Answered step by step

Verified Expert Solution

Question

1 Approved Answer

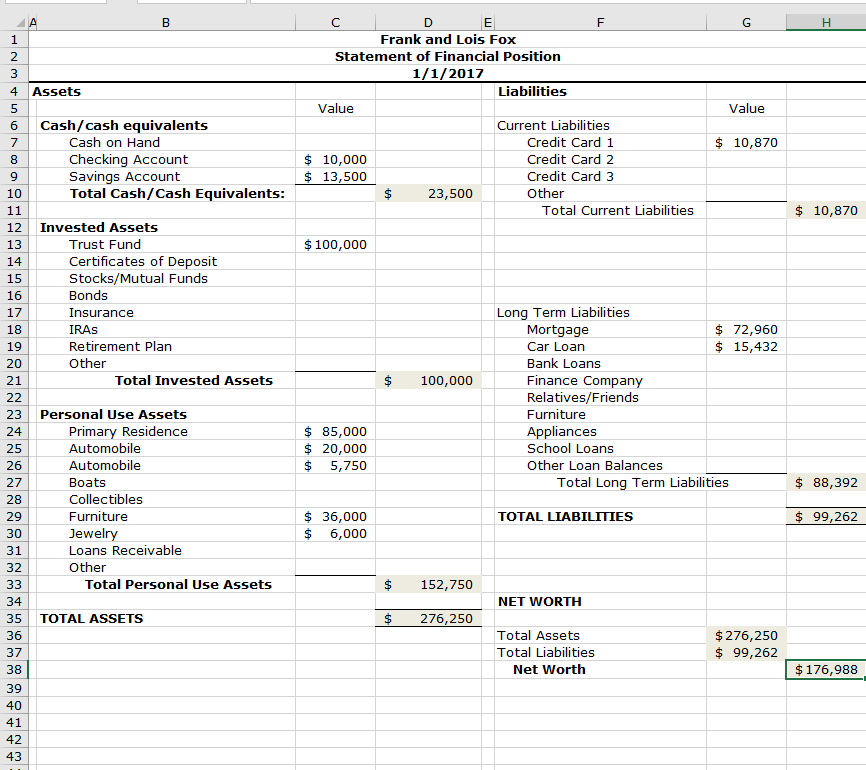

Solve for the ratios listed. Frank and Lois Fox Statement of Financial Position 1/1/2017 2 Liabilities 4 Assets 5 6 Cash/cash equivalents Value Value Current

Solve for the ratios listed.

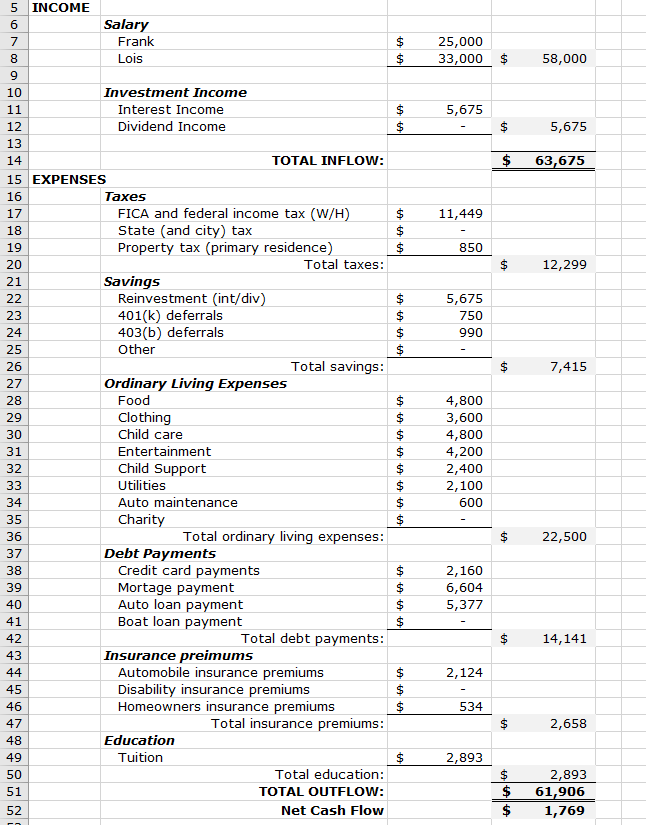

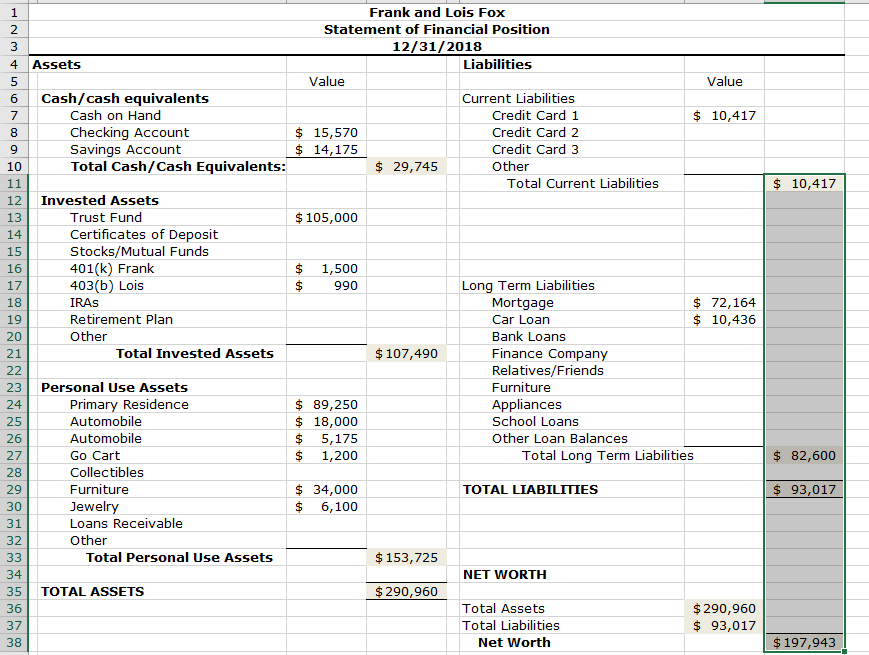

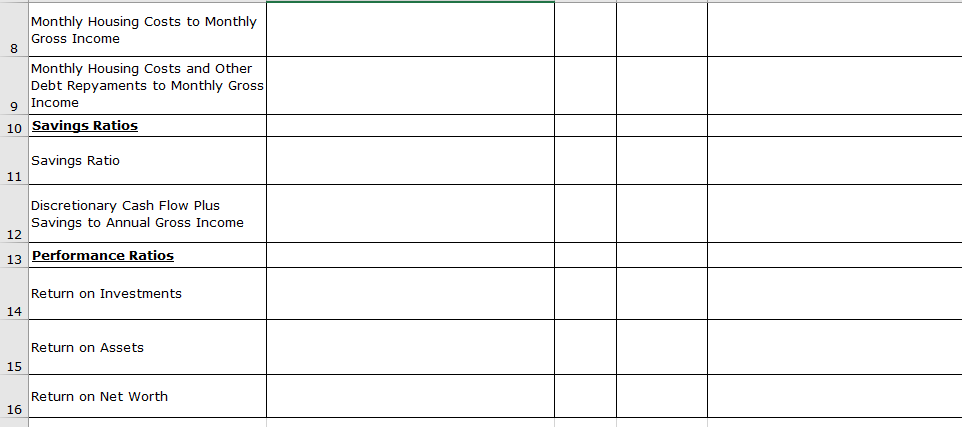

Frank and Lois Fox Statement of Financial Position 1/1/2017 2 Liabilities 4 Assets 5 6 Cash/cash equivalents Value Value Current Liabilities Cash on Hand Checking Account Savings Account Total Cash/Cash Equivalents: Credit Card 1 Credit Card 2 Credit Card 3 Other $ 10,870 $ 10,000 S 13,500 8 10 $23,500 Total Current Liabilities $ 10,870 12 Invested Assets 13 Trust Fund Certificates of Deposit Stocks/Mutual Funds Bonds Insurance IRAS Retirement Plan Other $100,000 15 16 17 18 19 Long Term Liabilities $ 72,960 $ 15,432 Mortgage Car Loan Bank Loans Finance Company Relatives/Friends Furniture Appliances School Loans Other Loan Balances Total Invested Assets $100,000 23 Personal Use Assets 25 27 29 Primary Residence Automobile Automobile Boats Collectibles Furniture Jewel Loans Receivable Other $ 85,000 $ 20,000 $ 5,750 Total Long Term Liabilities $ 88,392 $ 36,000 $6,000 TOTAL LIABILITIES 99,262 30 32 Total Personal Use Assets $152,750 NET WORTH 35 TOTAL ASSETS 36 37 38 39 40 276,250 Total Assets Total Liabilities $276,250 $ 99,262 Net Worth $176,988 42 43 5 INCOME 6 7 8 9 10 Salary Frank Lois $25,000 $ 33,000 $ 58,000 Investment income 5,675 Interest Income Dividend Income 5,675 TOTAL INFLOW: $63,675 15 EXPENSES 16 Taxes FICA and federal income tax (W/H) State (and city) tax Property tax (primary residence) $11,449 18 19 850 Total taxes: $12,299 Savings Reinvestment (int/div) 401(k) deferrals 403(b) deferrals Other 5,675 750 990 Total savings 7,415 27 Ordinary Living Expenses Food Clothing Child care Entertainment Child Support Utilities Auto maintenance Charity 4,800 3,600 4,800 4,200 2,400 2,100 600 32 Total ordinary living expenses $22,500 Debt Payments Credit card payments Mortage payment Auto loan payment Boat loan pavment 2,160 6,604 5,377 40 Total debt payments $14,141 42 43 Insurance preimuns Automobile insurance premiums Disability insurance premiums Homeowners insurance premiums 2,124 45 46 534 Total insurance premiums 2,658 48 49 Education Tuition 2,893 Total education: TOTAL OUTFLOW: Net Cash Flow 2,893 $61,906 $1,769 52 Frank and Lois Fox Statement of Financial Position 12/31/2018 Liabilities 4 Assets 5 6 Cash/ 7 8 9 10 Value Value /cash equivalents Cash on Hand Checking Account Savings Account Total Cash/Cash Equivalents: Current Liabilities Credit Card 1 Credit Card 2 Credit Card 3 Other $ 10,417 $ 15,570 S 14,175 $ 29,745 Total Current Liabilities $ 10,417 12 Invested Assets Trust Fund Certificates of Deposit Stocks/Mutual Funds 401(k) Frank 403 (b) Lois IRAS Retirement Plan Other $105,000 15 16 17 18 19 20 $1,500 $ 990 Long Term Liabilities $ 72,164 $ 10,436 Mortgage Car Loarn Bank Loans Finance Company Relatives/Friends Furniture Total Invested Assets $107,490 23 24 Personal Use Assets Primary Residence Automobile Automobile Go Cart Collectibles Furniture Jewelry Loans Receivable Other $ 89,250 $ 18,000 $ 5,175 $1,200 liances School Loans Other Loan Balances 27 28 29 30 Total Long Term Liabilities $ 82,600 $ 34,000 $6,100 TOTAL LIABILITIES 93,017 32 Total Personal Use Assets $153,725 NET WORTH 35 TOTAL ASSETS 36 37 38 $290,960 Total Assets Total Liabilities $290,960 $ 93,017 Net Worth $ 197,943 Monthly Housing Costs to Monthly Gross Income 8 Monthly Housing Costs and Other Debt Repyaments to Monthly Gross 9 Income 10 Savings Ratios Savings Ratio Discretionary Cash Flow Plus Savings to Annual Gross Income 12 13 Performance Ratios Return on Investments 14 Return on Assets 15 Return on Net Worth 16Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started