payments of $12,000 in years 3 through 9. A final payment to Harte of $10,000 would be due at the end of year 10 . a. Select the time line that represents the cash flows involved in the offer. b. If Harte applies a required rate of return of 11% to them, what is the present value of this series of payments? c. A second company has offered Harte an immediate one-time payment of $90,000 for the rights to market the home security system. Which offer should Harte accept? C. D. b. The present value of the mixed stream of cash flows involved in the offer is $ (Round to the nearest dollar.)

Value of a mixed stream Harte Systems, Inc., a maker of electronic survillance equipment, is considering selling the rights to market its home security system to a well-known hardware chain. The proposed deal calls for the hardware chain to pay Harte $26,000 and $25,000 at the end of years 1 and 2 and to make annual year-end payments of $12,000 in years 3 through 9. A final payment to Harte of $10,000 would be due at the end of year 10 . a. Select the time line that represents the cash flows involved in the offer. b. If Harte applies a required rate of return of 11% to them, what is the present value of this series of payments? c. A second company has offered Harte an immediate one-time payment of $90,000 for the rights to market the home security system. Which offer should Harte accept? C. D. b. The present value of the mixed stream of cash flows involved in the offer is $ (Round to the nearest dollar.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started