Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve for part B Wildhorse Products manufactures and sells a variety of camping products. Recently the company opened a new factory to manufacture a deluxe

Solve for part B

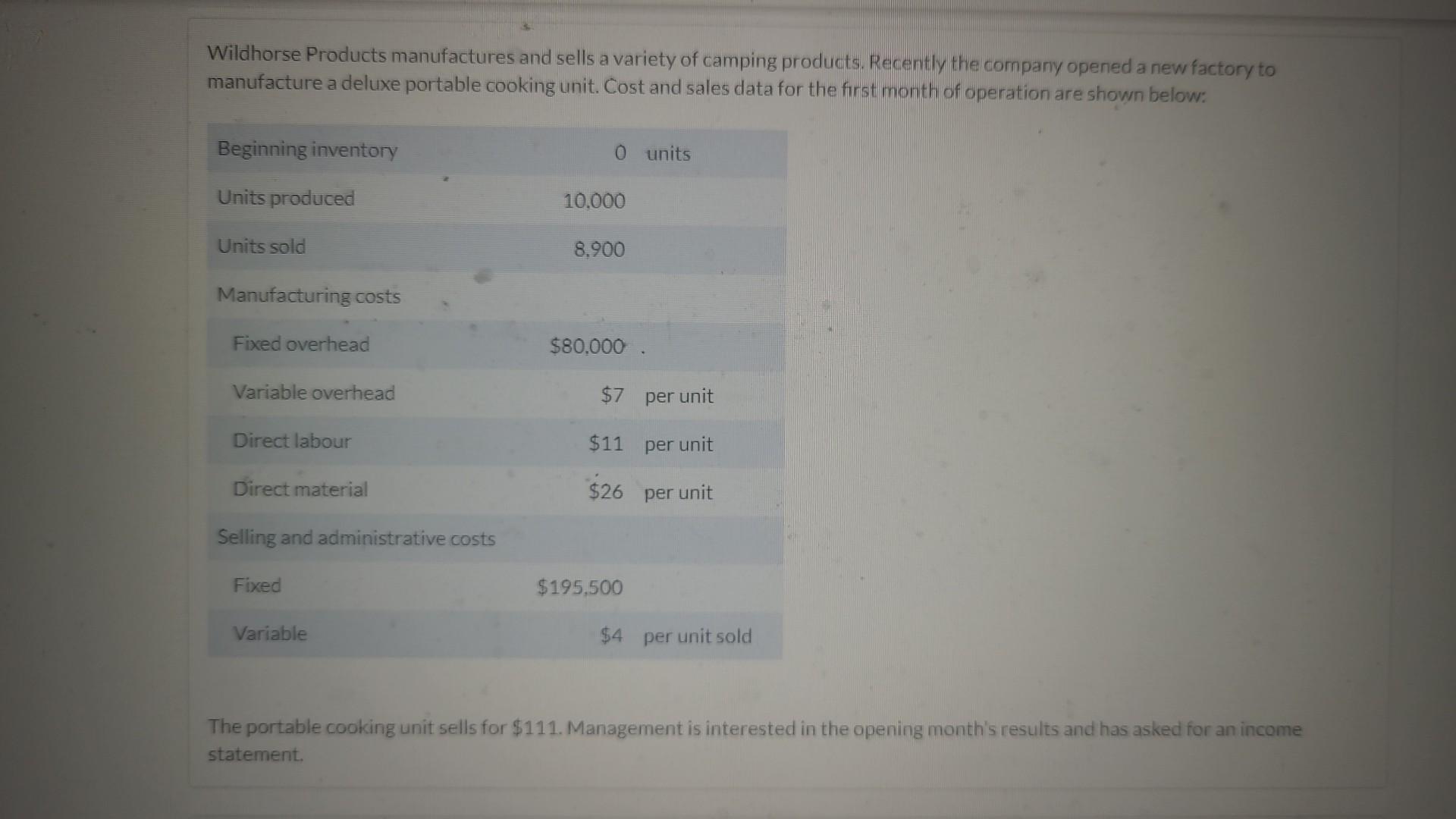

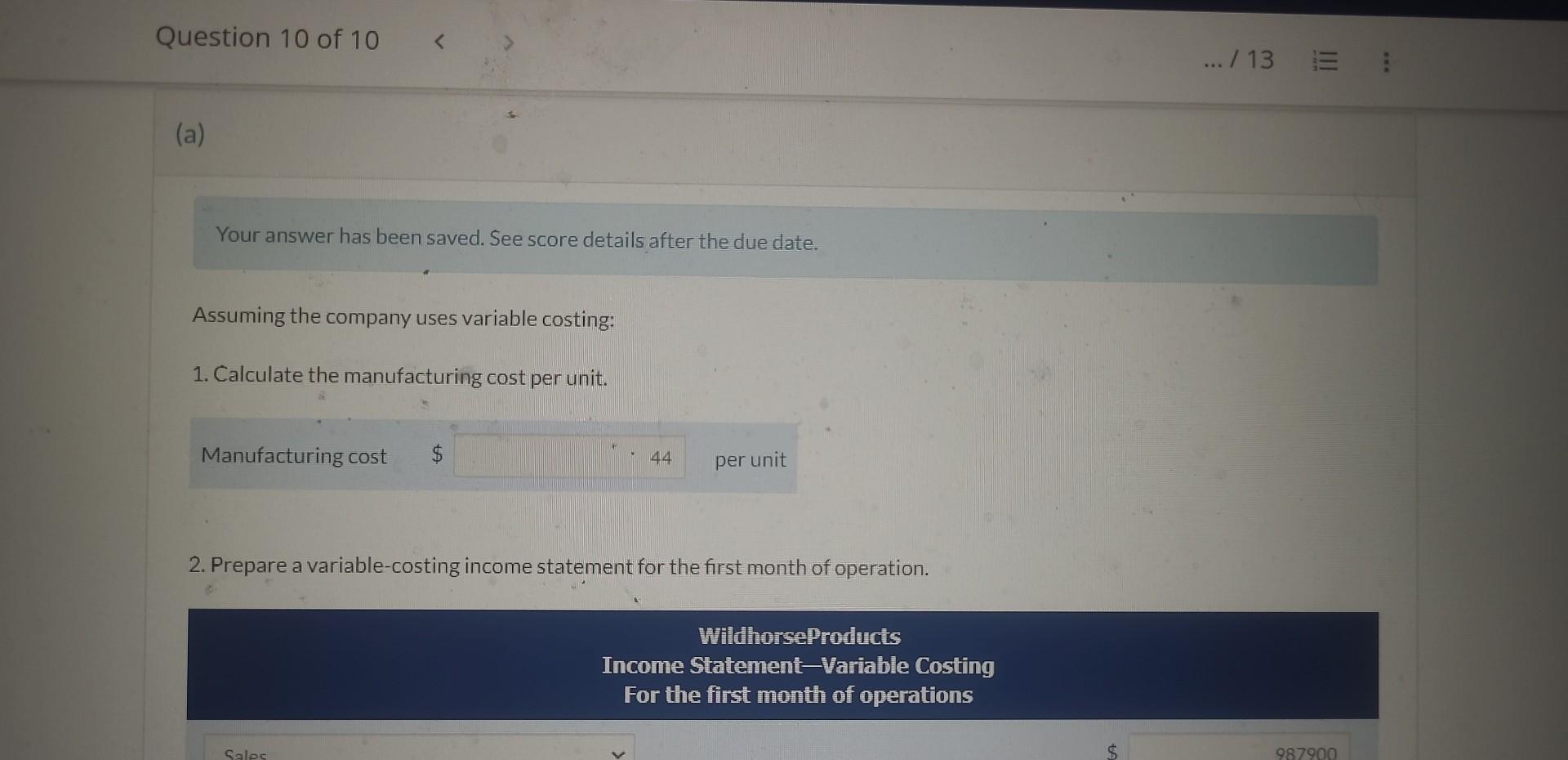

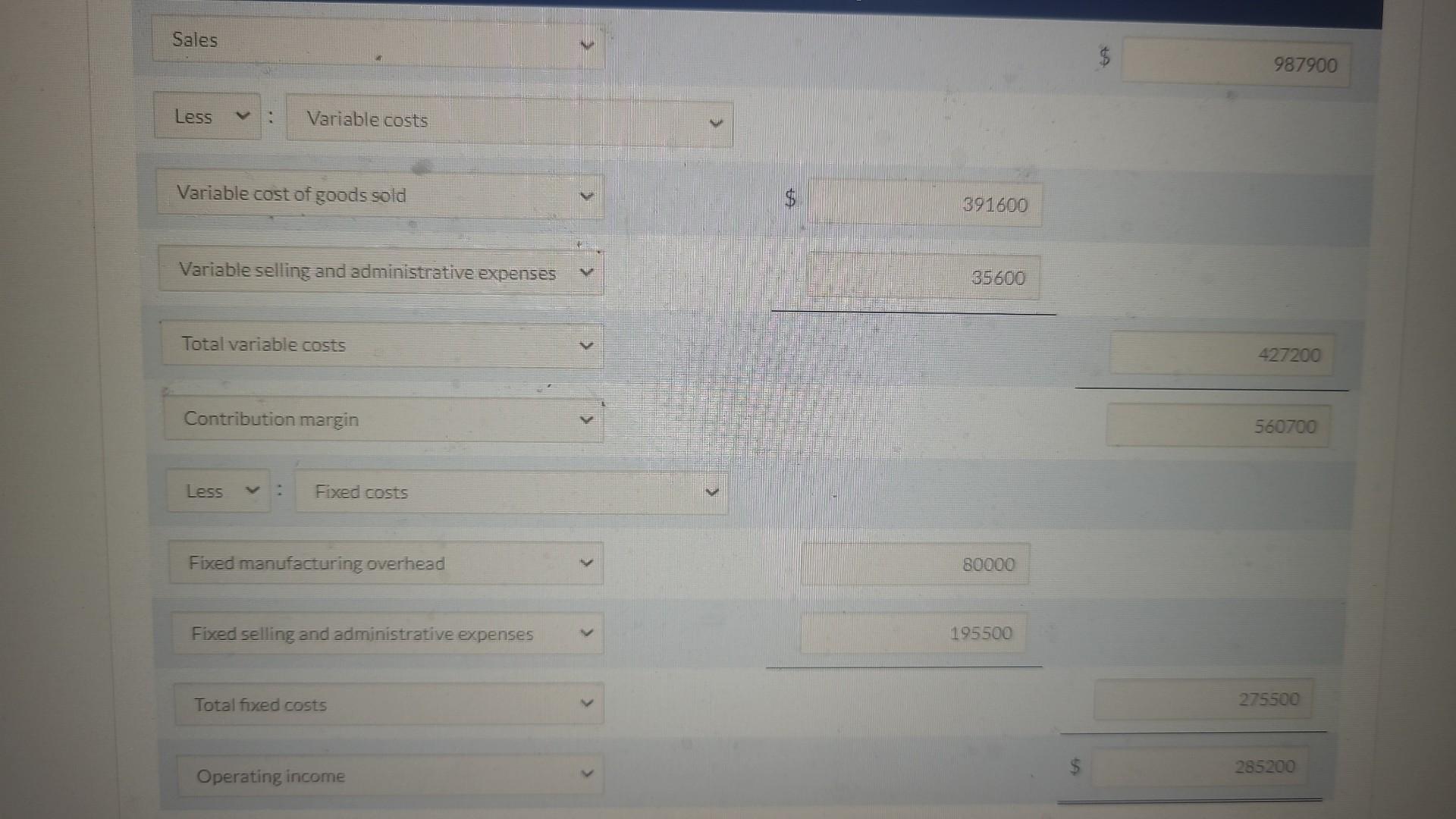

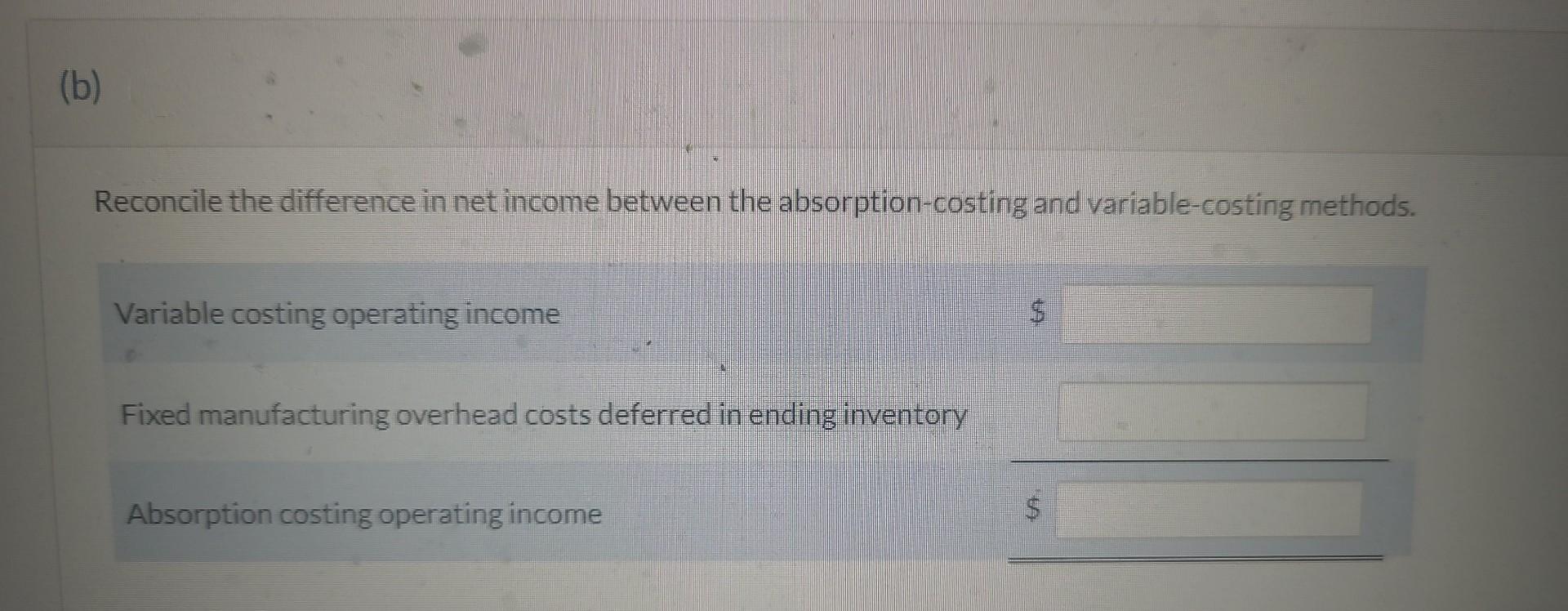

Wildhorse Products manufactures and sells a variety of camping products. Recently the company opened a new factory to manufacture a deluxe portable cooking unit. Cost and sales data for the first month of operation are shown below: The portable cooking unit sells for $111. Management is interested in the opening month's results and has asked for an income statement. Your answer has been saved. See score details after the due date. Assuming the company uses variable costing: 1. Calculate the manufacturing cost per unit. 2. Prepare a variable-costing income statement for the first month of operation. Sales Variable cost of goods sold Variable selling and administrative expenses $391600 Total variable costs Contribution margin Less : Fixed costs Fixed manufacturing overhead Fixed selling and administrative expenses Total fixed costs Operating income (b) Reconcile the difference in net income between the absorption-costing and variable-costing methods. Variable costing operating income Fixed manufacturing overhead costs deferred in ending inventory Absorption costing operating incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started