Answered step by step

Verified Expert Solution

Question

1 Approved Answer

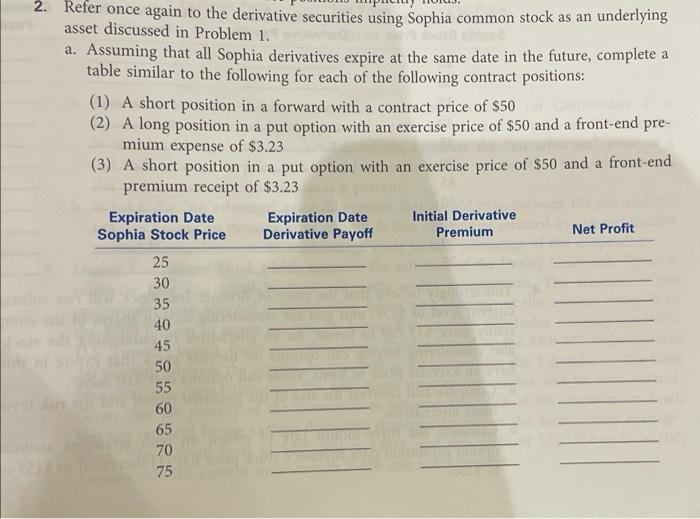

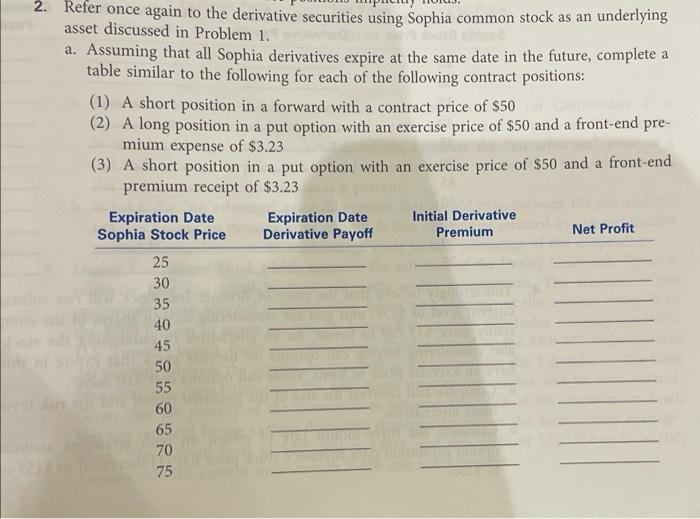

solve for one and two 2. Refer once again to the derivative securities using Sophia common stock as an underlying asset discussed in Problem 1.

solve for one and two

2. Refer once again to the derivative securities using Sophia common stock as an underlying asset discussed in Problem 1. a. Assuming that all Sophia derivatives expire at the same date in the future, complete a table similar to the following for each of the following contract positions: (1) A short position in a forward with a contract price of $50 (2) A long position in a put option with an exercise price of $50 and a front-end premium expense of $3.23 (3) A short position in a put option with an exercise price of $50 and a front-end premium receipt of $3.23

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started