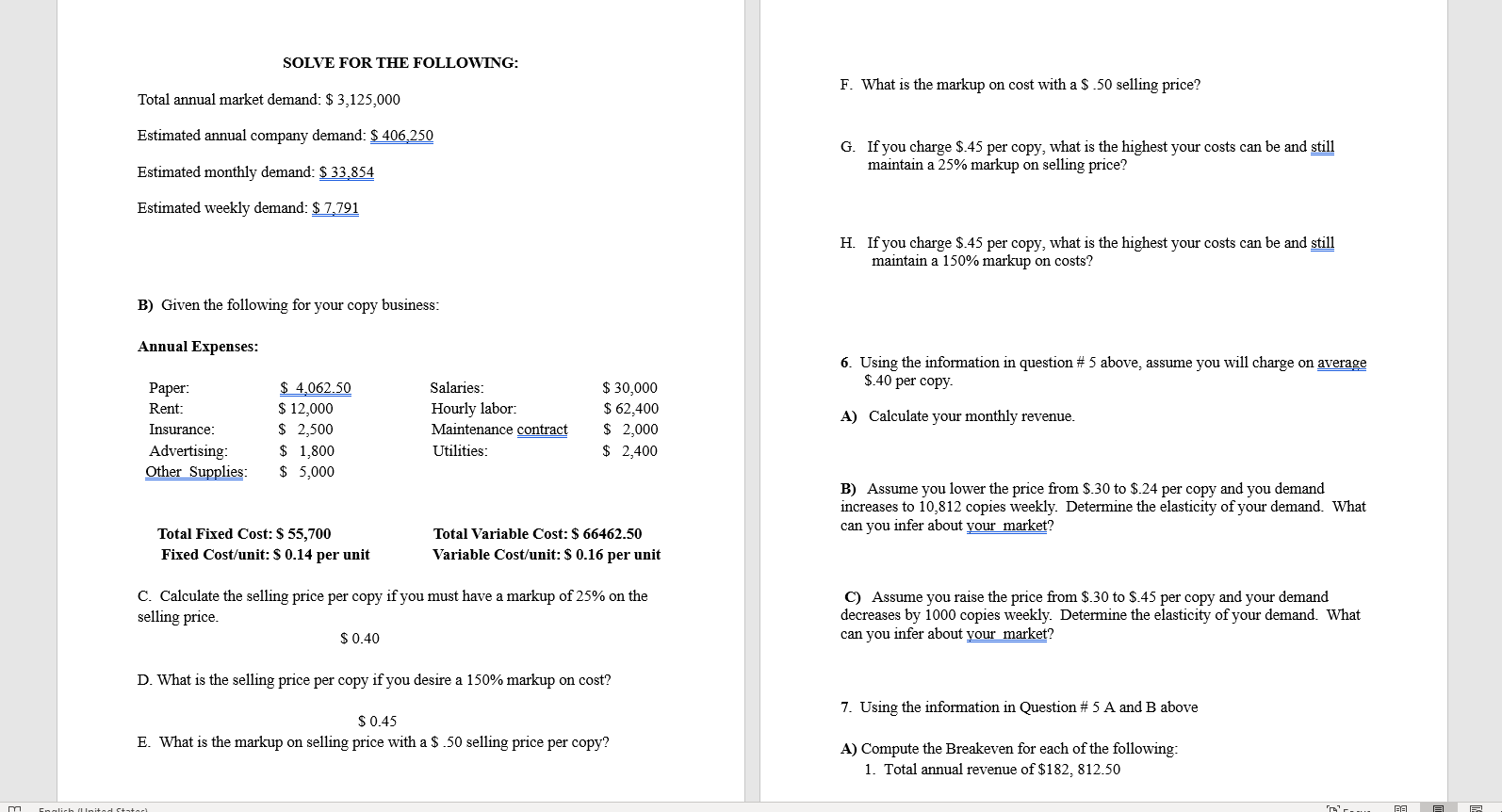

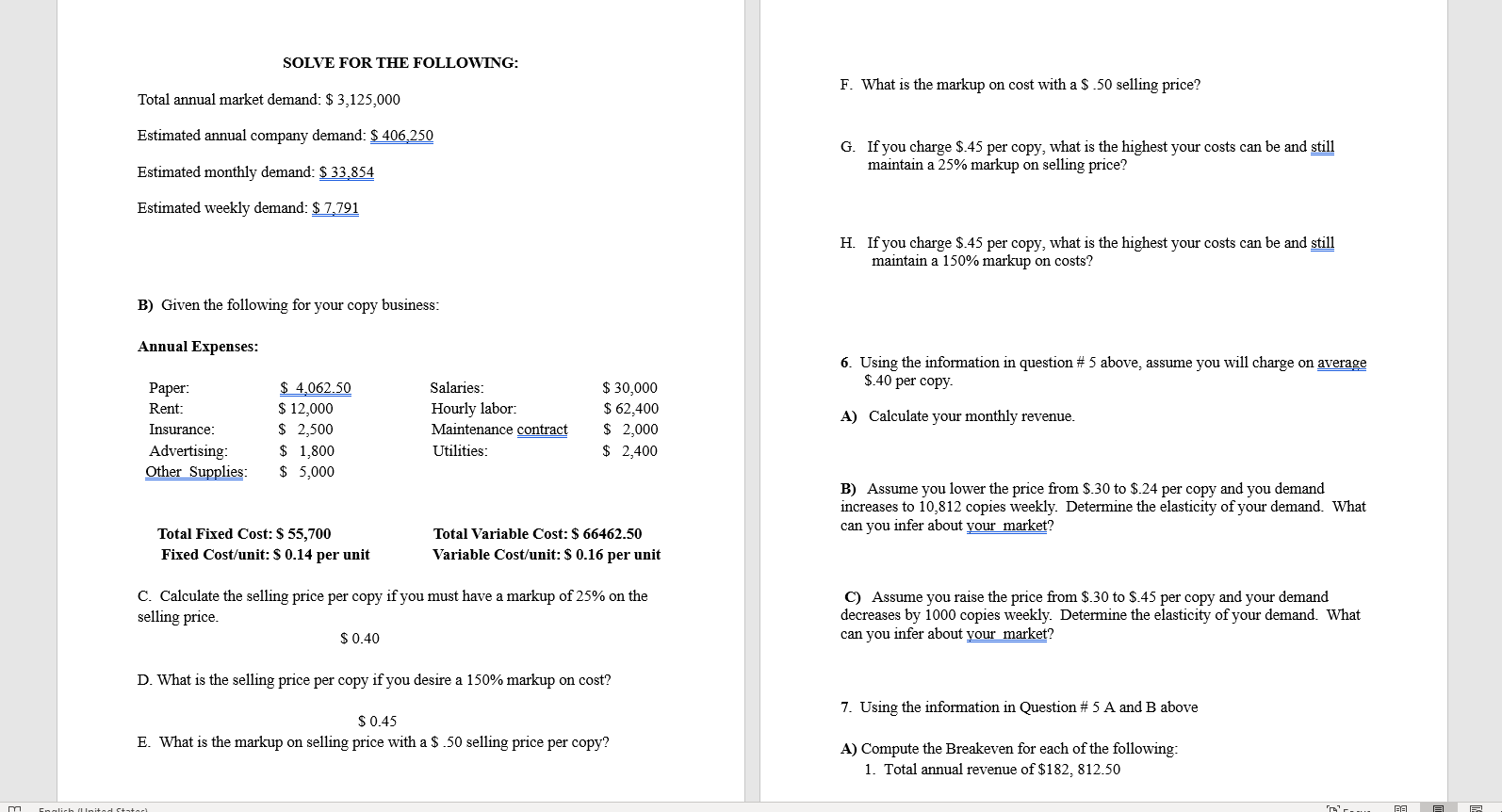

SOLVE FOR THE FOLLOWING: F. What is the markup on cost with a $ 50 selling price? Total annual market demand: $ 3,125,000 Estimated annual company demand: $ 406,250 G. If you charge $.45 per copy, what is the highest your costs can be and still maintain a 25% markup on selling price? Estimated monthly demand: $ 33,854 Estimated weekly demand: $ 7,791 H. If you charge $.45 per copy, what is the highest your costs can be and still maintain a 150% markup on costs? B) Given the following for your copy business: Annual Expenses: 6. Using the information in question # 5 above, assume you will charge on average $.40 per copy Paper: Rent: Insurance: Advertising: Other Supplies $ 4,062.50 $ 12,000 $ 2,500 $ 1,800 $ 5,000 Salaries: Hourly labor: Maintenance contract Utilities: A) Calculate your monthly revenue. $ 30,000 $ 62,400 $ 2,000 $ 2,400 B) Assume you lower the price from 9.30 to $.24 per copy and you demand increases to 10,812 copies weekly. Determine the elasticity of your demand. What can you infer about your market? Total Fixed Cost: $ 55,700 Fixed Cost/unit: S 0.14 per unit Total Variable Cost: $ 66462.50 Variable Cost/unit: $ 0.16 per unit C. Calculate the selling price per copy if you must have a markup of 25% on the selling price. $ 0.40 C) Assume you raise the price from $.30 to $.45 per copy and your demand decreases by 1000 copies weekly. Determine the elasticity of your demand. What can you infer about your market? D. What is the selling price per copy if you desire a 150% markup on cost? 7. Using the information in Question # 5 A and B above $ 0.45 E. What is the markup on selling price with a $1.50 selling price per copy? A) Compute the Breakeven for each of the following: 1. Total annual revenue of $182, 812.50 M Click it and stated SOLVE FOR THE FOLLOWING: F. What is the markup on cost with a $ 50 selling price? Total annual market demand: $ 3,125,000 Estimated annual company demand: $ 406,250 G. If you charge $.45 per copy, what is the highest your costs can be and still maintain a 25% markup on selling price? Estimated monthly demand: $ 33,854 Estimated weekly demand: $ 7,791 H. If you charge $.45 per copy, what is the highest your costs can be and still maintain a 150% markup on costs? B) Given the following for your copy business: Annual Expenses: 6. Using the information in question # 5 above, assume you will charge on average $.40 per copy Paper: Rent: Insurance: Advertising: Other Supplies $ 4,062.50 $ 12,000 $ 2,500 $ 1,800 $ 5,000 Salaries: Hourly labor: Maintenance contract Utilities: A) Calculate your monthly revenue. $ 30,000 $ 62,400 $ 2,000 $ 2,400 B) Assume you lower the price from 9.30 to $.24 per copy and you demand increases to 10,812 copies weekly. Determine the elasticity of your demand. What can you infer about your market? Total Fixed Cost: $ 55,700 Fixed Cost/unit: S 0.14 per unit Total Variable Cost: $ 66462.50 Variable Cost/unit: $ 0.16 per unit C. Calculate the selling price per copy if you must have a markup of 25% on the selling price. $ 0.40 C) Assume you raise the price from $.30 to $.45 per copy and your demand decreases by 1000 copies weekly. Determine the elasticity of your demand. What can you infer about your market? D. What is the selling price per copy if you desire a 150% markup on cost? 7. Using the information in Question # 5 A and B above $ 0.45 E. What is the markup on selling price with a $1.50 selling price per copy? A) Compute the Breakeven for each of the following: 1. Total annual revenue of $182, 812.50 M Click it and stated