Solve for July. Show Work Please.

Solve for July. Show Work Please.

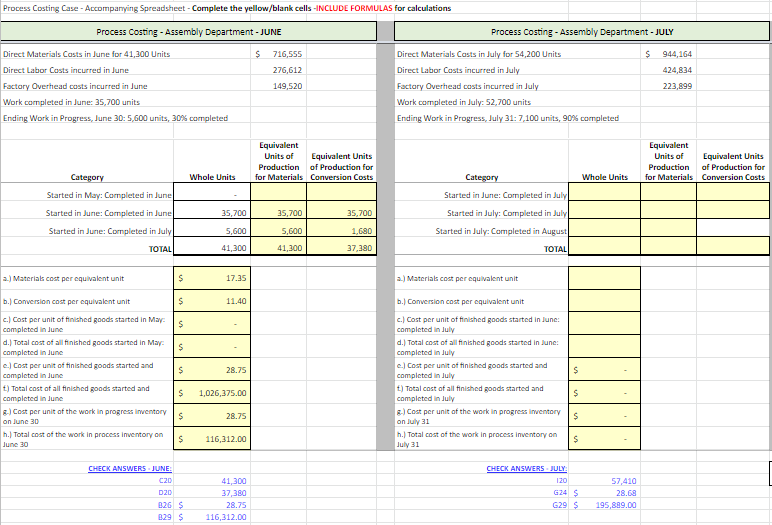

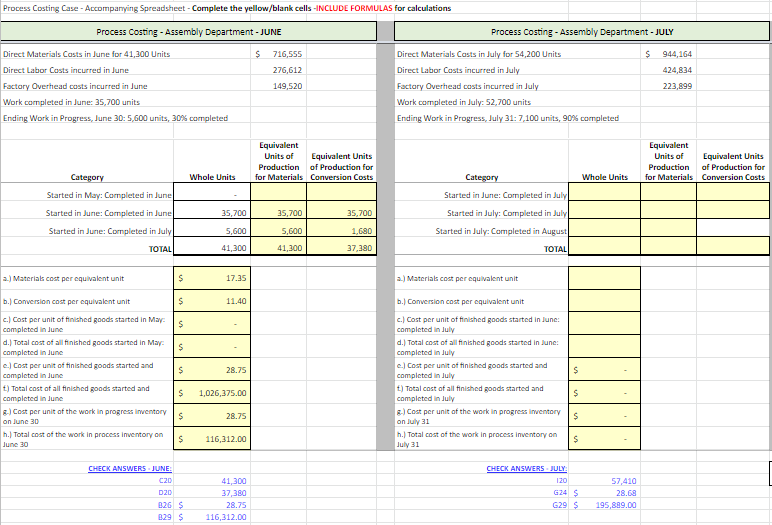

Process Costing Case - Accompanying Spreadsheet - Complete the yellow/blank cells -INCLUDE FORMULAS for calculations Process Costing - Assembly Department - JUNE $ 716,555 Direct Materials Costs in June for 41,300 Units Direct Labor Costs incurred in June Factory Overhead costs incurred in June Work completed in June: 35,700 units Ending Work in Progress, June 30:5,600 units, 30% completed 276,612 149,520 Process Costing - Assembly Department - JULY Direct Materials Costs in July for 54,200 Units 944,164 Direct Labor Costs incurred in July 424,834 Factory Overhead costs incurred in July 223,899 Work completed in July: 52,700 units Ending Work in Progress, July 31: 7,100 units, 90% completed Equivalent Units of Equivalent Units Production of Production for for Materials Conversion Costs Equivalent Units of Production for Materials Equivalent Units of Production for Conversion Costs Category Whole Units Whole Units 35,700 35,700 Started in May: Completed in June Started in June: Completed in June Started in June: Completed in July TOTALL Category Started in June: Completed in July Started in July: Completed in July Started in July: Completed in August TOTAL 35,700 5,600 41,300 5,600 41,300 1.690 37,380 a.) Materials cost per equivalent unit 17.35 2.) Materials cost per equivalent unit b.) Conversion cost per equivalent unit 11.40 b.) Conversion cost per equivalent unit c.) Cost per unit of finished goods started in May. completed in June d.) Total cost of all finished goods started in May completed in June c.) Cost per unit of finished goods started and completed in June t) Total cost of all finished goods started and completed in June Cost per unit of the work in progress inventory on June 30 h.) Total cost of the work in process inventory on June 30 $ $ 28.75 1,026,375.00 c.) Cost per unit of finished goods started in June: completed in July d.) Total cost of all finished goods started in June: completed in July c.) Cost per unit of finished goods started and completed in July t.) Total cost of all finished goods started and completed in July &.) Cost per unit of the work in progress inventory on July 31 h.) Total cost of the work in process inventory on July 31 S 28.75 $ 116,312.00 CHECK ANSWERSJUNE: 41,300 CHECK ANSWERSJULY 120 G24 S G29 $ D20 926 S 829 $ 37 380 29.75 116,312.00 57,410 28.68 195,899.00

Solve for July. Show Work Please.

Solve for July. Show Work Please.