Solve for question 4

Solve for question 4

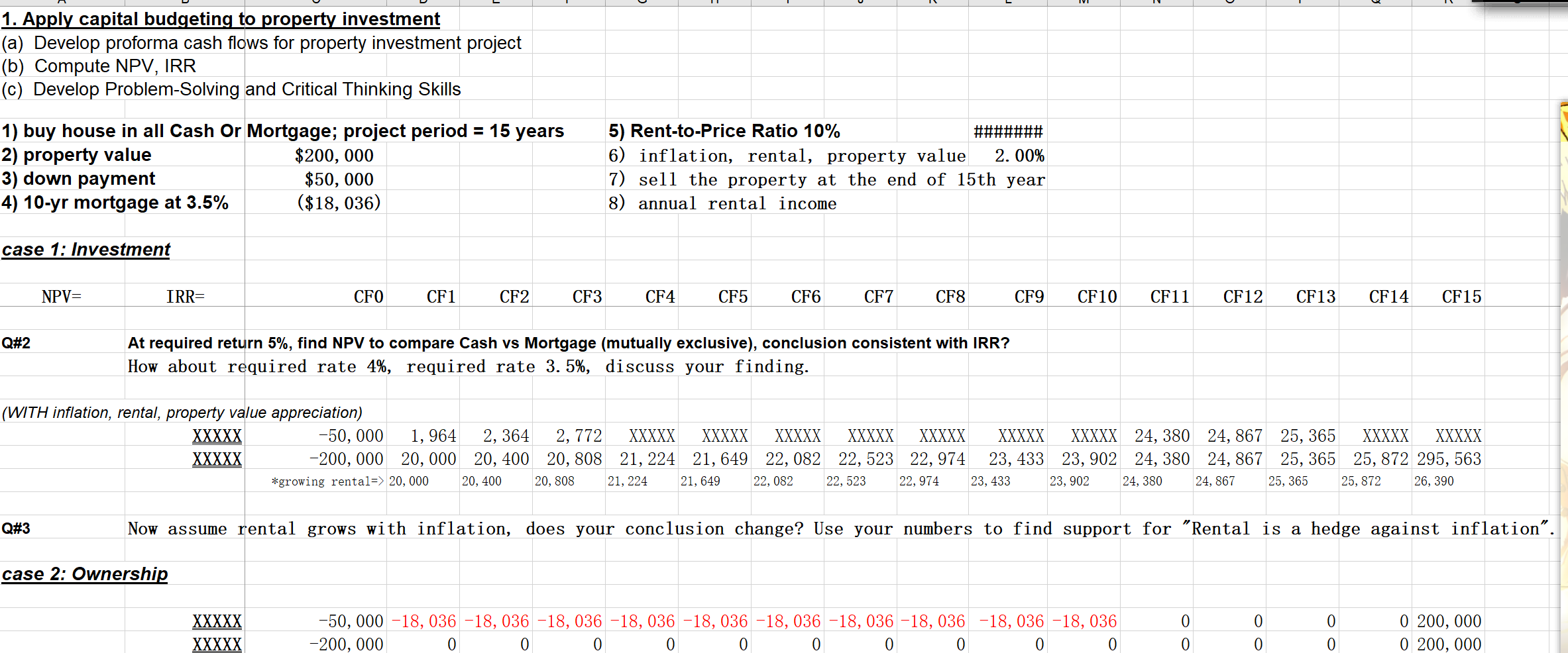

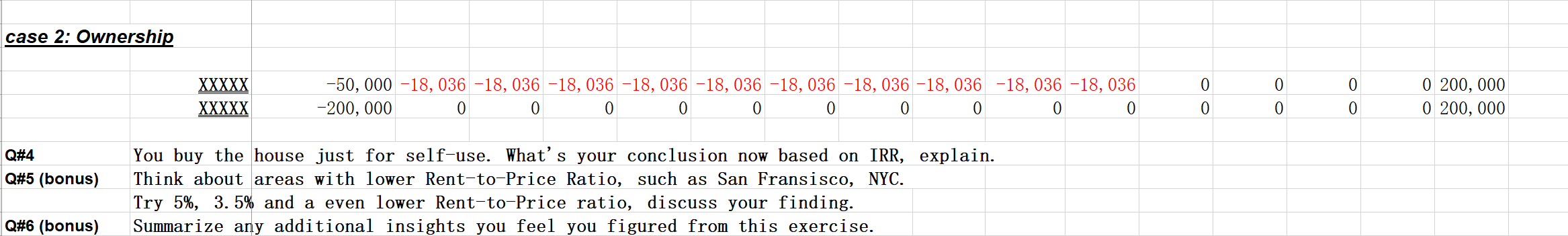

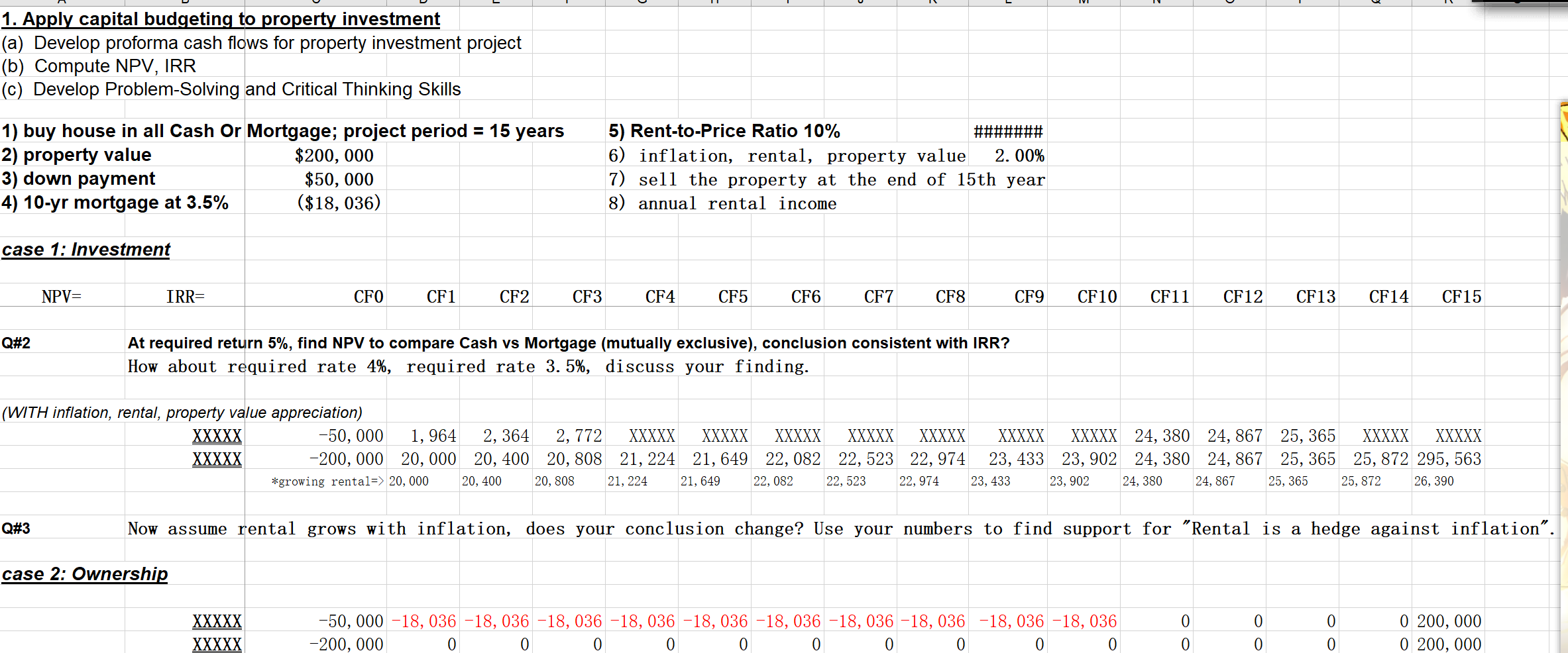

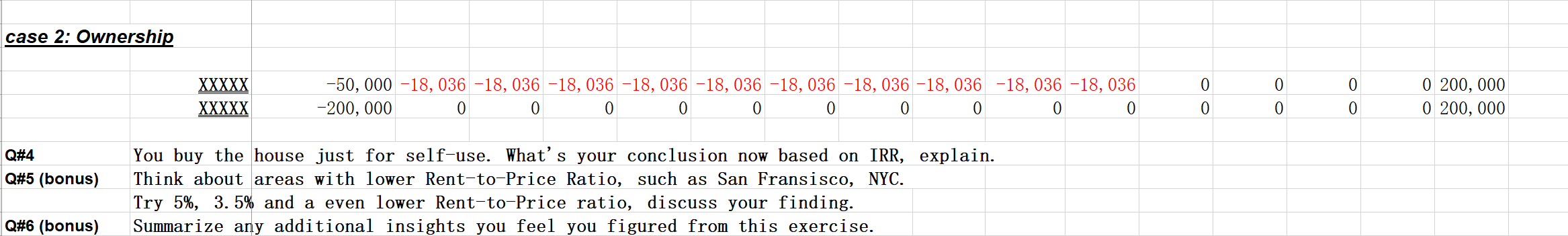

1. Apply capital budgeting to property investment (a) Develop proforma cash flows for property investment project (b) Compute NPV, IRR (c) Develop Problem-Solving and Critical Thinking Skills ####### 1) buy house in all Cash Or Mortgage; project period = 15 years 2) property value $200,000 3) down payment $50,000 4) 10-yr mortgage at 3.5% ($18, 036) 5) Rent-to-Price Ratio 10% 6) inflation, rental, property value 2. 00% 7) sell the property at the end of 15th year 8) annual rental income case 1: Investment NPV= IRR= CFO CF1 CF2 CF3 CF4 CF5 CF6 CF7 CF8 CF9 CF10 CF11 CF12 CF13 CF14 CF15 Q#2 At required return 5%, find NPV to compare Cash vs Mortgage (mutually exclusive), conclusion consistent with IRR? How about required rate 4%, required rate 3. 5%, discuss your finding. (WITH inflation, rental, property value appreciation) XXXXX -50, 000 1,964 2, 364 2, 772 XXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXX 24, 380 24, 867 25, 365 XXXXX XXXXX XXXXX -200, 000 20,000 20, 400 20, 808 21, 224 21, 649 22, 082 22,523 22, 974 23, 433 23, 902 24, 380 24, 867 25, 365 25, 872 295, 563 *growing rental=> 20,000 20, 400 20, 808 21, 224 21, 649 22,082 22, 523 22, 974 23, 433 23, 902 24, 380 24, 867 25, 365 25, 872 26, 390 Q#3 Now assume rental grows with inflation, does your conclusion change? Use your numbers to find support for "Rental is a hedge against inflation. case 2: Ownership 0 0 XXXXX XXXXX -50, 000 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -200, 000 0 0 0 0 0 0 0 0 0 0 0 0 0 200, 000 0 200,000 0 0 case 2: Ownership 0 0 XXXXX XXXXX -50, 000 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -200, 000 0 0 0 0 0 0 0 0 0 0 0 0 0 200,000 0 200,000 0 0 Q#4 Q#5 (bonus) You buy the house just for self-use. What's your conclusion now based on IRR, explain. Think about areas with lower Rent-to-Price Ratio, such as San Fransisco, NYC. Try 5%, 3. 5% and a even lower Rent-to-Price ratio, discuss your finding. Summarize any additional insights you feel you figured from this exercise. Q#6 (bonus) 1. Apply capital budgeting to property investment (a) Develop proforma cash flows for property investment project (b) Compute NPV, IRR (c) Develop Problem-Solving and Critical Thinking Skills ####### 1) buy house in all Cash Or Mortgage; project period = 15 years 2) property value $200,000 3) down payment $50,000 4) 10-yr mortgage at 3.5% ($18, 036) 5) Rent-to-Price Ratio 10% 6) inflation, rental, property value 2. 00% 7) sell the property at the end of 15th year 8) annual rental income case 1: Investment NPV= IRR= CFO CF1 CF2 CF3 CF4 CF5 CF6 CF7 CF8 CF9 CF10 CF11 CF12 CF13 CF14 CF15 Q#2 At required return 5%, find NPV to compare Cash vs Mortgage (mutually exclusive), conclusion consistent with IRR? How about required rate 4%, required rate 3. 5%, discuss your finding. (WITH inflation, rental, property value appreciation) XXXXX -50, 000 1,964 2, 364 2, 772 XXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXX 24, 380 24, 867 25, 365 XXXXX XXXXX XXXXX -200, 000 20,000 20, 400 20, 808 21, 224 21, 649 22, 082 22,523 22, 974 23, 433 23, 902 24, 380 24, 867 25, 365 25, 872 295, 563 *growing rental=> 20,000 20, 400 20, 808 21, 224 21, 649 22,082 22, 523 22, 974 23, 433 23, 902 24, 380 24, 867 25, 365 25, 872 26, 390 Q#3 Now assume rental grows with inflation, does your conclusion change? Use your numbers to find support for "Rental is a hedge against inflation. case 2: Ownership 0 0 XXXXX XXXXX -50, 000 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -200, 000 0 0 0 0 0 0 0 0 0 0 0 0 0 200, 000 0 200,000 0 0 case 2: Ownership 0 0 XXXXX XXXXX -50, 000 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -18, 036 -200, 000 0 0 0 0 0 0 0 0 0 0 0 0 0 200,000 0 200,000 0 0 Q#4 Q#5 (bonus) You buy the house just for self-use. What's your conclusion now based on IRR, explain. Think about areas with lower Rent-to-Price Ratio, such as San Fransisco, NYC. Try 5%, 3. 5% and a even lower Rent-to-Price ratio, discuss your finding. Summarize any additional insights you feel you figured from this exercise. Q#6 (bonus)

Solve for question 4

Solve for question 4