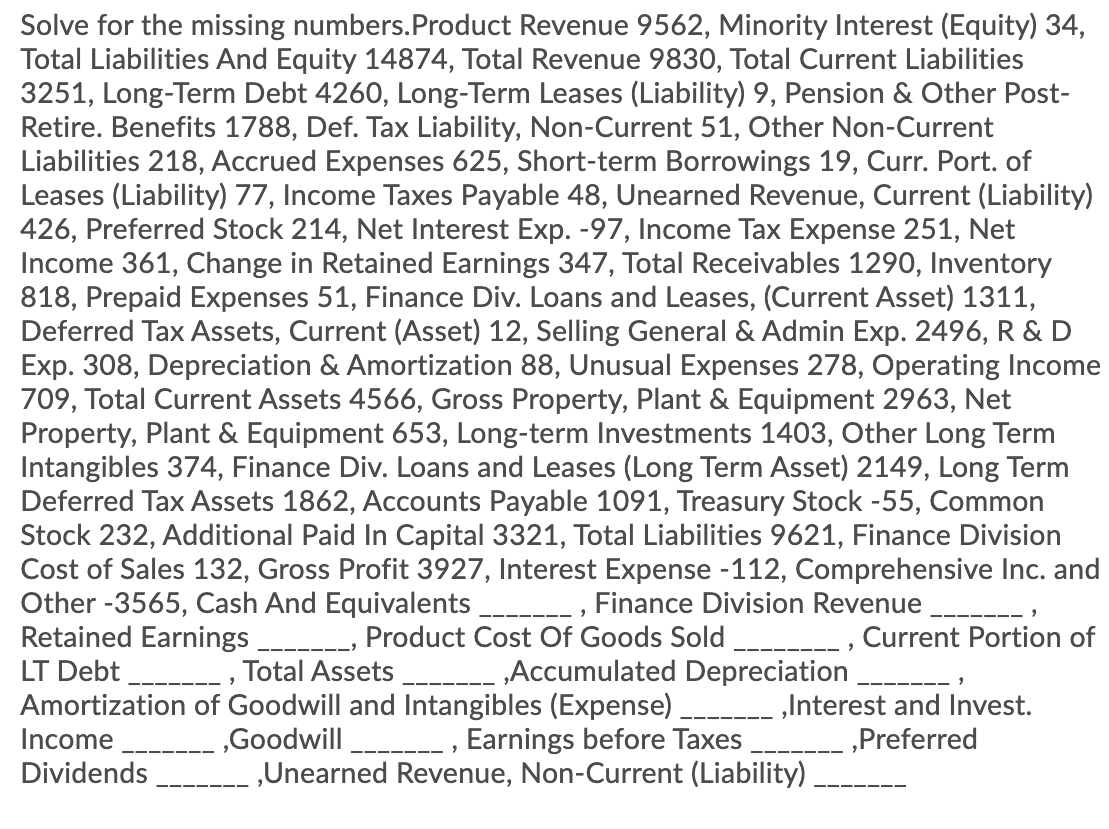

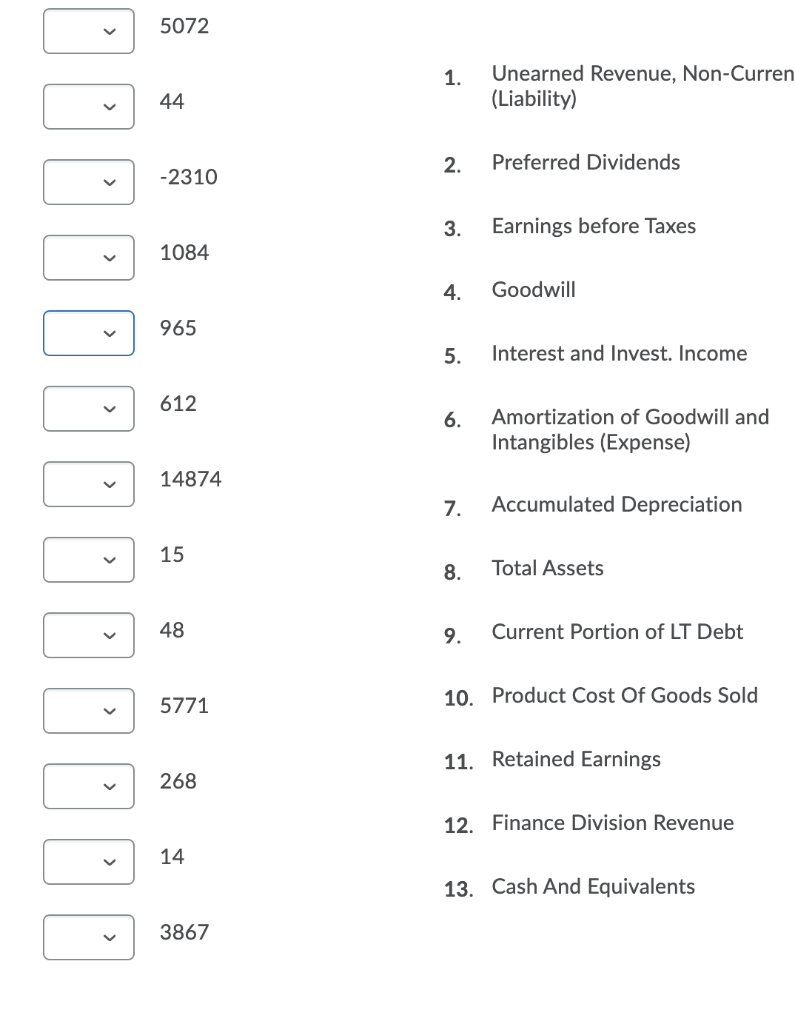

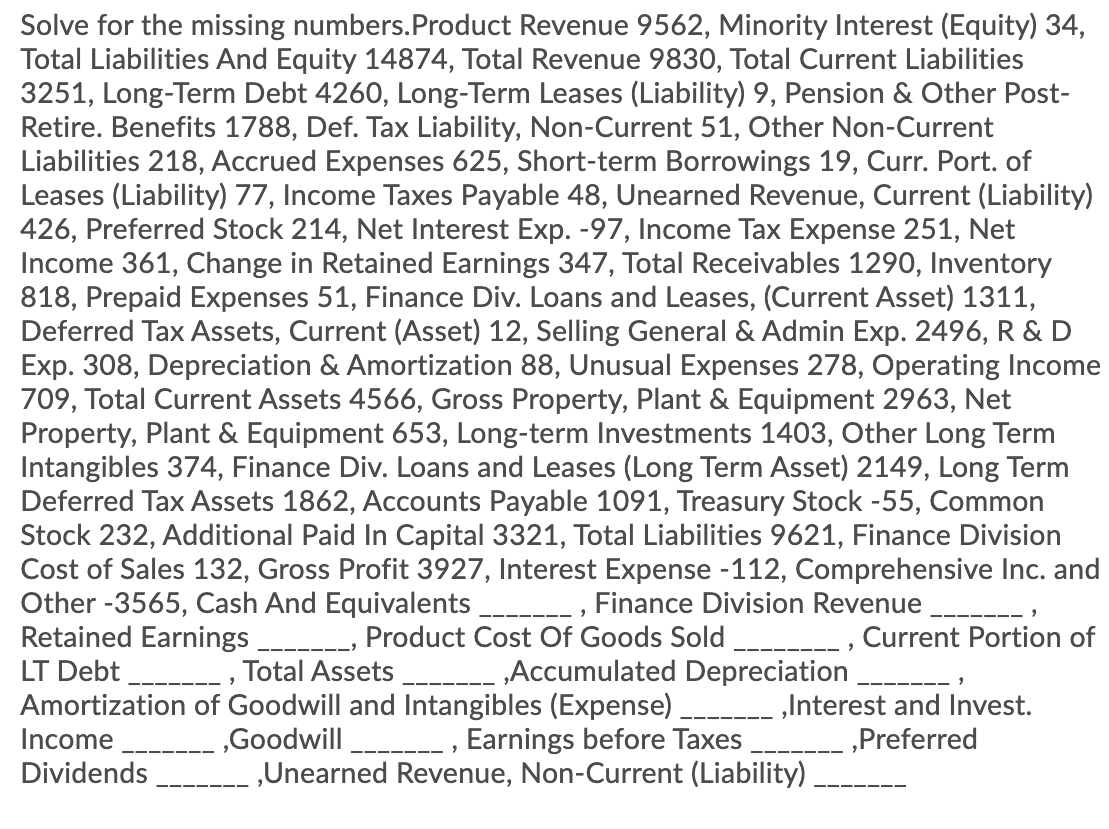

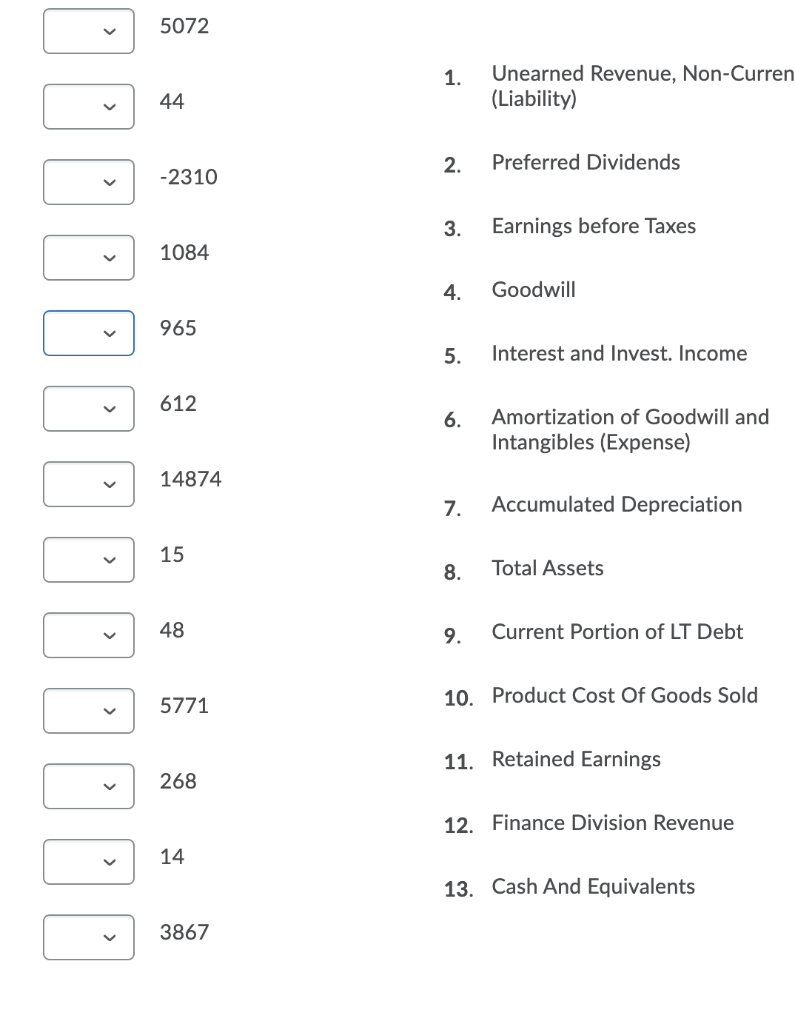

Solve for the missing numbers.Product Revenue 9562, Minority Interest (Equity) 34, Total Liabilities And Equity 14874, Total Revenue 9830, Total Current Liabilities 3251, Long-Term Debt 4260, Long-Term Leases (Liability) 9, Pension & Other Post- Retire. Benefits 1788, Def. Tax Liability, Non-Current 51, Other Non-Current Liabilities 218, Accrued Expenses 625, Short-term Borrowings 19, Curr. Port. of Leases (Liability) 77, Income Taxes Payable 48, Unearned Revenue, Current (Liability) 426, Preferred Stock 214, Net Interest Exp. -97, Income Tax Expense 251, Net Income 361, Change in Retained Earnings 347, Total Receivables 1290, Inventory 818, Prepaid Expenses 51, Finance Div. Loans and Leases, (Current Asset) 1311, Deferred Tax Assets, Current (Asset) 12, Selling General & Admin Exp. 2496, R & D Exp. 308, Depreciation & Amortization 88, Unusual Expenses 278, Operating Income 709, Total Current Assets 4566, Gross Property, Plant & Equipment 2963, Net Property, Plant & Equipment 653, Long-term Investments 1403, Other Long Term Intangibles 374, Finance Div. Loans and Leases (Long Term Asset) 2149, Long Term Deferred Tax Assets 1862, Accounts Payable 1091, Treasury Stock -55, Common Stock 232, Additional Paid In Capital 3321, Total Liabilities 9621, Finance Division Cost of Sales 132, Gross Profit 3927, Interest Expense -112, Comprehensive Inc. and Other -3565, Cash And Equivalents Finance Division Revenue Retained Earnings Product Cost Of Goods Sold Current Portion of LT Debt ------- , Total Assets ,Accumulated Depreciation Amortization of Goodwill and Intangibles (Expense) Interest and Invest. Income Goodwill Earnings before Taxes ,Preferred Dividends Unearned Revenue, Non-Current (Liability). 5072 1. Unearned Revenue, Non-Curren (Liability) 44 2. Preferred Dividends -2310 3. Earnings before Taxes 1084 4. Goodwill 965 5. Interest and Invest. Income 612 6. Amortization of Goodwill and Intangibles (Expense) 14874 > 7. Accumulated Depreciation 15 > 8. Total Assets 48 9. Current Portion of LT Debt > 5771 10. Product Cost Of Goods Sold 12. Finance Division Revenue v 14 13. Cash And Equivalents 3867 Solve for the missing numbers.Product Revenue 9562, Minority Interest (Equity) 34, Total Liabilities And Equity 14874, Total Revenue 9830, Total Current Liabilities 3251, Long-Term Debt 4260, Long-Term Leases (Liability) 9, Pension & Other Post- Retire. Benefits 1788, Def. Tax Liability, Non-Current 51, Other Non-Current Liabilities 218, Accrued Expenses 625, Short-term Borrowings 19, Curr. Port. of Leases (Liability) 77, Income Taxes Payable 48, Unearned Revenue, Current (Liability) 426, Preferred Stock 214, Net Interest Exp. -97, Income Tax Expense 251, Net Income 361, Change in Retained Earnings 347, Total Receivables 1290, Inventory 818, Prepaid Expenses 51, Finance Div. Loans and Leases, (Current Asset) 1311, Deferred Tax Assets, Current (Asset) 12, Selling General & Admin Exp. 2496, R & D Exp. 308, Depreciation & Amortization 88, Unusual Expenses 278, Operating Income 709, Total Current Assets 4566, Gross Property, Plant & Equipment 2963, Net Property, Plant & Equipment 653, Long-term Investments 1403, Other Long Term Intangibles 374, Finance Div. Loans and Leases (Long Term Asset) 2149, Long Term Deferred Tax Assets 1862, Accounts Payable 1091, Treasury Stock -55, Common Stock 232, Additional Paid In Capital 3321, Total Liabilities 9621, Finance Division Cost of Sales 132, Gross Profit 3927, Interest Expense -112, Comprehensive Inc. and Other -3565, Cash And Equivalents Finance Division Revenue Retained Earnings Product Cost Of Goods Sold Current Portion of LT Debt ------- , Total Assets ,Accumulated Depreciation Amortization of Goodwill and Intangibles (Expense) Interest and Invest. Income Goodwill Earnings before Taxes ,Preferred Dividends Unearned Revenue, Non-Current (Liability). 5072 1. Unearned Revenue, Non-Curren (Liability) 44 2. Preferred Dividends -2310 3. Earnings before Taxes 1084 4. Goodwill 965 5. Interest and Invest. Income 612 6. Amortization of Goodwill and Intangibles (Expense) 14874 > 7. Accumulated Depreciation 15 > 8. Total Assets 48 9. Current Portion of LT Debt > 5771 10. Product Cost Of Goods Sold 12. Finance Division Revenue v 14 13. Cash And Equivalents 3867