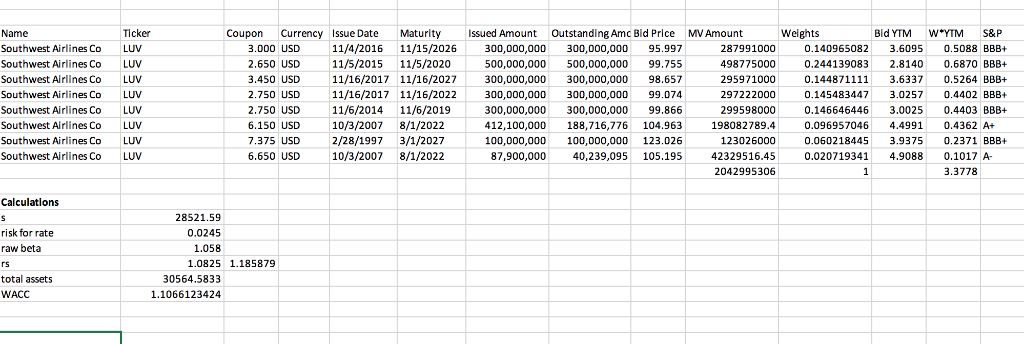

solve for WACC

What is the weighted debt (d)

Estimate of Beta for Southwest Airlines Against the New York Stock Exchange Composite Index for the last Two Years using Weekly Returns, April 21, 2019

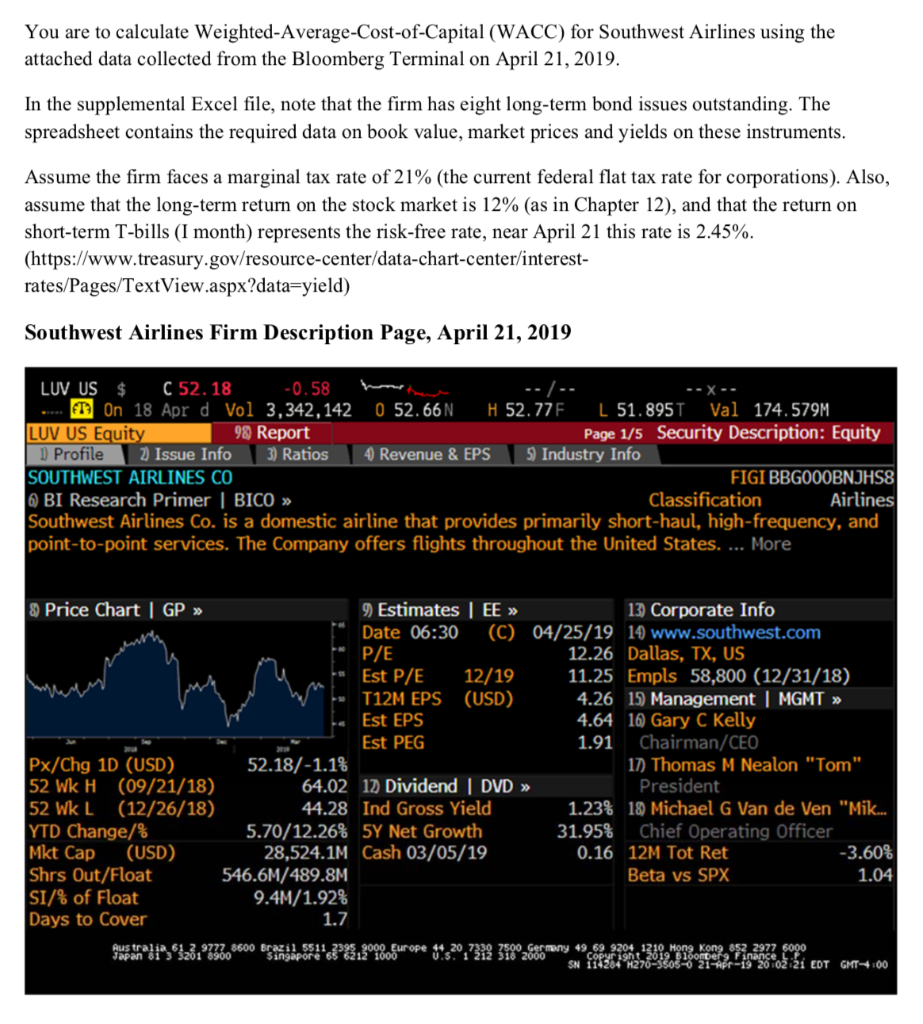

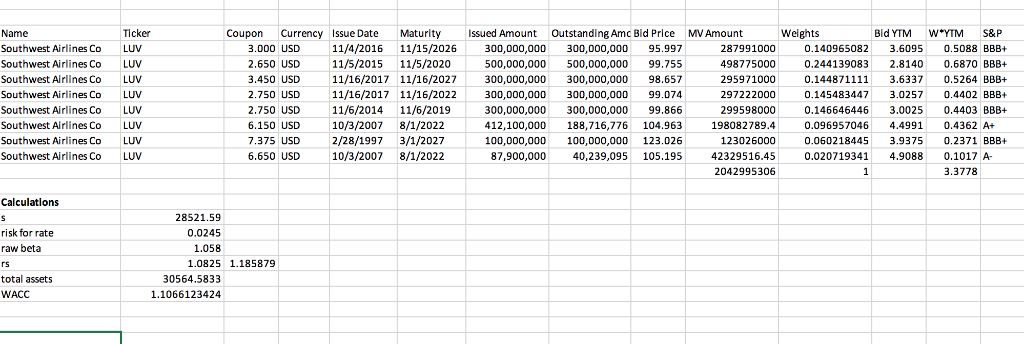

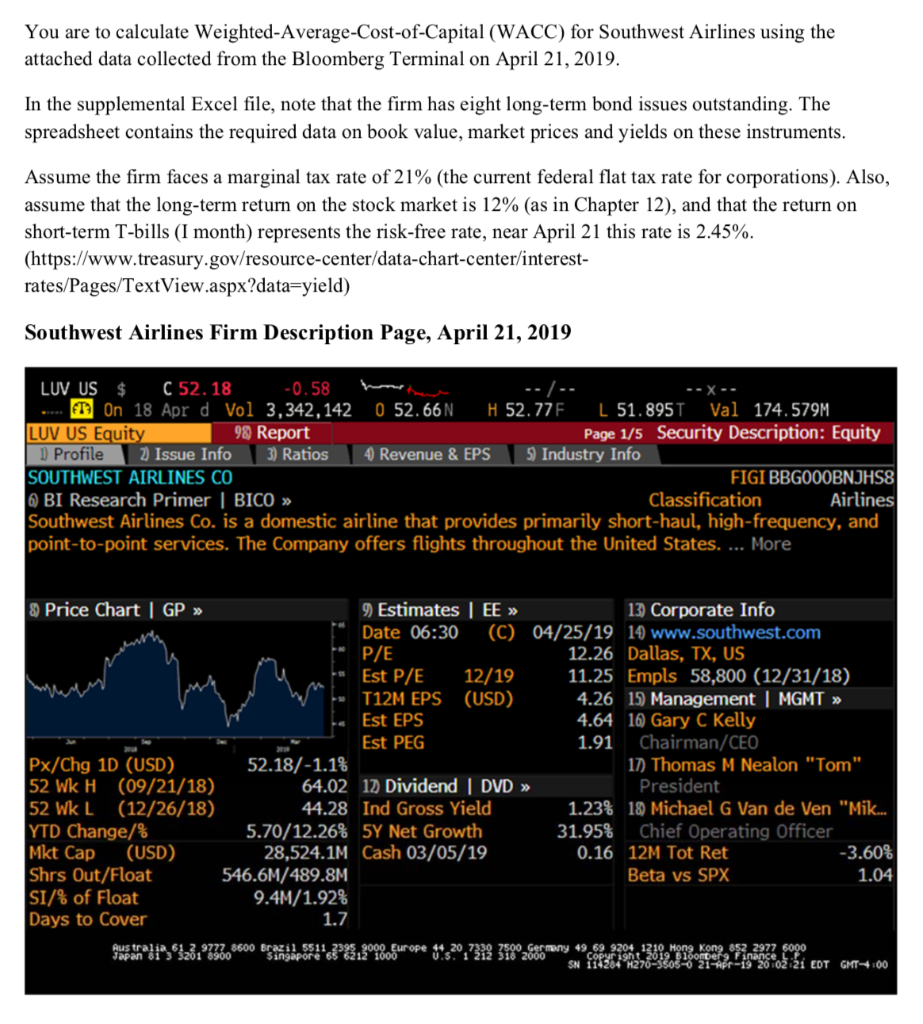

0.58 LUV US C52.18 - T 18 Apr d Vol 3,342,142 0 52.66N H 52.77F 51.895T Val 174.579M On LUV US Equity Relative Index SPX Inde ata Last Price Historical Beta 9Actions 9 Edit Beta +/-. Non-Param Reg On Pre nl. Winsorize2 Std Dev Local Last P ata Last Price Linear 04/21/2018Lag 04/18/2017 04/18/2019 | K Statistics|Transformations Y SOUTHEST AIRLINES CO X = S&P 500 INDEX Linear Beta 10 -1058 X-0216 Range 1 1.058 1.039 -0.216 0.317 0.563 3.060 0.304 0.155 6.850 0.000 -0.178 0.430 103 2854.28 0.018 Raw BETA Adjusted BETA ALPHA (Intercept) R"2 (Correlation*2) R (Correlation) Std Dev of Error Std Error of ALPHA Std Error of BETA t-Test Significance Last T-Value 12- 24. Number of Points Last Spread Last Ratio SPX Indox-Porcent Aus tralia 61 2 9777 8600 Brazi1 5511 Japan 8133201 4 20.7 49 69 9204 1210 2977 SN 02703500 -19 26 0554 EDT GH4,00 Singapore 65 621 You are to calculate Weighted-Average-Cost-of-Capital (WACC) for Southwest Airlines using the attached data collected from the Bloomberg Terminal on April 21, 2019 In the supplemental Excel file, note that the firm has eight long-term bond issues outstanding. The spreadsheet contains the required data on book value, market prices and yields on these instruments Assume the firm faces a marginal tax rate of 21% (the current federal flat tax rate for corporations). Also, assume that the long-term return on the stock market is 12% (as in Chapter 12), and that the return on short-term T-bills (1 month) represents the risk-free rate, near April 21 this rate is 2.45% (https://www.treasury.gov/resource-center/data-chart-center/interest- rates/Pages/TextView.aspx?data-yield) Southwest Airlines Firm Description Page, April 21, 2019 0.58 LUV US C 52.18 On 18 Apr d Vol 3,342,142 0 52.66N H 52.77F L 51.895T Val 174.579M Page 1/5 Security Description: Equity 98 Report LUV US Equi ) Profile SOUTHWEST AIRLINES CO 6 BI Research Primer | BICO Southwest Airlines Co. is a domestic airline that provides primarily short-haul, high-frequency, and point-to-point services. The Company offers flights throughout the United States.... More 2) Issue Info 3) Ratios 4) Revenue & EPS Industry Info FIGI BBGO00BNJHS8 Airlines Classification Price Chart | GP Estimates | EE Date 06:30 (C) 04/25/19 10 www.southwest.com 3 Corporate Info 12.26 Dallas, TX, US Est P/E 12/19 11.25 Empls 58,800 (12/31/18) T12M EPS (USD) Est EPS 4.26 15 Management I MGMT 4.64 1 Gary C Kelly .91 Chairman/CEO Est PEG Px/Chg 1D (USD) 52 Wk H(09/21/18) 52 Wk L (12/26/18) YTD Change/% Mkt Cap (USD) Shrs Out/Float SI/% of Float Days to Cover 5218/-1.1% 7) Thomas M Nealon "Tomm 10 64.02 i) Dividend! DVD 44.28 Ind Gross Yield President 1.23% 1 Michael G Van de Ven .. Mik. 5.70/12.26% 5Y Net Growth 28,524.1M Cash 03/05/19 31.95% Chief Operating Officer -3.60% 1.04 0.16 12M Tot Ret Beta vs SPX 546.6M/489.8M 9.4M/ 1.92% 1.7 Aus tralia 61 2 9777 8600 Brazi1 5511 urope 44 20 49 69 9204 1210 Singapore SN 114284 H2 Coupon Currency Issue Date Maturity Issued Amount Outstanding Amc Bid Price MV Amount 11/4/2016 11/15/2026 300,000,00300,000,000 95.997 11/5/2015 11/5/2020 11/16/2017 11/16/2027 300,000,000 300,000,000 98.657 11/16/2017 11/16/2022 300,,0 300,000,000 99.074 11/6/2014 11/6/2019 10/3/2007 8/1/2022 2/28/1997 3/1/2027 10/3/2007 8/1/2022 Southwest Airlines Co LUV Southwest Airlines Co LUV Southwest Airlines Co LUV Southwest Airlines Co LUV Southwest Airlines Co LUV Southwest Airlines Co LUV Southwest Airlines CoLUV Southwest Airlines Co LUV 3.000 USD 2.650 USD 3.450 USD 2.750 USD 2.750 USD 6.150 USD 7.375 USD 6.650 USD 287991000 498775000 295971000 297222000 299598000 198082789.4 123026000 42329516.45 2042995306 0.140965082 3.6095 0.5088 BBB+ 0.244139083 2.8140 0.6870 BBB+ 0.144871111 3.633 0.5264 BBB+ 0.1454834473.0257 0.4402 BBB+ 0.146646446 3.0025 0.4403 BBB+ 0.096957046 4.4991 0.4362 At 0.0602184453.9375 0.2371 BBB+ 0.020719341 4.9088 0.1017 A 500,000,000 500,000,000 99.755 300,000,000 300,000,000 99.866 412,100,000 188,716,776 104.963 100,000,000 100,000,000 123.026 40,239,095 105.195 0 87,900,000 1 3.3778 Calculations 28521.59 risk for rate raw beta 0.0245 1.0825 1.185879 total assets 30564.5833 1.1066123424 WACC 0.58 LUV US C52.18 - T 18 Apr d Vol 3,342,142 0 52.66N H 52.77F 51.895T Val 174.579M On LUV US Equity Relative Index SPX Inde ata Last Price Historical Beta 9Actions 9 Edit Beta +/-. Non-Param Reg On Pre nl. Winsorize2 Std Dev Local Last P ata Last Price Linear 04/21/2018Lag 04/18/2017 04/18/2019 | K Statistics|Transformations Y SOUTHEST AIRLINES CO X = S&P 500 INDEX Linear Beta 10 -1058 X-0216 Range 1 1.058 1.039 -0.216 0.317 0.563 3.060 0.304 0.155 6.850 0.000 -0.178 0.430 103 2854.28 0.018 Raw BETA Adjusted BETA ALPHA (Intercept) R"2 (Correlation*2) R (Correlation) Std Dev of Error Std Error of ALPHA Std Error of BETA t-Test Significance Last T-Value 12- 24. Number of Points Last Spread Last Ratio SPX Indox-Porcent Aus tralia 61 2 9777 8600 Brazi1 5511 Japan 8133201 4 20.7 49 69 9204 1210 2977 SN 02703500 -19 26 0554 EDT GH4,00 Singapore 65 621 You are to calculate Weighted-Average-Cost-of-Capital (WACC) for Southwest Airlines using the attached data collected from the Bloomberg Terminal on April 21, 2019 In the supplemental Excel file, note that the firm has eight long-term bond issues outstanding. The spreadsheet contains the required data on book value, market prices and yields on these instruments Assume the firm faces a marginal tax rate of 21% (the current federal flat tax rate for corporations). Also, assume that the long-term return on the stock market is 12% (as in Chapter 12), and that the return on short-term T-bills (1 month) represents the risk-free rate, near April 21 this rate is 2.45% (https://www.treasury.gov/resource-center/data-chart-center/interest- rates/Pages/TextView.aspx?data-yield) Southwest Airlines Firm Description Page, April 21, 2019 0.58 LUV US C 52.18 On 18 Apr d Vol 3,342,142 0 52.66N H 52.77F L 51.895T Val 174.579M Page 1/5 Security Description: Equity 98 Report LUV US Equi ) Profile SOUTHWEST AIRLINES CO 6 BI Research Primer | BICO Southwest Airlines Co. is a domestic airline that provides primarily short-haul, high-frequency, and point-to-point services. The Company offers flights throughout the United States.... More 2) Issue Info 3) Ratios 4) Revenue & EPS Industry Info FIGI BBGO00BNJHS8 Airlines Classification Price Chart | GP Estimates | EE Date 06:30 (C) 04/25/19 10 www.southwest.com 3 Corporate Info 12.26 Dallas, TX, US Est P/E 12/19 11.25 Empls 58,800 (12/31/18) T12M EPS (USD) Est EPS 4.26 15 Management I MGMT 4.64 1 Gary C Kelly .91 Chairman/CEO Est PEG Px/Chg 1D (USD) 52 Wk H(09/21/18) 52 Wk L (12/26/18) YTD Change/% Mkt Cap (USD) Shrs Out/Float SI/% of Float Days to Cover 5218/-1.1% 7) Thomas M Nealon "Tomm 10 64.02 i) Dividend! DVD 44.28 Ind Gross Yield President 1.23% 1 Michael G Van de Ven .. Mik. 5.70/12.26% 5Y Net Growth 28,524.1M Cash 03/05/19 31.95% Chief Operating Officer -3.60% 1.04 0.16 12M Tot Ret Beta vs SPX 546.6M/489.8M 9.4M/ 1.92% 1.7 Aus tralia 61 2 9777 8600 Brazi1 5511 urope 44 20 49 69 9204 1210 Singapore SN 114284 H2 Coupon Currency Issue Date Maturity Issued Amount Outstanding Amc Bid Price MV Amount 11/4/2016 11/15/2026 300,000,00300,000,000 95.997 11/5/2015 11/5/2020 11/16/2017 11/16/2027 300,000,000 300,000,000 98.657 11/16/2017 11/16/2022 300,,0 300,000,000 99.074 11/6/2014 11/6/2019 10/3/2007 8/1/2022 2/28/1997 3/1/2027 10/3/2007 8/1/2022 Southwest Airlines Co LUV Southwest Airlines Co LUV Southwest Airlines Co LUV Southwest Airlines Co LUV Southwest Airlines Co LUV Southwest Airlines Co LUV Southwest Airlines CoLUV Southwest Airlines Co LUV 3.000 USD 2.650 USD 3.450 USD 2.750 USD 2.750 USD 6.150 USD 7.375 USD 6.650 USD 287991000 498775000 295971000 297222000 299598000 198082789.4 123026000 42329516.45 2042995306 0.140965082 3.6095 0.5088 BBB+ 0.244139083 2.8140 0.6870 BBB+ 0.144871111 3.633 0.5264 BBB+ 0.1454834473.0257 0.4402 BBB+ 0.146646446 3.0025 0.4403 BBB+ 0.096957046 4.4991 0.4362 At 0.0602184453.9375 0.2371 BBB+ 0.020719341 4.9088 0.1017 A 500,000,000 500,000,000 99.755 300,000,000 300,000,000 99.866 412,100,000 188,716,776 104.963 100,000,000 100,000,000 123.026 40,239,095 105.195 0 87,900,000 1 3.3778 Calculations 28521.59 risk for rate raw beta 0.0245 1.0825 1.185879 total assets 30564.5833 1.1066123424 WACC