solve hand written

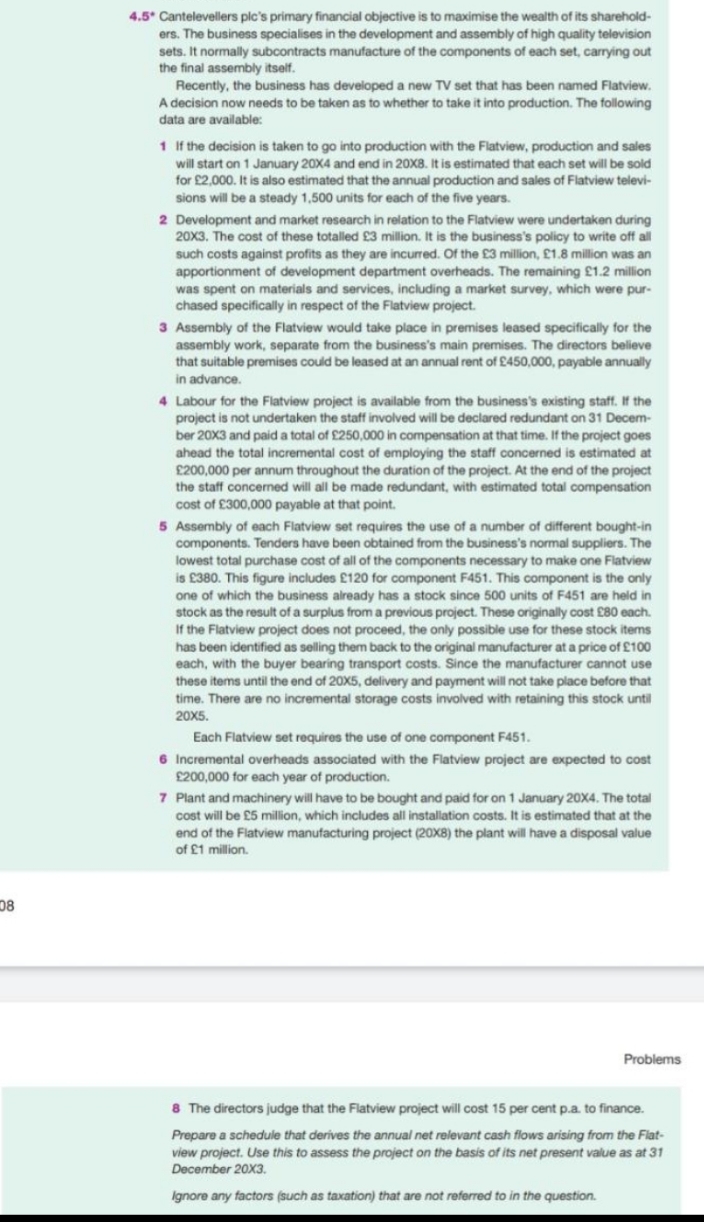

4.5* Cantelevellers pic's primary financial objective is to maximise the wealth of its sharehold- ers. The business specialises in the development and assembly of high quality television sets. It normally subcontracts manufacture of the components of each set, carrying out the final assembly itself. Recently, the business has developed a new TV set that has been named Flatview. A decision now needs to be taken as to whether to take it into production. The following data are available: 1 If the decision is taken to go into production with the Flatview, production and sales will start on 1 January 20X4 and end in 20X8. It is estimated that each set will be sold for $2,000. It is also estimated that the annual production and sales of Flatview televi- sions will be a steady 1.500 units for each of the five years. 2 Development and market research in relation to the Flatview were undertaken during 20X3. The cost of these totalled 23 million. It is the business's policy to write off all such costs against profits as they are incurred. Of the $3 million, 21.8 million was an apportionment of development department overheads. The remaining $1.2 million was spent on materials and services, including a market survey, which were pur- chased specifically in respect of the Flatview project. 3 Assembly of the Flatview would take place in premises leased specifically for the assembly work, separate from the business's main premises. The directors believe that suitable premises could be leased at an annual rent of $450,000, payable annually in advance. 4 Labour for the Flatview project is available from the business's existing staff. If the project is not undertaken the staff involved will be declared redundant on 31 Decem- ber 20X3 and paid a total of $250,000 in compensation at that time. If the project goes ahead the total incremental cost of employing the staff concerned is estimated at (200,000 per annum throughout the duration of the project. At the end of the project the staff concerned will all be made redundant, with estimated total compensation cost of $300,000 payable at that point. 5 Assembly of each Flatview set requires the use of a number of different bought-in components. Tenders have been obtained from the business's normal suppliers. The lowest total purchase cost of all of the components necessary to make one Flatview is 2380. This figure includes $120 for component F451. This component is the only one of which the business already has a stock since 500 units of F451 are held in stock as the result of a surplus from a previous project. These originally cost 280 each. If the Flatview project does not proceed, the only possible use for these stock items has been identified as selling them back to the original manufacturer at a price of $100 each, with the buyer bearing transport costs. Since the manufacturer cannot use these items until the end of 20X5, delivery and payment will not take place before that time. There are no incremental storage costs involved with retaining this stock until 20X5. Each Flatview set requires the use of one component F451. 6 Incremental overheads associated with the Flatview project are expected to cost $200,000 for each year of production. 7 Plant and machinery will have to be bought and paid for on 1 January 20X4. The total cost will be 25 million, which includes all installation costs. It is estimated that at the end of the Flatview manufacturing project (20%8) the plant will have a disposal value of 21 million. 08 Problems 8 The directors judge that the Flatview project will cost 15 per cent p.a. to finance. Prepare a schedule that derives the annual net relevant cash flows arising from the Flat- view project. Use this to assess the project on the basis of its net present value as at 31 December 20X3. Ignore any factors (such as taxation) that are not referred to in the